Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.5 - 120.5 million VND/tael (buy - sell), down 1 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5 - 120.5 million VND/tael (buy - sell), down 1 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5 - 120.5 million VND/tael (buy - sell), down 1 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118 - 120.5 million VND/tael (buy - sell), down 1 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5 - 116 million VND/tael (buy - sell), down 1 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-1195 million VND/tael (buy - sell), down 1 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5 - 118.5 million VND/tael (buy - sell), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

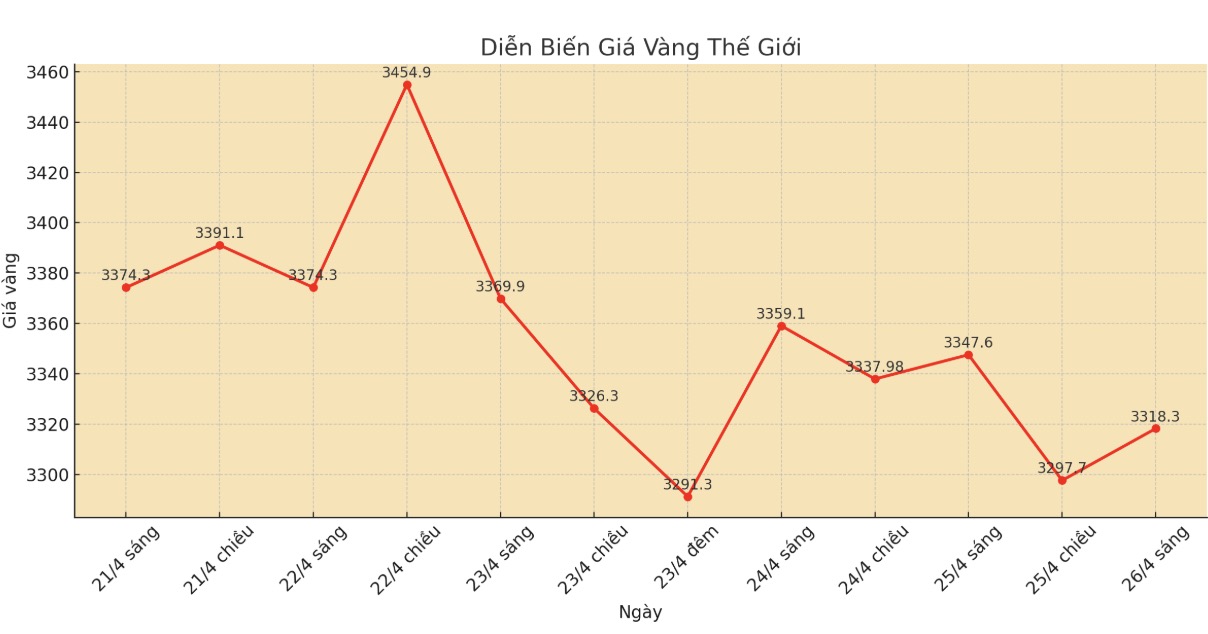

World gold price

At 9:00 a.m., the world gold price listed on Kitco was around 3,318.3 USD/ounce, down 29.3 USD.

Gold price forecast

According to Kitco, gold prices fell sharply as investor sentiment increasing risk appetite increased, putting pressure on safe-haven metals such as gold and silver.

The Asian and European stock markets mostly increased points in the last session. US stock indexes are expected to open slightly down.

Jim Wyckoff - senior analyst at Kitco commented that it seems that the tension in US-China relations is showing signs of cooling down, as both sides have shown a desire to negotiate trade and have had low-level meetings. This contributes to improving investment sentiment in the market.

World gold prices fell 6% compared to the historical peak. However, analysts said that the upward trend is not over yet.

Kelvin Wong - an expert at OANDA, said that the gold rally is not over. He forecasts gold's next resistance at $3,670 - $3,750 and $3,890/ounce.

Lukman Otunuga - an expert at FXTM - said that the current selling pressure at profit does not change the factors supporting gold. Big data from the US next week such as GDP, inflation, and employment will affect expectations of a Fed rate cut, thereby affecting gold prices.

If gold prices fall below $3,250/ounce, they could fall further to $3,170. Conversely, if it stays above $3,250/ounce, gold could increase back to $3,390-3,500/ounce.

In a recent interview with Kitco News, Ryan McIntyre, managing partner at Sprott Inc, said that when compared to the over- Valuated stock market, gold has room to increase in the long term.

McIntyre said that the stock market will continue to face difficulties due to high inflation, forcing the Fed to maintain a neutral monetary policy. Many investors are worried about an economic downturn.

In the current context, gold has the potential to build a new foundation of over 3,000 USD/ounce. Investors do not need to worry about gold at current levels.

Important economic data next week

Monday: Federal election in Canada

Tuesday: New Employment ratio (JOLTS) and US Consumer Confidence Index

Wednesday: ADP Employment Report, Preliminary Q1 GDP, Waiting for Selling Housing Contracts in the US; Japanese Central Bank monetary policy meeting

Thursday:Weekly jobless claims and US Manufacturing Purchase Management Index (ISM Manufacturing PMI)

Friday: Non-farm Payrolls Report in the US

See more news related to gold prices HERE...