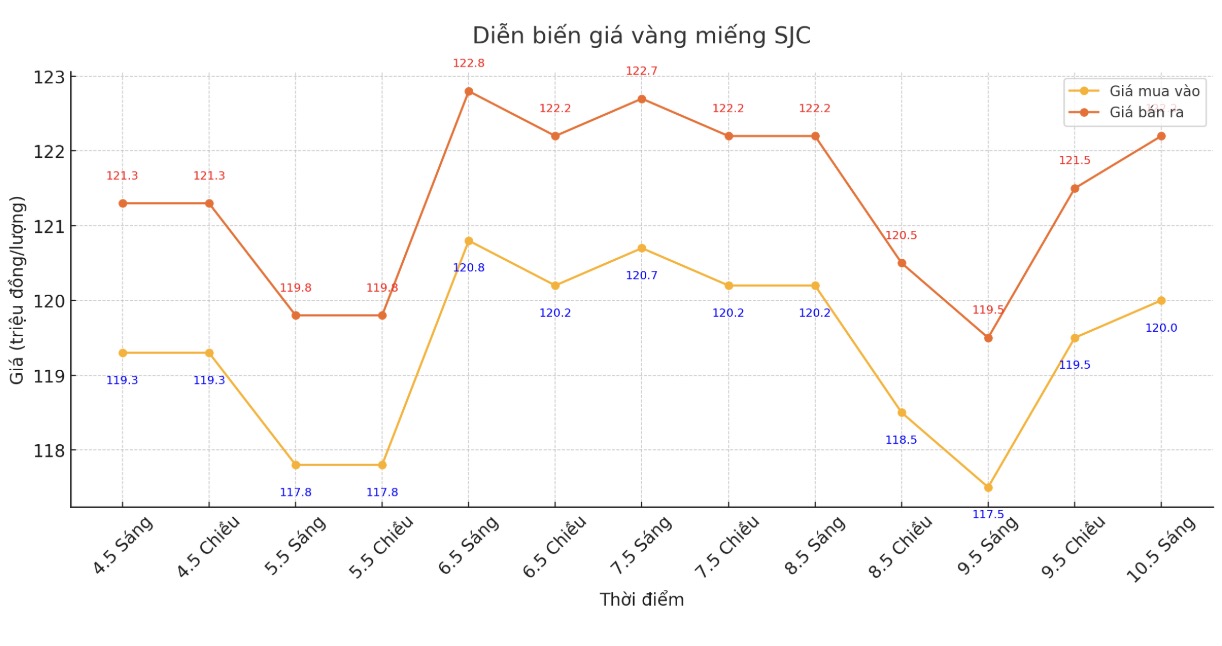

Updated SJC gold price

As of 9:10 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND120-122.2 million/tael (buy - sell), an increase of VND2.5 million/tael for buying and an increase of VND2.7 million/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 120-122.2 million VND/tael (buy - sell), an increase of 2.5 million VND/tael for buying and an increase of 2.7 million VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-122.2 million VND/tael (buy - sell), an increase of 2.5 million VND/tael for buying and an increase of 2.7 million VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119-122 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

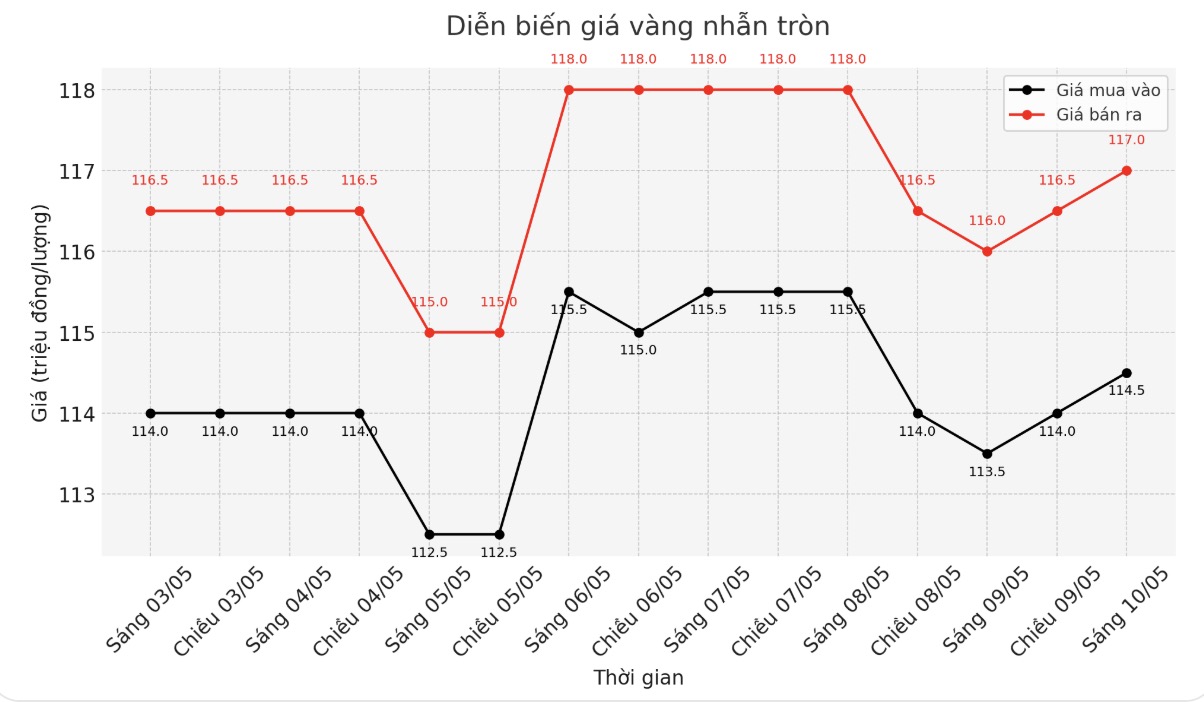

9999 round gold ring price

As of 9:10 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 114.5-117 million/tael (buy in - sell out), an increase of VND 1 million/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy in - sell out).

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

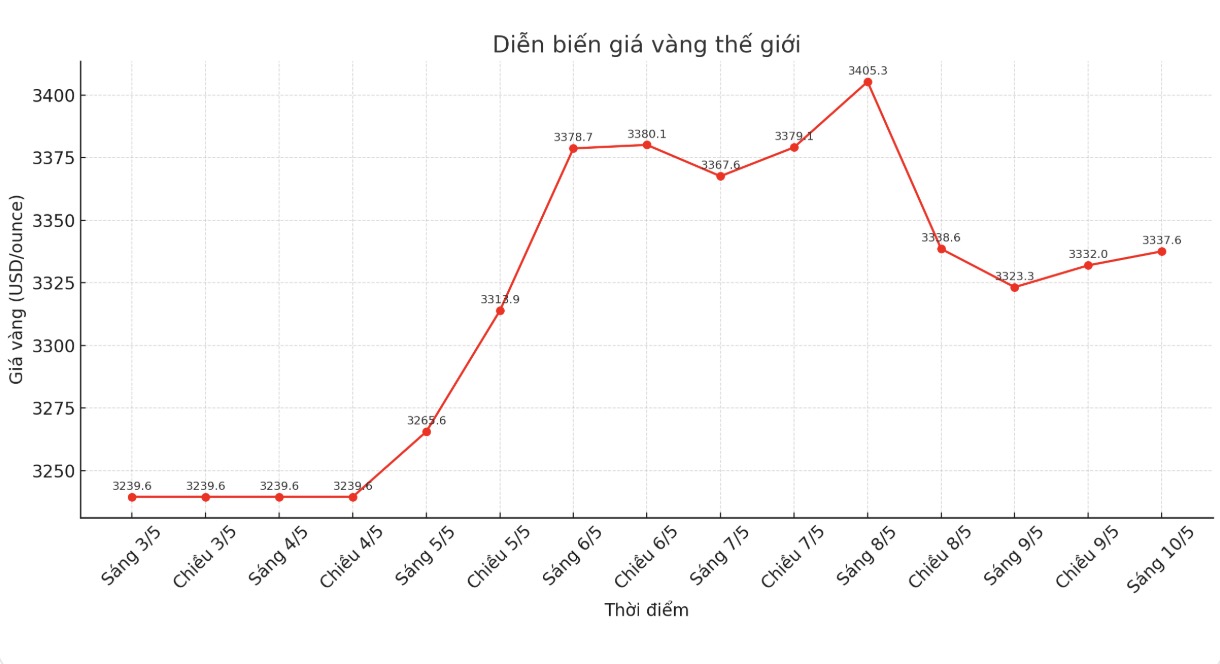

World gold price

At 9:23, the world gold price listed on Kitco was around 3,323.3 USD/ounce, up 42.3 USD/ounce.

Gold price forecast

According to Kitco, gold prices recovered quite well after the recent sell-off, thanks to support from external factors such as the declining USD index and rising crude oil prices. However, the risk-off sentiment of improving over the weekend and rising US Treasury yields are limiting the upward momentum of precious metals prices.

The negative impact of the US-China trade war is clearly visible when reviewing data on goods transportation. Bloomberg said the volume of goods imported through Los Angeles Port - the busiest container port in North America - has fallen by a third.

A CEO of the transportation industry said that the amount of goods from China decreased by 60%. This will affect the chain of many US businesses, from loading and unloading workers, logistics to retailers. Even with a trade deal, restoring the supply chain will take a long time.

Over the past two years, Asia has been the leading region in physical demand for gold. Now, this trend continues to spread to the "paper" gold market, with the buying volume of gold ETFs (port rate exchange-traded funds with gold guarantees) increasing the most compared to other regions, according to the latest data from the World Gold Council (WGC).

Total global gold ETF holdings increased by 115 tons in April, equivalent to 11 billion USD, bringing the total to 3,561 tons. This is the 5th consecutive month of recorded net inflows, and also the highest level since August 2022. However, this figure is still 10% lower than the record set in 2020.

Asia accounts for 65% of total global net capital flows, the highest ever. North America also recorded significant demand, while capital flows in Europe turned negative (capital flows were withdrawn) the report said.

Although gold prices hit a historic peak of $3,500/ounce last month, the WGC said gold still has room to continue to increase, even in the context of strong fluctuations and increased profit-taking activities.

Large gold rallies in the past have often led to strong inflows into ETFs. However, the current holdings of gold held by Western funds are still down from the 2020 peak by 575 tons (equivalent to 15%) - the analysis report.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...