According to precious metal analysts at Heraeus (a multinational technology and industrial materials corporation of Germany), history shows that silver is currently overvalued compared to gold, in the context of price spikes forcing many key industries to find ways to innovate and reduce dependence on this gray metal. On the contrary, gold prices continue to rise sharply even though tensions between the US and Europe related to Greenland have cooled down.

In the latest update report, Heraeus said that silver's spectacular dominance over gold in the past 9 months shows that this upward momentum may be about to peak in the short term.

According to experts, in history, silver often surpassed gold in the final stages of price increases. The gold/silver ratio has fallen from 105 in April 2025 to a bottom of 49 last week, the lowest level since 2013, even when gold prices continuously set new records. Although this ratio was once lower than the present in the past, it is rare to witness such a strong fluctuation in a short time.

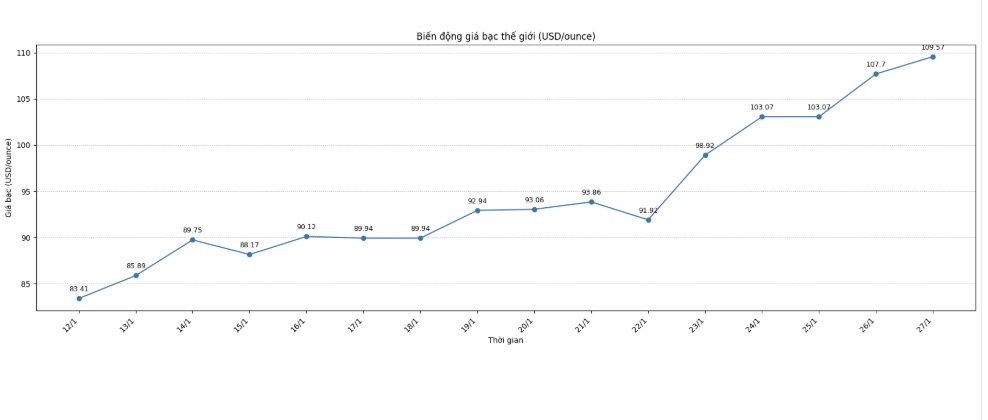

Heraeus assessed that the current silver price increase is the most extreme since 1980, when the Hunt brothers sought to manipulate the market. On January 23, when silver prices exceeded $100/ounce, this price was 54% higher than the 200-day moving average.

In 1980, at its peak, silver prices were 70% higher than the 200-day average. In 1974, prices also increased to a level 54% higher than the 200-day average before a sharp correction, with a decrease from peak to bottom of up to 44%, and then continued to enter a prolonged increase until 1980.

Experts also noted that reality shows that, although prices seem to be at an extreme level, the market may still continue to rise. Although investors have legitimate concerns about geopolitical risks, US monetary and fiscal policy, as well as the future of the USD, history shows that this increase is likely closer to the end than in the starting stage.

Whether the current cow market will be like the 1970s with a mid-term correction or will it end when prices reach their peak is still an open question, but price fluctuations are forecast to remain high for a long time.

Heraeus said that silver surpassing the 100 USD/ounce mark last week was mainly driven by the strength of the gold market, as geopolitical tensions around Greenland increased cash flow seeking safe havens.

Technically, this increase is becoming very tense. The relative strength index RSI on the daily chart is still maintained above the threshold of 70, showing a situation of overbought, although differentiation is currently appearing when RSI is at a lower price peak at the end of December and is higher. The speculative net buying position on the futures contract market continued to increase in January, from 146 million ounces to 160 million ounces in just one week.

However, this level is still much lower than the extreme period of 2025, when the net buying position reached nearly 300 million ounces, showing that there is still room for investors to continue to participate.

Heraeus also emphasized that high prices are starting to erode industrial demand in price-sensitive sectors. In the photovoltaic industry, manufacturers are reducing silver content and switching to using copper in metallization technology, with silver-copper hybrid solutions that have entered commercial production. Recently, Chinese metal-coated material supplier DK Electronic Materials announced that it has commercially developed high-density copper copper systems for gigawatt-scale solar panel production.

According to Heraeus, if industrial demand continues to adapt to the high price environment, this could become a driving force for the silver price factor based on the real supply-demand foundation.