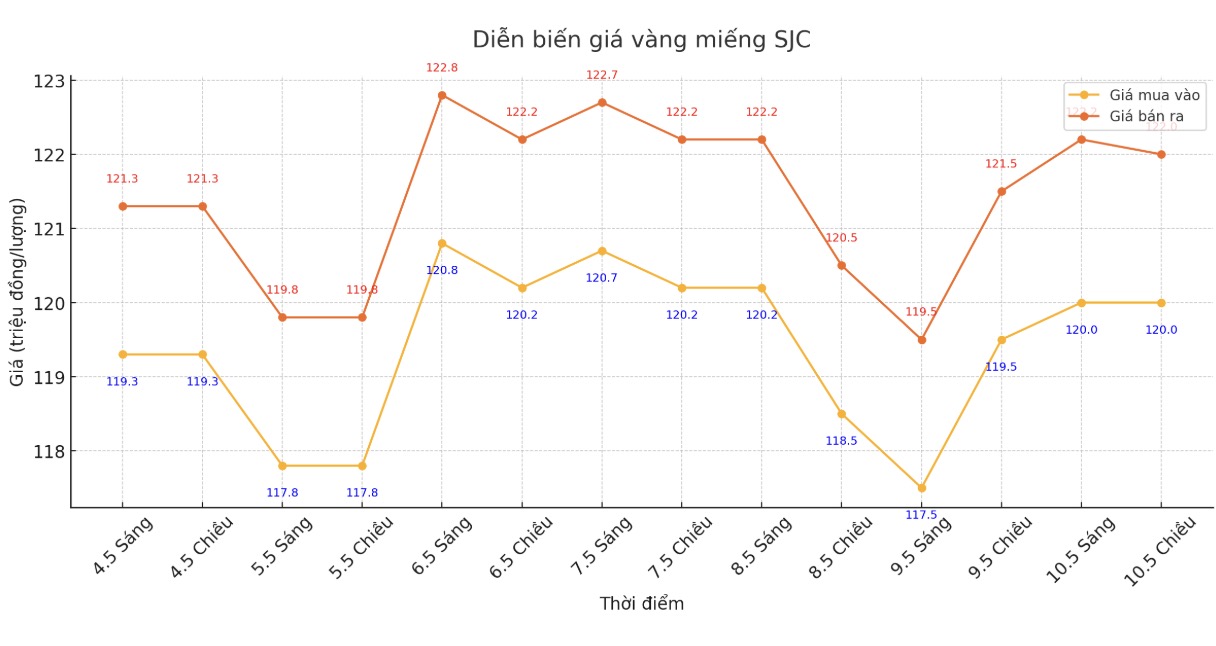

Updated SJC gold price

As of 5:40 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND120 - 122 million/tael (buy - sell), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 120 - 122 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120 - 122 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119 - 122 million VND/tael (buy - sell). The difference between buying and selling prices is at 3 million VND/tael.

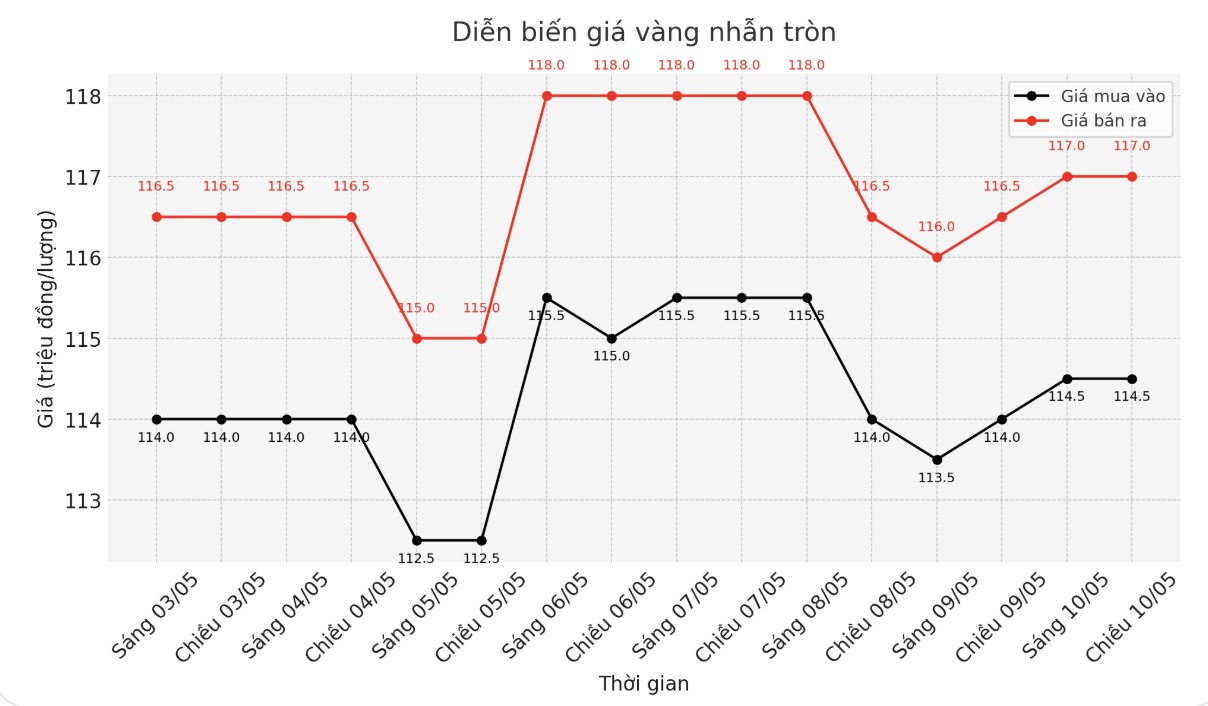

9999 round gold ring price

As of 5:40 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114.5 - 117 million VND/tael (buy - sell), an increase of 500,000 VND/tael. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117 - 120 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115 - 118 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

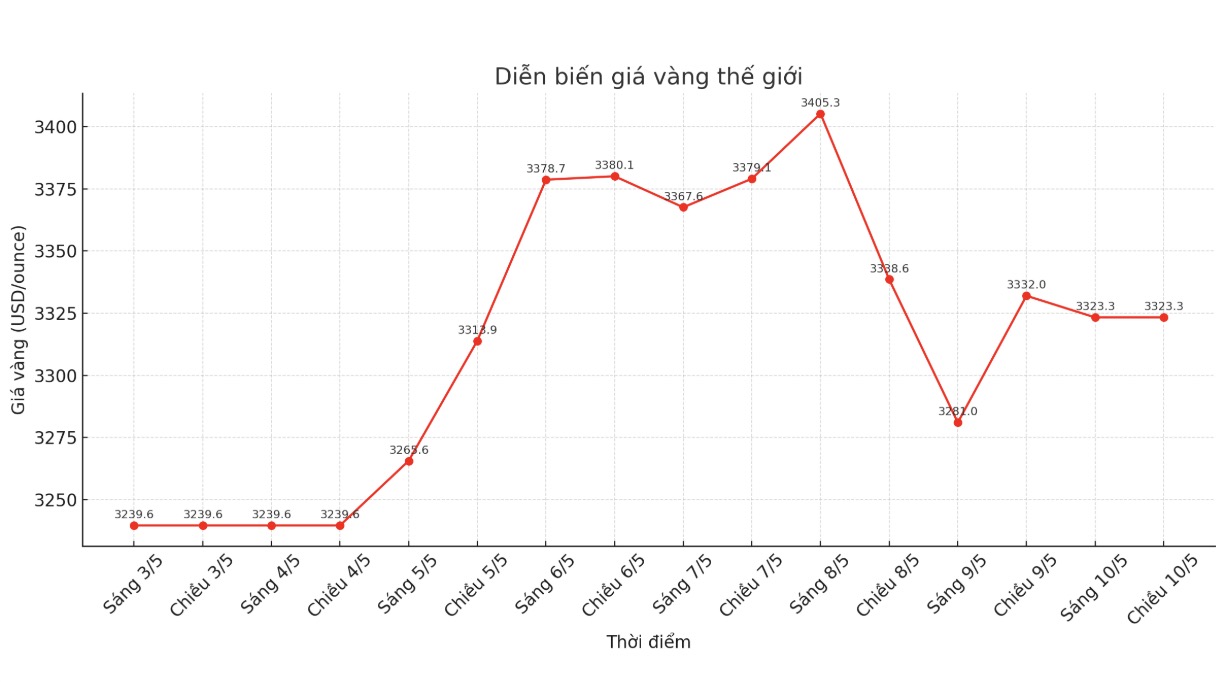

World gold price

At 5:40 p.m., the world gold price listed on Kitco was around 3,323.3 USD/ounce, down 8.7 USD.

Gold price forecast

Although it has not returned to the peak of 3,500 USD/ounce, gold prices have fully recovered from last week's decline and closed the weekend session at 3,300 USD/ounce, up 3% for the week.

Gold price fluctuations increased sharply by 6% this week, higher than the average of 1-2%/day in the past 25 years. Despite making trading more difficult, gold's long-term prospects are still bright thanks to geopolitical instability, public debt and inflation.

Experts recommend that investors prepare mentally for new fluctuations when the US - China meet at the weekend. As the question of the extent of damage and the speed of recovery of the global economy remains unanswered, gold remains a strategic safe haven asset.

According to FTSE Russell, the 60/40 investment model is gradually losing its effectiveness and should focus at least 20% of its portfolio on gold. In the past month, Asian investors bought 69.6 tonnes of gold via ETFs (7.31 billion USD), far exceeding North America (44.2 tonnes).

With strong demand, many banks predict gold could reach $4,000/ounce this year, with Bank of America being the most optimistic unit.

Timerer Waterer - market analyst of KCM Trade - commented that the trend of buying gold when prices decrease is still popular. This has helped curb gold's decline, although demand for gold to keep assets has eased as the US and UK reached a trade deal.

I am still leaning towards the bullish scenario, said senior market strategist James Stanley at Forex.com. The $3,500/ounce threshold is a formidable resistance level for spot gold, but buying power remains strong as prices hit $3,200/ounce last week and $3,300/ounce this week which shows that buyers have not completely withdrawn.

See more news related to gold prices HERE...