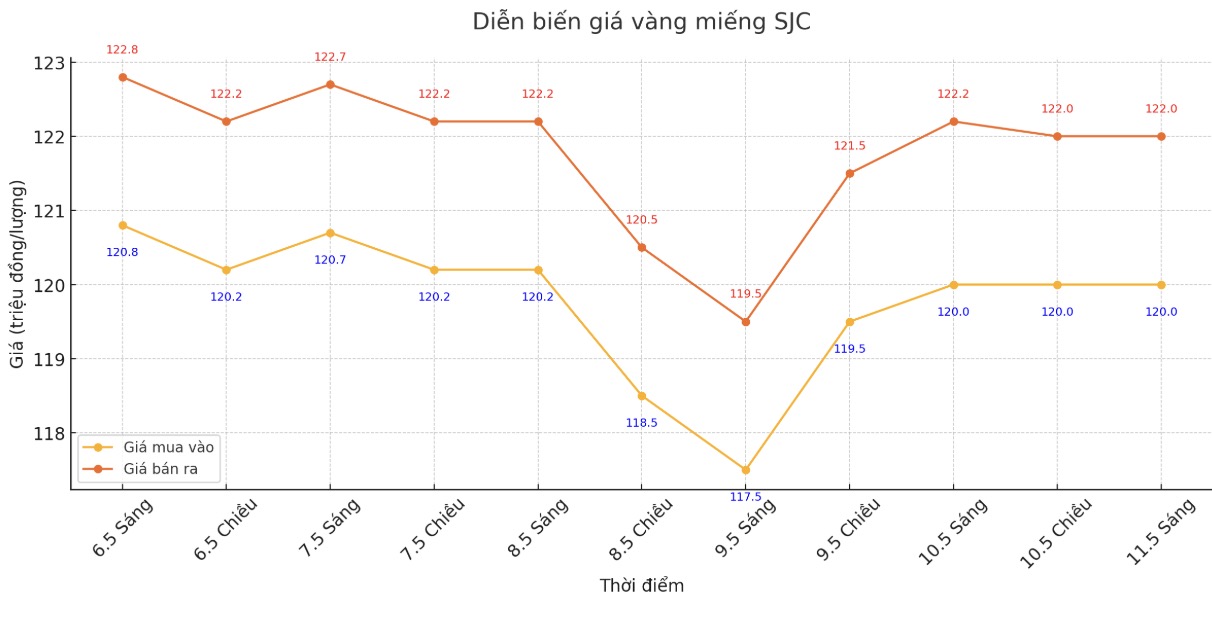

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at 120-122 million VND/tael (buy - sell).

Compared to the closing price of the previous trading session (May 4, 2025), the price of SJC gold bars at DOJI increased by 700,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 120-122 million VND/tael (buy in - sell out).

Compared to the closing price of the previous trading session (May 4, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 700,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of 4.5 and selling it in today's session (11.), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 1.3 million VND/tael.

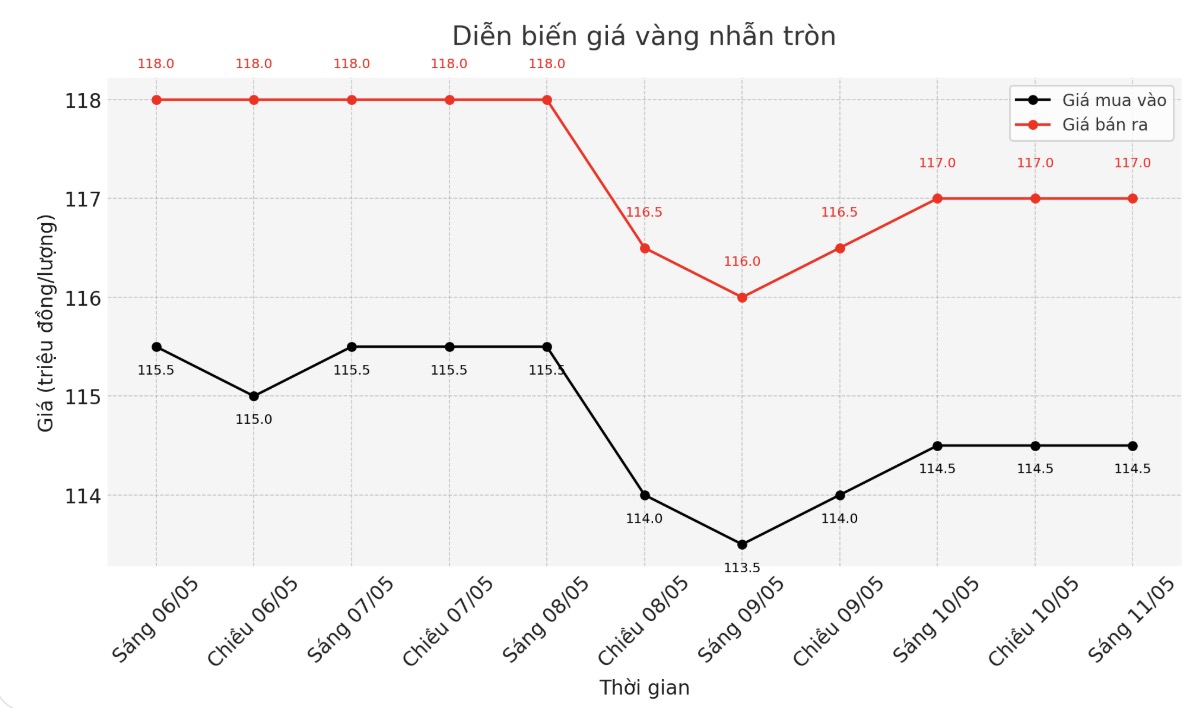

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 114.5-117 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions compared to the closing price of the previous trading session. The difference between buying and selling is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell); increased by 400,000 VND/tael for buying and increased by 300,000 VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 3 million VND/tael.

If buying gold rings in the session of 4.5 and selling in today's session (May 11), buyers at DOJI will lose 2 million VND/tael and Bao Tin Minh Chau will lose 2.7 million VND/tael.

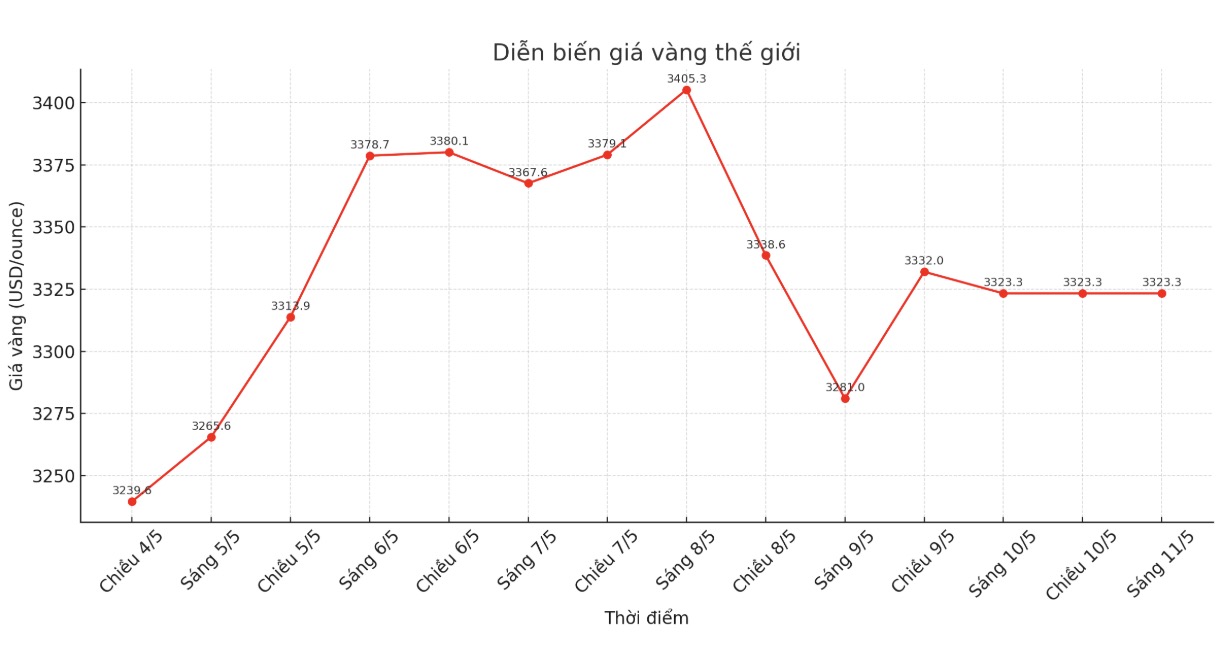

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,323.3 USD/ounce, up 83.7 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

The latest weekly gold price survey by Kitco News shows that Wall Street experts share their views between three trends of increase, decrease and move sideways, reflecting a clear differentiation in the context of many uncertain factors in the market. Meanwhile, the majority of retail investors remain bullish after the recent strong recovery of the precious metal.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said the uptrend is still being supported by a weakening USD. Neither the UK-US trade deal nor the Feds policy has created a significant boost. It will take a big event to be able to turn the market around, he said.

However, many experts warn that the current increase is slowing down. James Stanley - market strategist at Forex.com - commented that gold can still stay in the high range, but it is difficult to overcome the resistance level of 3,500 USD/ounce in the short term. I dont think buyers have withdrawn yet, but I dont expect a new breakout, he said.

Michael Brown - an expert at Pepperstone - even predicted that if US-China trade negotiations make positive progress, gold prices could be under strong downward pressure to the $3,000/ounce area. However, he still sees this as a good opportunity to buy, as gold continues to play a reliable safe haven asset amid geopolitical risks and the global economy that have not cooled down. In particular, many emerging countries are also boosting gold reserves in foreign exchange reserves, further strengthening long-term demand for precious metals.

Darin Newsom - senior market analyst at Barchart.com - said: "The precious metal should increase in price. Although there is no such thing as certain in the market, it is clear that traditional technical analysis is gradually losing its position in the era of algorithmic trading.

US economic data calendar next week

Tuesday: Consumer Price Index (CPI) April.

Thursday: Producer Price Index (PPI), retail sales, weekly jobless claims, Empire State manufacturing survey and FED Philadelphia survey. FED Chairman Jerome Powell speaks in Washington.

Friday: University of Michigan preliminary consumer confidence index for May.

See more news related to gold prices HERE...