Gold prices held their strongest decline in more than a week as investors considered the increase of the USD and cautious sentiment spreading in the market.

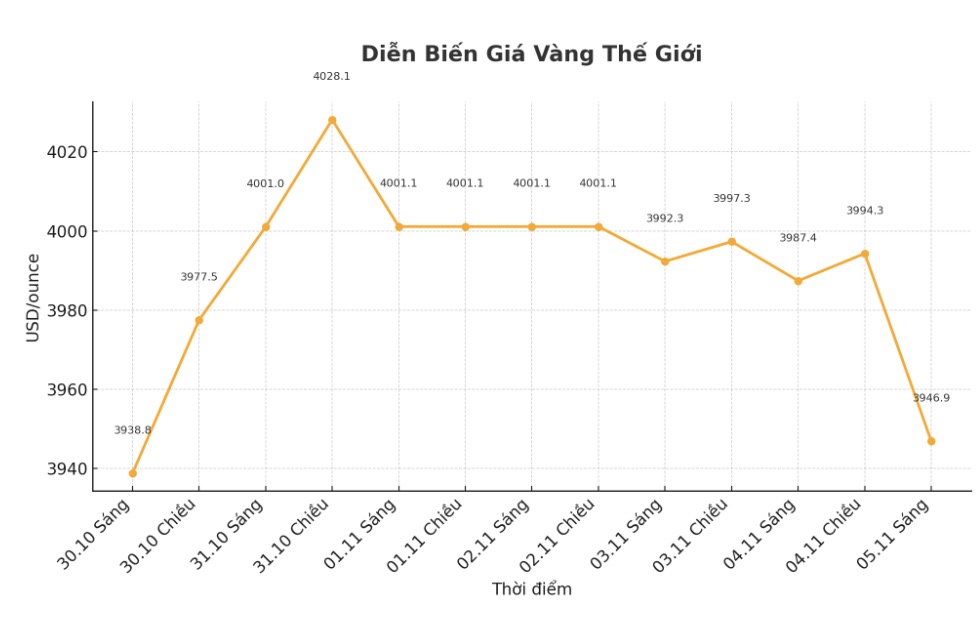

Spot gold prices are steady around $3,940/ounce, after falling nearly 2% in the previous session due to the USD index increasing for the fifth consecutive session. Global stocks continued to lose points on Wednesday, after recording the sharpest decline in nearly a month amid concerns about high valuations. Most other goods also decreased simultaneously.

The decline in gold in the third session came as three officials of the US Federal Reserve (FED) avoided expressing support for further interest rate cuts in December, as they considered the risk of inflation and a weakening of the labor market. Investors will have more opportunities to hear new views from FED leaders this week, including FED Chairman St. Louis Alberto Musalem and FED Chairman Cleveland Beth Hammack.

Gold prices are still around 50% above the start of the year, after hitting a record high last month and then adjusting down. This pullback following a series of signals of too much upward momentum comes with with withdrawals from gold ETFs. Traders are now assessing whether the price drop has ended or not.

Its not surprising that gold prices are adjusting and accumulating in the $3,8004,050/ounce range, Bart Melek, a strategist at TD Securities, said in the report, citing the uncertain outlook for the Feds interest rate cuts and concerns about gold consumption demand in China.

However, he said that factors supporting gold's rally this year are generally unchanged, and strong buying from central banks and solid demand from individual investors will help gold prices increase again after a period of accumulation.

In Singapore, at 10:22, spot gold prices increased by 0.2% to 3,939.38 USD/ounce. Bloomberg Dollar spot moved sideways after closing at its highest level since mid-May. Silver prices remained almost unchanged, while platinum and gold prices continued to decline.