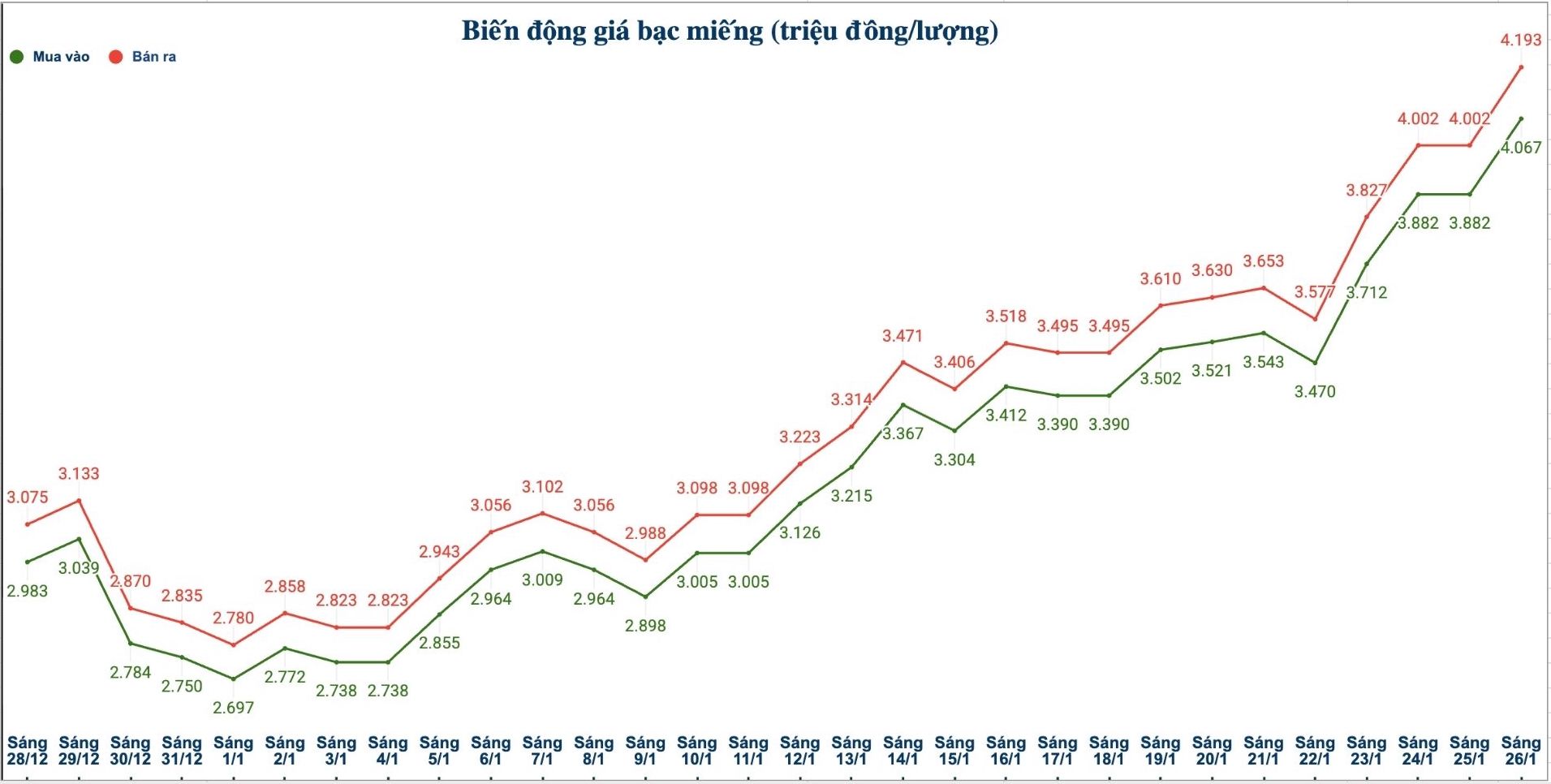

Domestic silver prices

As of 12:00 PM on January 26, the price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) was listed at 4.107 - 4.209 million VND/tael (buying - selling); an increase of 366,000 VND/tael on the buying side and an increase of 372,000 VND/tael on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 4.067 - 4.193 million VND/tael (buying - selling); an increase of 185,000 VND/tael on the buying side and an increase of 191,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 108.453 - 111.813 million VND/kg (buying - selling); an increase of 4.934 million VND/kg on the buying side and an increase of 5.094 million VND/kg on the selling side compared to yesterday morning.

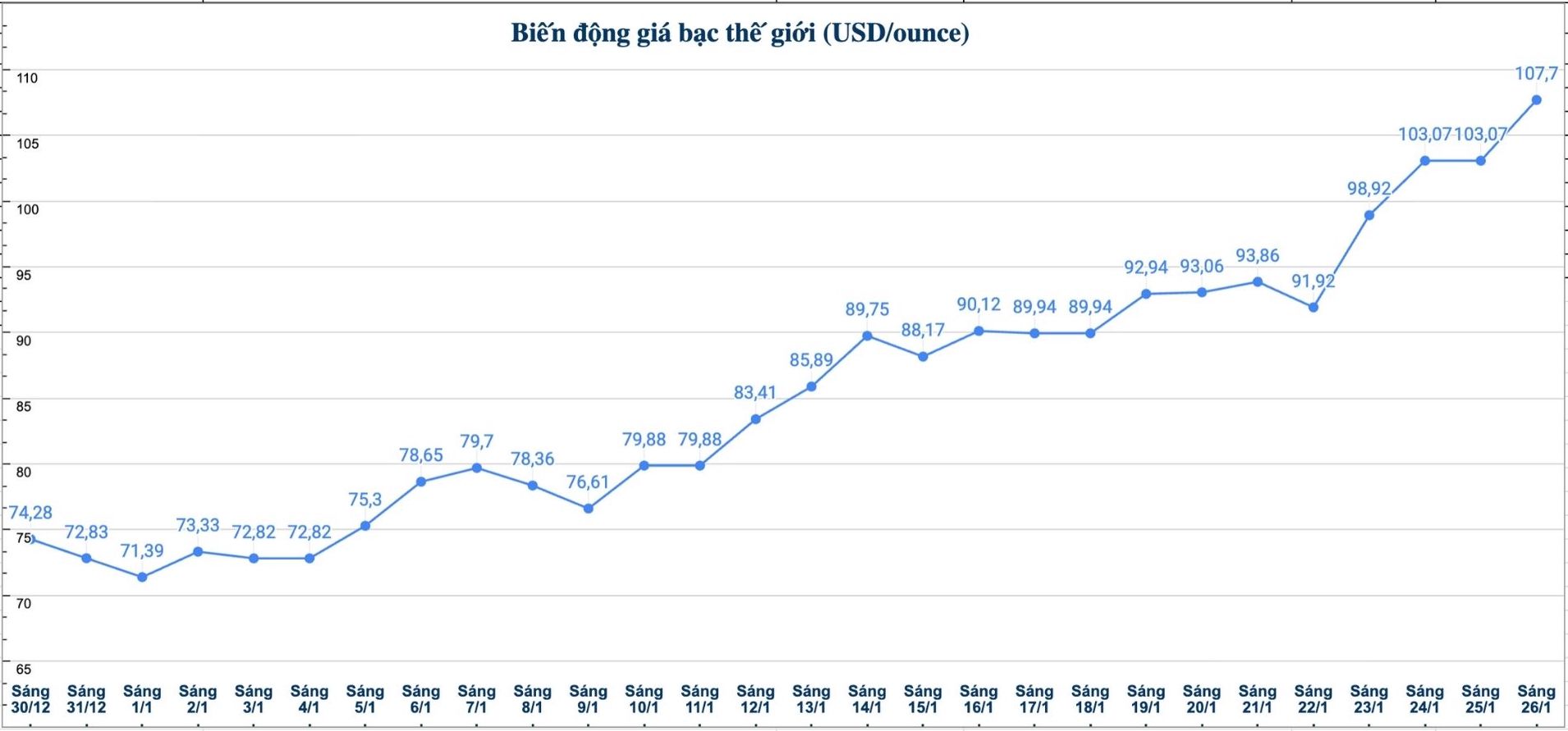

World silver prices

On the world market, as of 12:05 PM on January 26 (Vietnam time), the world silver price was listed at 107.7 USD/ounce; up 4.63 USD compared to yesterday morning.

Causes and forecasts

Silver prices continued to rise sharply in the first trading session of the week. According to Reuters, treasury inventories at the New York Commodity Exchange (COMEX) have decreased by about 114 million ounces since October, mainly due to the buying activity of individual investors and ETF funds. The main driving force comes from the fear of missed opportunities (FOMO), as prices continuously hit new peaks.

Meanwhile, Bank of America (BofA) estimates the reasonable value of silver at only about 60 USD/ounce, nearly 40% lower than the current price. BofA believes that silver demand in the solar energy sector is weakening, while industrial activity is showing signs of slowing down as prices rise too high.

Technically, Ms. Rhona O'Connell - an analyst at StoneX - believes that the too-fast price increase is creating a major risk.

Cash prices are currently increasing too quickly compared to the market base. When signs of imbalance appear, the upward momentum may reverse sharply, leading to a risk of a sharp drop in the short term" - Ms. O'Connell warned.

Sharing the same view, Mr. David Wilson - BNP Paribas's strategist - said that profit-taking activities may take place sooner rather than later, especially in the context of the physical gold market gradually cooling down. According to him, although silver still benefits from its role as a channel for investing in precious metals with lower prices than gold, the risk of correction is still assessed at a high level.

Another factor noted by analysts is the possibility that the Chicago Mercantile Exchange (CME) will continue to raise margin requirements, similar to what happened in December.

Increasing margin may force speculators using high leverage to sell, thereby triggering a strong downward wave" - David Wilson noted.

See more news related to silver prices HERE...