USD Index

On the morning of November 6, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies increased by 0.21%, standing at 100.31 points.

Compared to the same period in September, the increase is 3 times higher. However, compared to the same period in 2024, the USD Index is still 0.11 points lower.

According to a Reuters survey with foreign exchange strategists, traders will maintain a net selling position for the USD in November, as the currency is expected to weaken in the coming months as the market continues to bet on the possibility of the US Federal Reserve (Fed) cutting interest rates many times.

Policy decisions are also complicated by the record 36-day US government shutdown, which has delayed many important economic reports, forcing the Fed to rely more on private data and alternative indicators to assess the economic situation.

The US Commodity Exchange (CSTC) has not yet released official position data since late September, and the currency world is still unclear how deep the "fake" level of the USD is, forcing large banks to rely on internal models and monitor alternative cash flow for estimates.

According to LSEG data, the probability of the Fed cutting interest rates in December is currently around 70%, down from nearly 90% before last week's policy meeting.

This has caused a wave of USD selling to cool down, although the long-term outlook remains unchanged. Since the beginning of the year, the greenback has decreased by about 8%, compared to 11% in September.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 6, the State Bank announced that the central exchange rate of the Vietnamese Dong increased by 2 VND, currently at 25,097 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office increased by 2 VND, currently at: 23,893 VND - 26,301 VND.

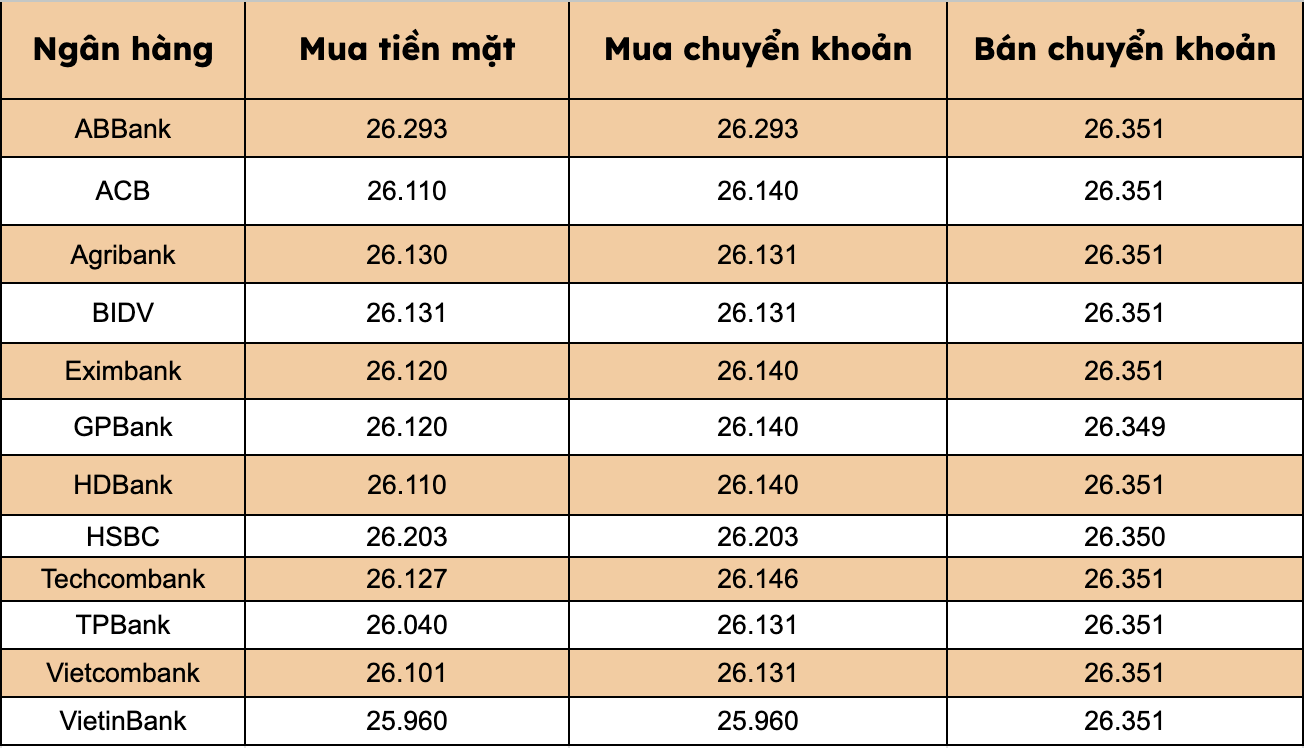

At commercial banks, the USD price maintained its upward momentum.

Banks listed USD selling prices at VND26,351/USD, up VND2/USD.

The bank with the highest cash and transfer price of USD: HSBC (26,203 VND/USD).

The difference between buying and selling prices at banks ranges from 148-391 VND/USD.