This information was released by the London Bullion Market Association (LBMA) in the context of reports of a sharp increase in gold imports into the US, leading to a risk of shortage in London and the formation of a reserve worth 82 billion USD in New York.

"The US gold market has traded at a premium to the London market since the US presidential election results were announced in late 2024. This has occasionally happened in markets around the world," the London Bullion Market Association (LBMA) announced.

The LBMA also confirmed that physical gold supply and liquidity in London remain stable. Meanwhile, CME Group and the US Commodity Futures Trading Commission (CFTC) did not respond to requests for comment from Reuters.

Gold market fluctuates on tariff concerns

Concerns about broad tariffs, including potential ones on precious metals, have sent the US gold market surging, increasing demand for physical gold in the country. This has led to doubts about the current state of gold reserves and the future price outlook.

The Financial Times reported on Wednesday that soaring demand for gold in the United States has created a shortage in London. The report cited sources as saying that the time it takes to withdraw gold from the Bank of England’s vaults has extended from a few days to four to eight weeks due to the high supply pressure.

Since the US presidential election in early November 2024, gold traders and financial institutions have moved 393 tonnes of gold into Comex warehouses in New York, a nearly 75% increase to 926 tonnes - the highest since August 2022.

Some market experts believe the actual figure could be higher, because in addition to the gold on the Comex floor, there are other gold lots stored in private vaults of HSBC and JPMorgan in New York.

Gold prices hit new record high

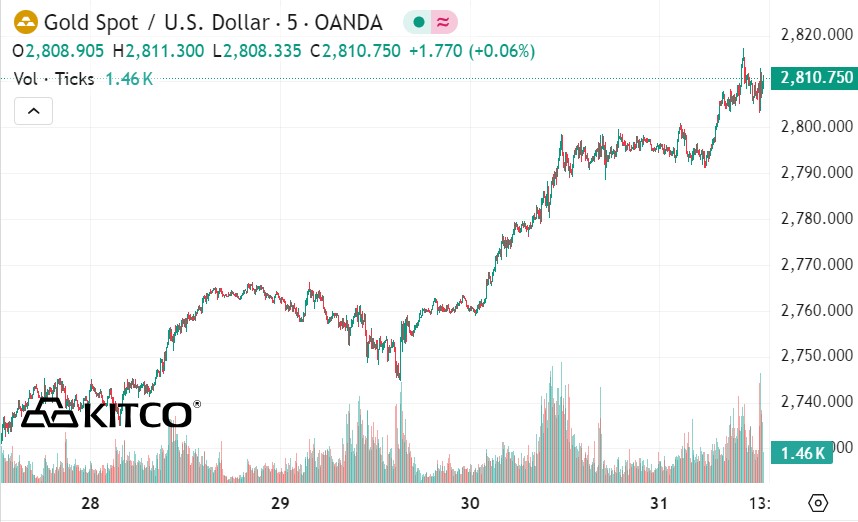

The volatility pushed spot gold to a new record high of $2,798.60 an ounce on Thursday. By Friday morning, gold had risen to $2,817.21 an ounce at 10:12 a.m. EST.

Kevin Grady, president of Phoenix Futures and Options, told Kitco News that the uncertainty surrounding tariffs is having a big impact on the physical gold market. "We have to watch this closely. There is no full information on specific tariffs at this point, so it's hard to make any predictions," Grady said.

He also said that the financial community is paying special attention to the new tax policy of the US President Donald Trump administration, as this could shape the gold market in the first half of 2025. "Everyone is watching closely, this will probably be the biggest story in the first and second quarter of 2025" - Grady commented.

Another issue Grady warned about was the risk of gold contracts being suspended due to a lack of physical gold for immediate delivery. According to him, if this situation persists, within just a few weeks or months, the gold market could face many major difficulties.

The gold refining industry is also under pressure because the process of refining precious metals takes time. "There can be a lot of gold on the market, but if it's not refined, it can't be traded. That's a big problem, and it happened in 2020 during COVID-19," Grady added.

Grady believes that major financial institutions are actively lobbying the new administration to ensure the stability of the gold market.

"Currently, many large organizations may be working with Donald Trump's transition team to find solutions," he said.

“If the US wants to be the center of global financial markets, it needs to ensure that the markets operate smoothly and without major volatility.”

According to Grady, the separation between the New York and London gold markets could complicate the global trading system, especially as investors shy away from moving precious metals between the two financial centers.

See more news related to gold prices HERE...