Since the full-scale conflict between Russia and Ukraine in 2022, Europe has made significant strides in restructuring its energy strategy.

Thanks to the flow of liquefied natural gas (LNG) from the US and other countries, along with a sharp cut in gas consumption, the old continent has temporarily escaped the shadow of Russian gas.

However, according to the Financial Times, the gas market has become unstable in recent weeks. Reserves are lower than normal at this time of year. Gas prices soared to a two-year high on 10 February before falling nearly 20% as European countries considered easing demand for additional reserves in the summer.

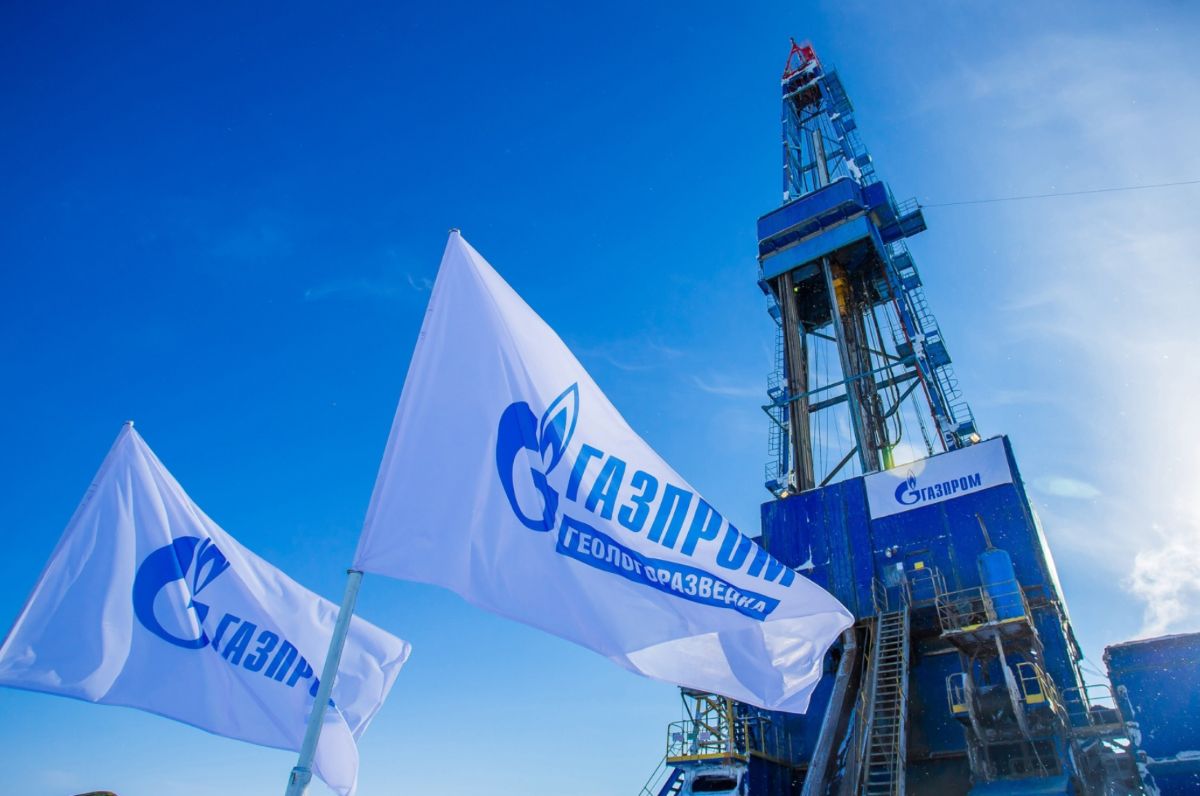

As Ukrainian peace talks begin, there are also rumors that Russian gas could quietly return to Europe.

Part of the demand for gas that has disappeared from Europe is gradually recovering. Compared to 2021, European gas consumption has decreased by about 100 billion m3, equivalent to a decrease of 18% compared to pre-crisis levels. In part, it is due to renewable energy replacement - this is an irreversible trend.

About 20% of the decline comes from the European industry losing market share due to high gas prices - which may be difficult to recover. The rest is luck as Europe has gone through two consecutive mild winters.

However, in the fourth quarter of last year, European gas demand increased by 9% due to colder weather and weak winds - which shows that the current energy balance is still very fragile. This, combined with the tightening global LNG supply, has pushed gas prices to skyrocket in recent times.

Europe is facing the temptation to return to dependence on Russia. However, the Financial Times believes that the LNG projects are delayed and will be completed, helping to stabilize supply. The US - which wants Europe to buy its LNG - will not easily let Russia regain market share.

But Russia is still a great power. Even without taking into account the supply from the frozen pipeline, the Arctic LNG 2 project could add an additional 27 billion cubic meters of gas when completed.