Update SJC gold price

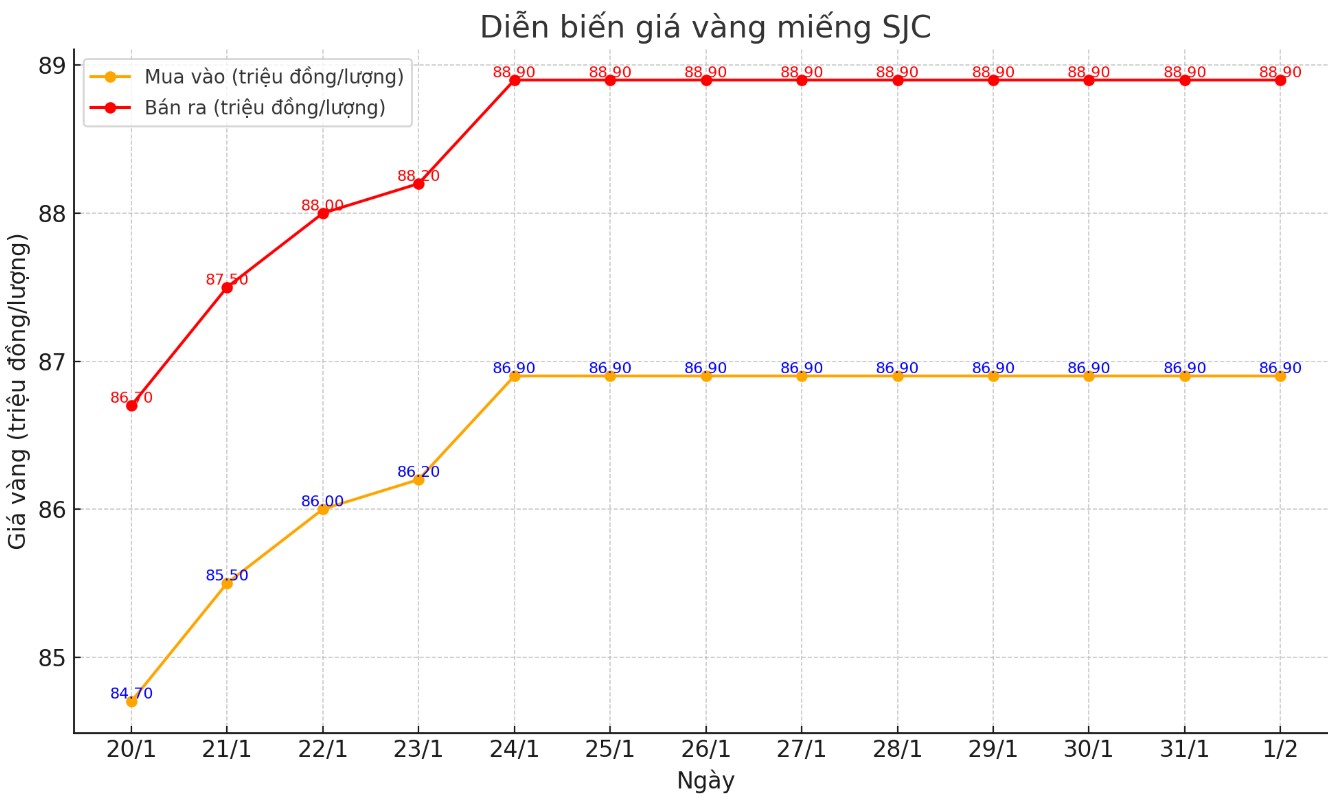

As of 9:40 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

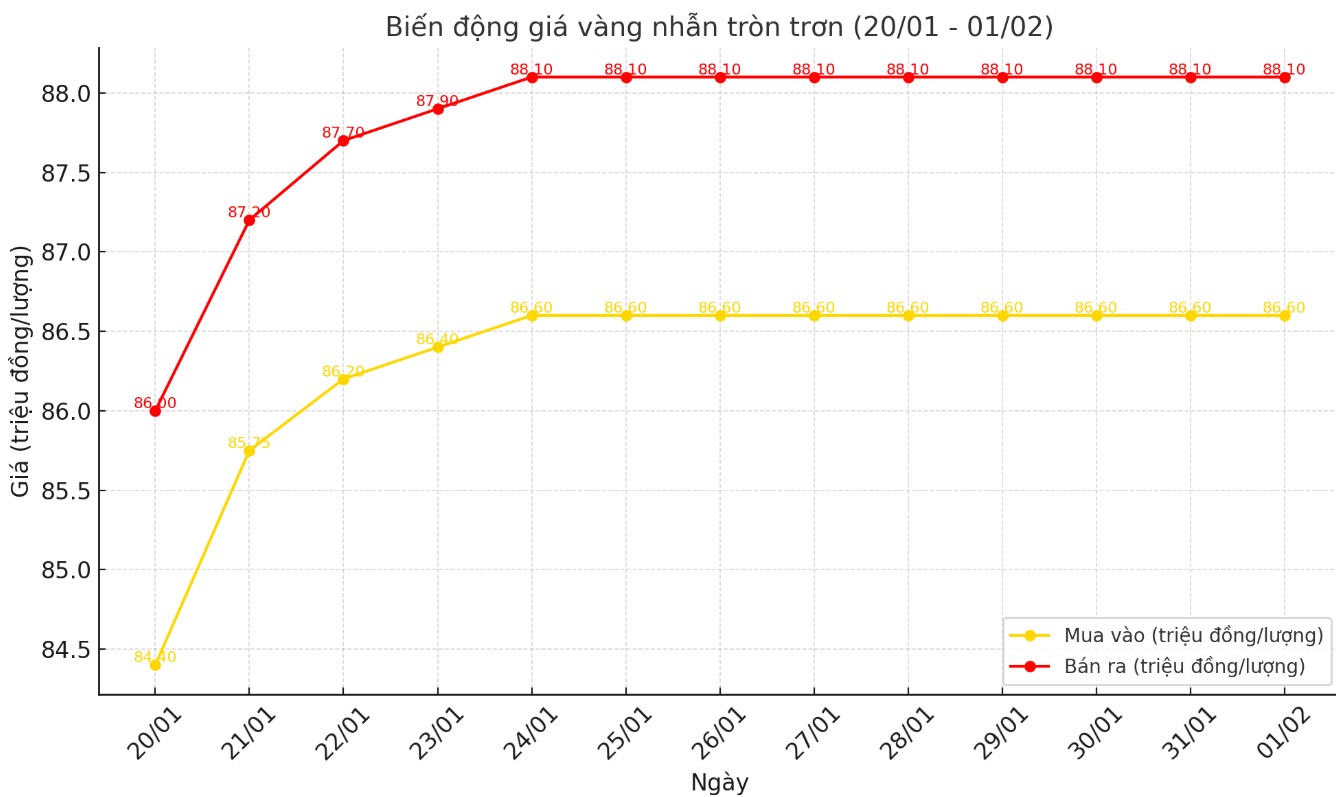

As of 9:45 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both selling prices remain the same compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

World gold price

As of 9:40 a.m., the world gold price listed on Kitco was at 2,797.9 USD/ounce, up 3 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices are under pressure amid the rising USD. Recorded at 9:40 a.m. on February 1, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.360 points (up 0.68%).

After breaking through the record of 2,800 USD/ounce, the gold price increase was hindered by profit-taking wave of investors. However, the precious metal still received positive reviews from experts.

According to Neils Christensen - analyst of Kitco News, gold prices are anchored high in the context of US inflation data remaining high, in line with forecasts.

The core personal consumption expenditures (PCE) index - the Federal Reserve's preferred inflation gauge, which excludes volatile food and energy prices - rose 0.2% last month, up from a 0.1% increase in November. The increase in consumer prices was in line with analysts' forecasts.

Core inflation rose 2.8% over the past 12 months, unchanged from November's reading, the Commerce Department reported on Friday.

Analysts say the latest inflation data paints a mixed picture for gold. High consumer prices will make it difficult for the Federal Reserve to cut interest rates in the near future. However, uncontrolled inflation also poses risks to the economy, thereby reinforcing gold's safe-haven role.

In addition, high inflation and interest rates could increase risks to the already volatile stock market, creating additional momentum to support gold prices.

Meanwhile, Bob Haberkorn - senior market strategist at RJO Futures - said that the conflicting signals from the FED and the current Donald Trump administration are also causing instability in the market... Mr. Trump wants to cut interest rates, while the FED wants to keep interest rates unchanged.

If high inflation and slow growth come together, the $3,000/ounce mark will be easy to reach, said Ricardo Evangelista, senior analyst at ActivTrades.

See more news related to gold prices HERE...