Updated SJC gold price

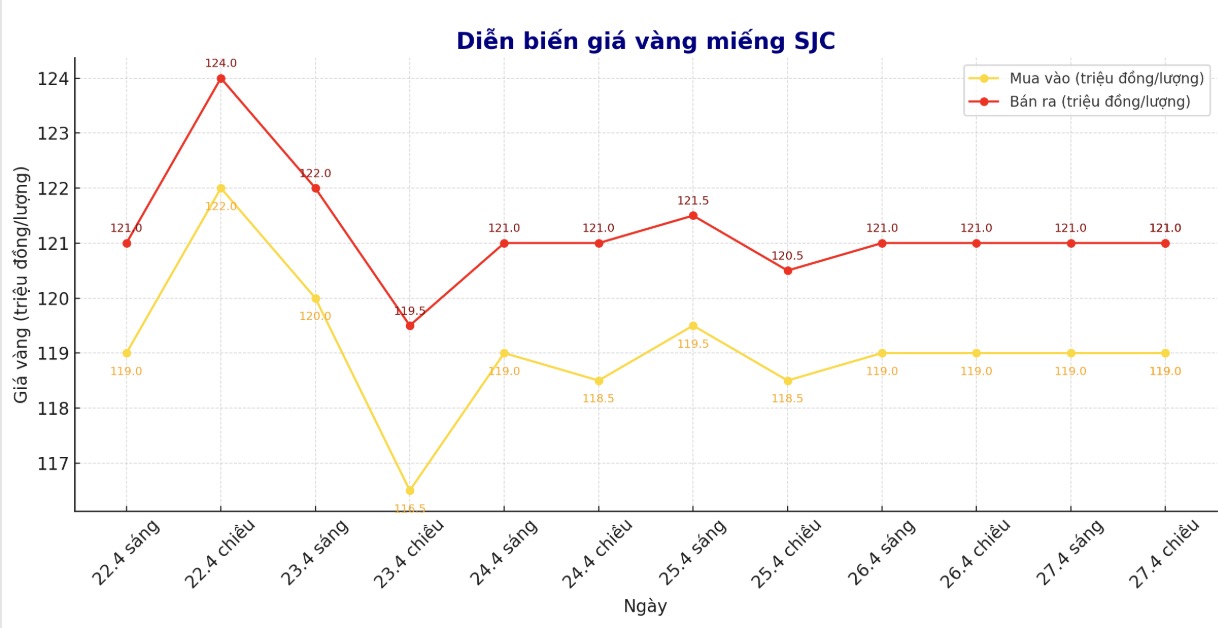

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 119-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.5-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

9999 round gold ring price

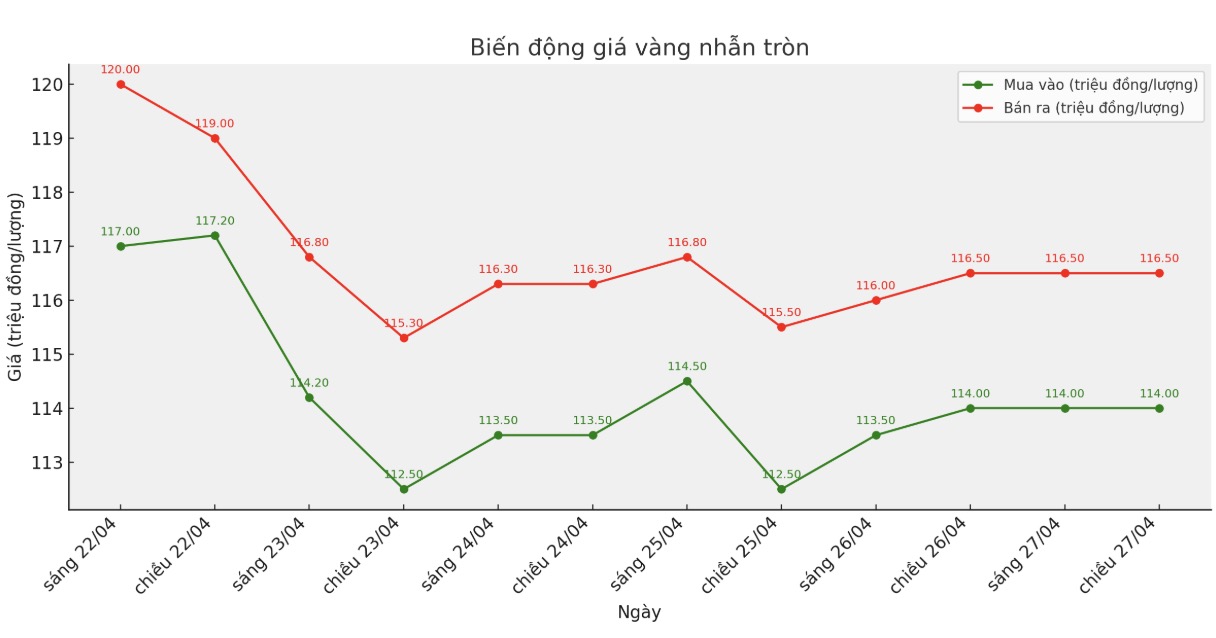

As of 6:00 a.m., the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

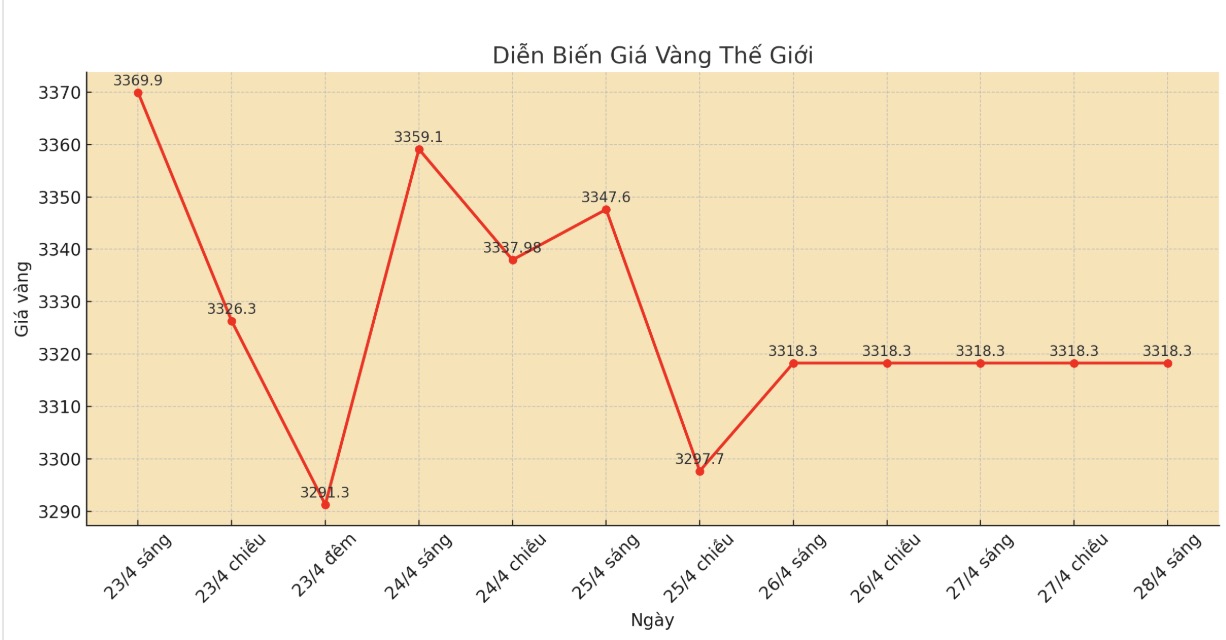

At 6:00 a.m., the world gold price was listed on Kitco around 3,318.3 USD/ounce.

Gold price forecast

Despite the sharp decline, gold has still increased by more than 25% since the beginning of the year and 41% in the past 12 months, continuing to be a safe choice for long-term investors.

However, in the short term, most Wall Street experts predict gold prices will correct. 54% of survey experts believe that prices will decrease, 46% predict an increase. The survey of 316 individual investors also showed caution when only 48% expected prices to increase, 29% said they would decrease and 23% said they would go sideways.

Adrian Day - Chairman of Adrian Day Asset Maangement said: "The possibility of the US and China making further grants in the tax war, along with concerns about increasing economic recession will put pressure on gold prices in the short term, so I think prices will decrease. However, factors supporting gold throughout the past year have remained, possibly just a slowdown in demand, so this decline may not be long and not too deep.

Kevin Grady - President of Phoenix Futures and Options said that gold has increased too quickly: "Gold prices increased by 500 USD in a very short time, but there was no corresponding increase in volume or opening interest rates, showing that many weak speculators have entered the market. Therefore, gold prices fluctuate strongly and are likely to fall sharply".

He said the current important support level is $3,000/ounce and prices could move sideways around the current level until there is concrete progress in trade negotiations.

Meanwhile, Kelvin Wong - an expert at OANDA - is still optimistic: "The gold rally has not stopped". According to him, the next resistance levels are at 3,670-3,750 USD/ounce and further away are 3,890 USD/ounce.

Lukman Otunuga - an expert at FXTM - commented that the current selling pressure at profit does not change the factors supporting gold. The upcoming key US data, including GDP, inflation and employment, will have a strong impact on expectations for the Fed's rate cut roadmap, thereby dominating gold prices.

If gold prices fall below $3,250/ounce, the downtrend could extend to $3,170/ounce. Conversely, holding above $3,250/ounce will open up an opportunity for gold to recover to $3,390-3,500/ounce.

See more news related to gold prices HERE...