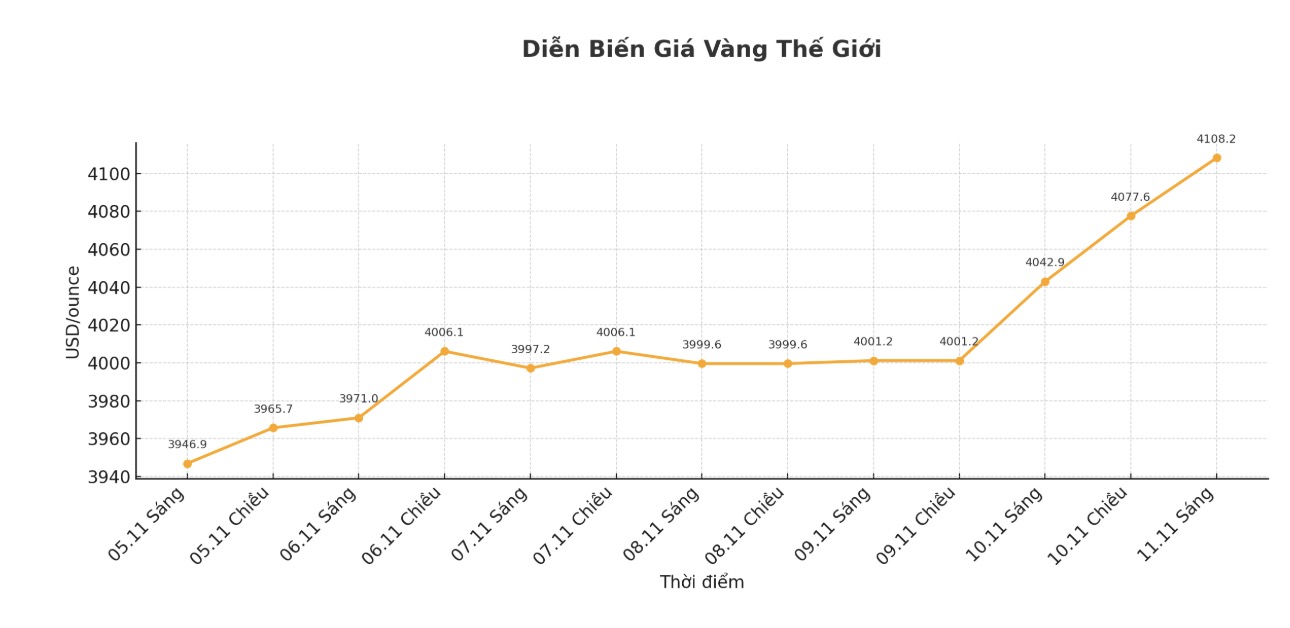

World gold prices increased sharply earlier this week, when spot gold conquered the threshold of 4,100 USD/ounce. This rally was driven by a series of weaker-than-expected US economic data and growing expectations that the Federal Reserve (FED) will cut interest rates in November.

The USD index fell 0.1%, making gold more attractive in the international market. US Treasury yields have also fallen as safe-haven demand has increased.

Traders believe that the increase in gold prices reflects the fragility of the macro economy in parallel with the optimistic that the US Government will soon end the closure.

However, investors should not expect too much from the current rally, as most of these supporting factors have been reflected in prices - and the question now is whether gold can break out of the current tightness zone, or will temporarily stop before a short-term "barrier" of the market.

Main factors affecting gold prices

This gold price increase stems from three main factors: Weakness of the macro economy, policy instability and expectations of US monetary easing. Data released last week showed that the number of jobs cut in the public and retail sectors, along with consumer confidence falling to nearly 3.5-year lows.

The US government's 40-day closure has delayed many important economic reports, thereby damaging growth. Recent statements from US President Donald Trump that a government opening deal is very close have helped improve short-term sentiment, but investors are still concerned about the long term prospects.

The market currently rates a 65% chance that the FED will cut interest rates in December to offset the negative impact of the government shutdown. Low interest rates often put pressure on the USD and reduce the cost of holding gold - an ideal environment for gold prices to increase.

In addition, safe-haven demand is still reinforced by many geopolitical risks such as trade tensions and conflicts in the Middle East. However, traders also need to be cautious: when the government reopens and risk sentiment recovers, profit-taking may cause gold prices to correct down.

Technical analysis

Technically, the long-term outlook for gold remains positive, but there may be correction pressure in the short term. Gold prices need to clearly break out above the key resistance zone of 4,300 USD/ounce with strong buying power to maintain upward momentum.

The positive point is that prices are still above the 50-day moving average (SMA) - a sign that the current correction is still " Strengthening".

However, if prices cannot maintain this increase, gold may reverse to decrease, re-evaluate the 50-day SMA, or even break below this threshold to find a lower support zone. The RSI index on the date frame shows that gold is no longer overbought, but has not yet reached the over-selling zone.

In general, gold's recovery is currently being reinforced by the weakening of the US economy, expectations of a monetary policy easing cycle and the psychology of finding a safe haven. However, the platform is not yet truly sustainable, as supporting factors have largely reflected in prices.

As the prospect of reopening the US government becomes clearer, defense demand may cool down and cash flow may temporarily leave gold to seek higher yields. That increases the pressure to adjust in the short term, although the long-term trend is still leaning towards the positive.

In the context of slowing global growth and a weakening USD, gold is likely to remain around the $4,000/ounce range. Conquering the $4,150/ounce threshold may need new support signals. Investors should maintain flexibility, and can consider the increase at the beginning of the week as the warm-up step of a short adjustment cycle, instead of affirming it as a sustainable uptrend.