Domestic silver prices

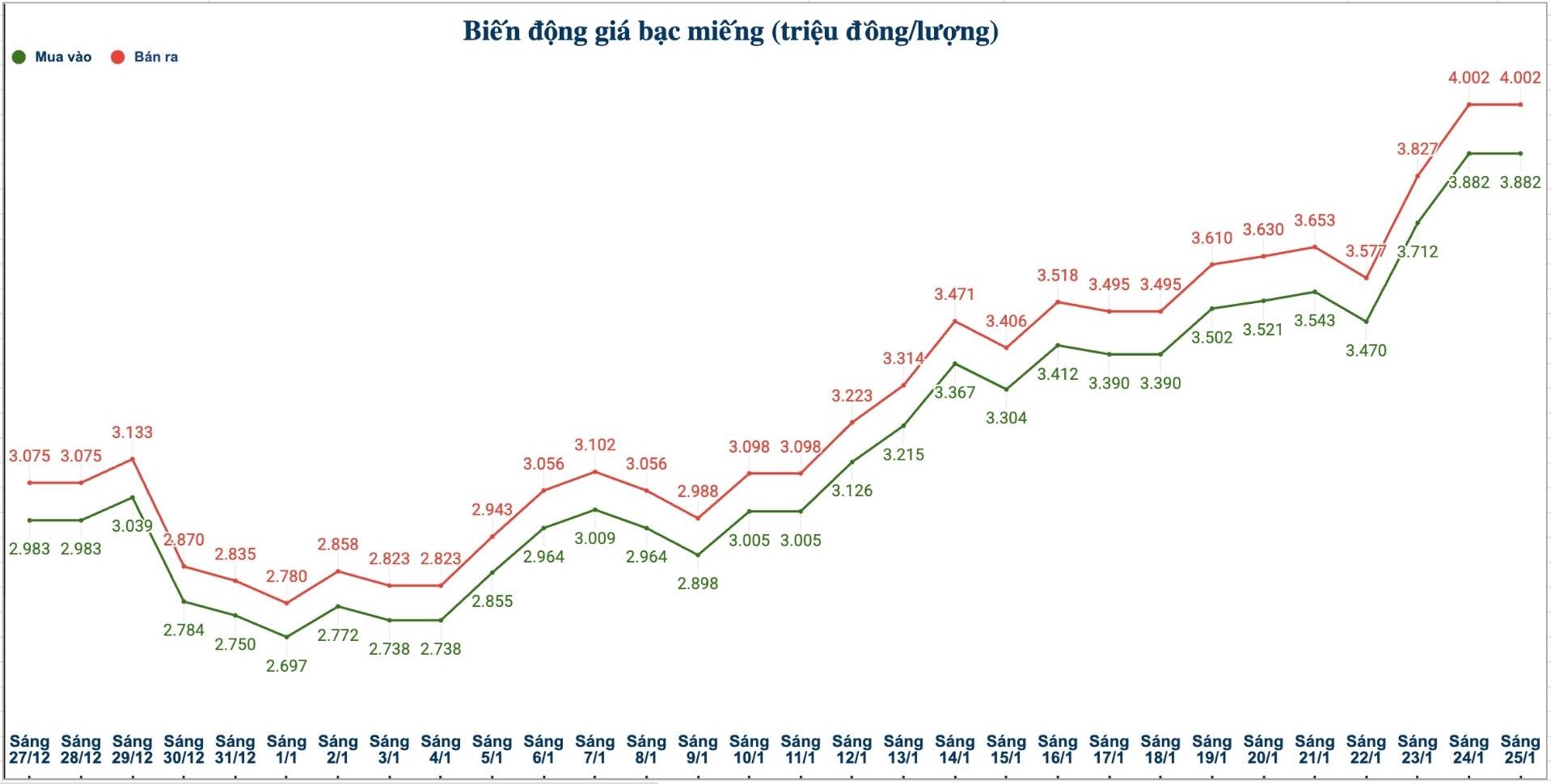

As of 9:15 am on January 25, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company is listed at the threshold of 3.886 - 3.982 million VND/tael (buying - selling).

The price of 2025 Ancarat 999 (1kg) bars at Ancarat Jewelry Company is listed at 102.566 - 105.686 million VND/kg (buying - selling).

In the previous week's trading session (morning of January 18, 2026), the price of 2025 Ancarat 999 (1kg) silver bar at Ancarat Jewelry Company was listed at 89.474 - 92.194 million VND/kg (buying - selling).

Thus, if you buy 2025 Ancarat 999 (1kg) ingots at Ancarat Jewelry Company in the session on January 18, 2026 and sell them in the session this morning (January 25, 2026), the buyer will make a profit of 10.372 million VND/kg.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 3.882 - 4.002 million VND/tael (buying - selling).

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at the threshold of 103.519 - 106.719 million VND/kg (buying - selling).

In the previous week's trading session (morning of January 18, 2026), the price of 999 silver bars (1kg) at Phu Quy Jewelry Group was listed at 90.399 - 93.199 million VND/kg (buying - selling).

Thus, if you buy 999 silver bars (1kg) at Phu Quy Jewelry Group in the session on January 18, 2026 and sell them in the session this morning (January 25, 2026), the buyer will make a profit of 10.32 million VND/kg.

World silver prices

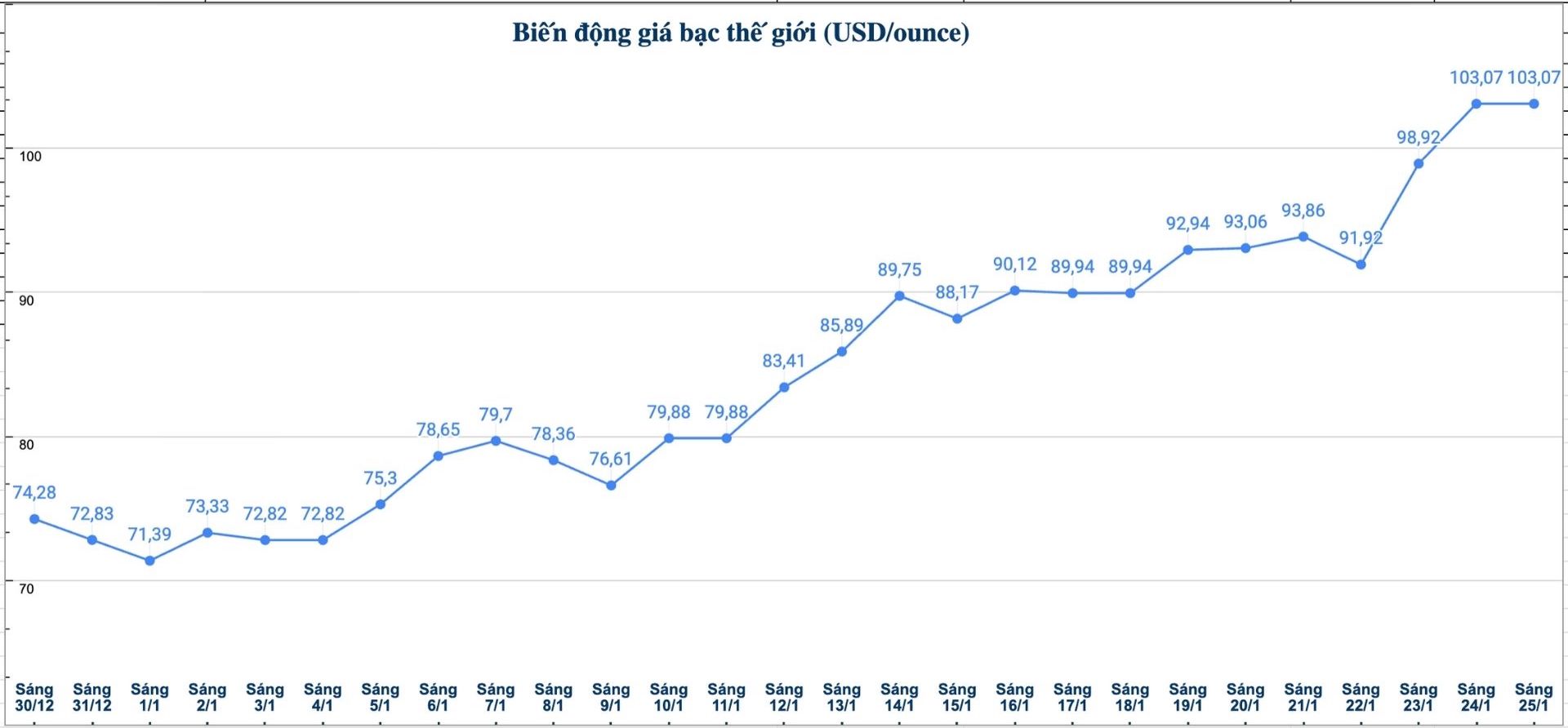

On the world market, as of 9:15 am on January 25 (Vietnam time), the world silver price was listed at 103.07 USD/ounce.

Causes and forecasts

Silver prices continue to increase sharply in recent sessions. Neils Christensen - an analyst at Kitco News - said that the breakthrough increase of silver prices to the 100 USD/ounce mark reflects the superior strength of market momentum, in the context that investor sentiment is completely overwhelming traditional valuation factors.

Silver at the 100 USD/ounce mark is very exciting, and clearly the upward momentum is still very strong. But at these price levels, caution is necessary - investors should be patient and avoid chasing prices" - Neils Christensen gave his opinion.

Sharing the same view, in the updated report on the precious metals market, Ms. Roukaya Ibrahim - strategist of BCA Research - said that although the long-term outlook for silver is still quite positive, investors should not chase buying at the current price level, because the risk of deep corrections is increasing.

In just the first month of the year, silver prices increased by nearly 40%, following a nearly 150% increase in 2025. This upward momentum is driven by a combination of strong investment demand, high industrial consumption and increasingly tighter material supply. However, Ms. Ibrahim said that speculation plays an increasingly large role in the recent upward trend, making the current trend less sustainable.

We still assess the macroeconomic and geopolitical environment as a supporting factor for silver in the medium and long term, while maintaining a positive stance on this metal throughout the past year" - Ms. Roukaya Ibrahim said.

See more news related to silver prices HERE...