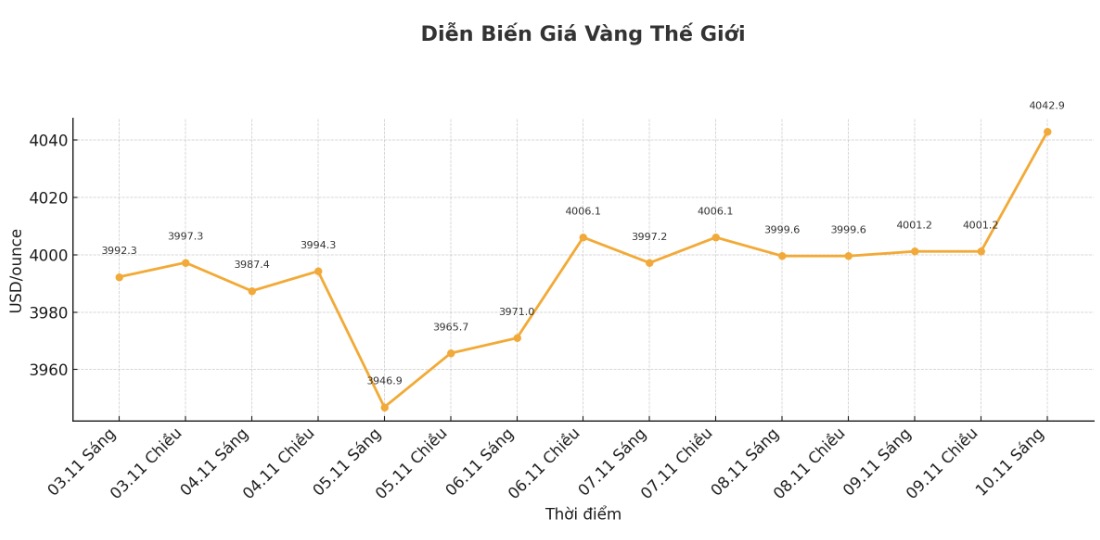

At 1:45 GMT (ie 8,15 Vietnam time), the US December gold futures increased by 0.7% to $4,036.6/ounce. Spot gold prices increased to $4,049.8/ounce at 10:49 on November 10.

The US economy lost jobs in October, mainly in the government and retail sectors, while cost cuts and the application of artificial intelligence (AI) caused the number of layoff notices to increase sharply, according to data released last week.

US consumer confidence fell to its lowest level in nearly 3 and a half years in early November, amid concerns about the economic impact of the longest government shutdown in history, according to a survey released on Friday.

According to CME FedWatch tool, investors now see a 67% chance of the Federal Reserve cutting interest rates in December. Gold - un interest-bearing assets often benefit in a low interest rate environment and when economic instability increases.

On Sunday, the US Senate seemed to prepare to pass a bill to reopen the federal government, ending a 40-day holiday that has forced hundreds of thousands of employees to quit, caused food subsidies to stall and the aviation industry to chaos.

Global stock markets increased in Asia on expectations that the US government shutdown crisis is about to end, while the USD continued to be pressured after last week's decline.

SPDR Gold Trust - the world's largest gold ETF - said its holdings increased by 0.16% to 1,042.06 tons on Friday, compared to 1,040.35 tons on Thursday.

In India, physical demand for gold remained weak last week due to strong price fluctuations that made buyers hesitant, forcing dealers to deeply reduce prices to stimulate demand. Meanwhile, demand in China has also cooled due to changes in tax regulations.

In other markets, spot silver rose 1.1% to $48.84/ounce, platinum rose 1.2% to $1,563.25/ounce, and palladium rose 1.2% to $1,396.75/ounce.

See more news related to gold prices HERE...