Gold prices will increase if central banks continue to buy

Frank personal - CEO of U.S. Global Investors and President Hive Digital technologies believe that gold prices could reach $6,000/ounce by the end of President Donald Trump's term. He told Kitco News that this increase comes from the restructuring of the global financial system, the wave of de-dollarization and countries, especially China, increasing their gold purchases.

I think the target is gold to $6,000/ounce under Trumps term. If tariffs increase by 25%, the USD must decrease by 25%, Holmes said.

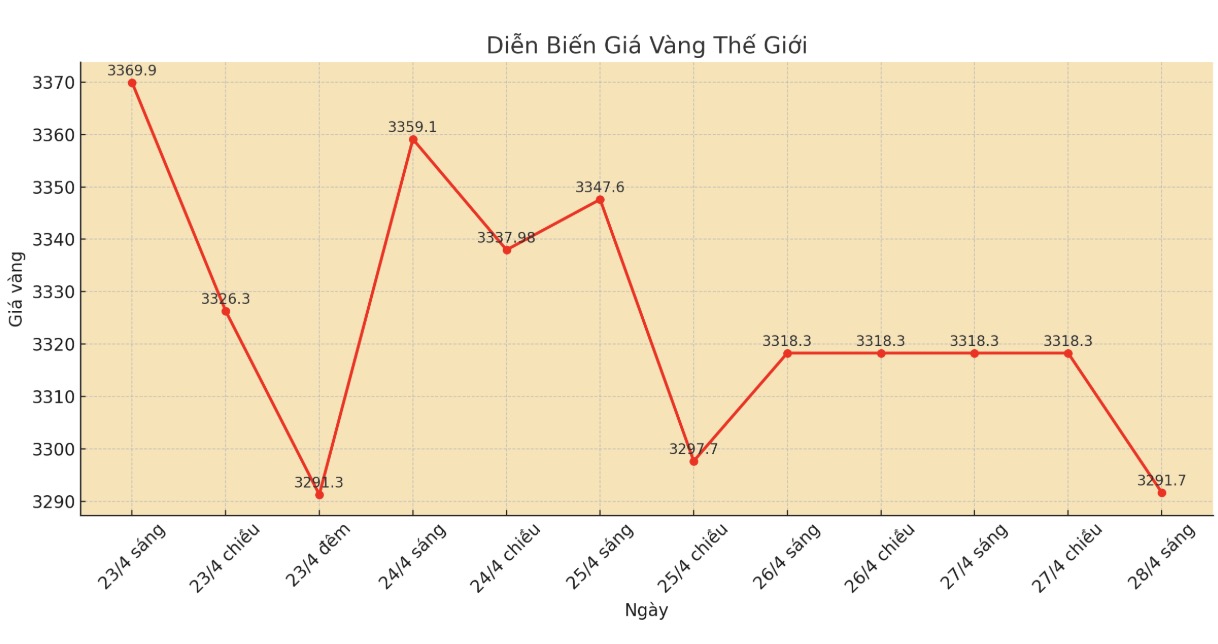

Gold is currently holding around $3,300/ounce after hitting a historical peak of $3,509/ounce early last week, then falling sharply by $200. JPMorgan forecasts gold to reach $4,000/ounce in the next 12 months. However, Holmes believes that gold prices will increase sharply if central banks continue to buy.

The role of China

The People's Bank of China has been the world's largest gold buyer for 5 consecutive months. In the first quarter of 2025 alone, China added more than 27 tons of gold, bringing its official reserves to more than 2,300 tons - the highest level in history.

Some estimates suggest that the actual figure is much higher when including gold from state-related organizations such as SAFE and commercial banks.

Holmes said that China's gold purchases are part of a USD-dependent downturn strategy and enhance the popularity of the yuan in international trade.

A reconstruction is underway

The US Federal Reserve (FED) is under political pressure to lower interest rates as trade tensions escalate. The IMF lowered its forecast for US GDP growth in 2025 to just 1.2%.

US Treasury Secretary Scott Bessent criticized the IMF and the World Bank this week for focusing on social policy rather than stabilizing the economy, and called for "resuring the global monetary system".

Holmes said the change would weaken the USD further. This is a reconstruction button that is being activated, he said.

According to this expert, BRICS is promoting de-dollarization, and "really, USD transactions are increasing, while the euro is decreasing". However, the trend of monetary restructuring has begun.

I think the dollar will fall. When real interest rates are negative, people print money... that leads to dividends and gold will revive as a safe asset, 2424 added.

Gold stocks have not been noticed

Despite the strong increase in gold, Holmes said investors are still not paying attention to gold stocks. Gold stocks still have great potential, he said. Their holdings have fallen to just 1% in ETFs, now they are rising back to 2%.

Newmont Corp - the world's largest gold quarry has just reported its highest mining cost in nearly 10 years at 1,651 USD/ounce, but still exceeded profit expectations thanks to high gold prices. Holmes believes this is a turning point.

Gold mining companies are generating huge cash flows... They are no longer buying back small companies, but buying back their own stocks, increasing dividends, said the expert.

Frank personal - a pioneer in the pre-selling gold model for capital at Franco-Nevada said that if the gold price at that time reached 3,500 USD/ounce, the profit would increase sharply.

The profit will increase many times. If they earn $1 million a day, small and medium-sized gold mining companies will grow brilliantly, he said.

In addition, Holmes also predicted that Bitcoin will increase with gold, thanks to broader acceptance and a weak USD. Bitcoin is trading at nearly $93,000, and Holmes believes it could reach $250,000 if ETFs develop.