Updated SJC gold price

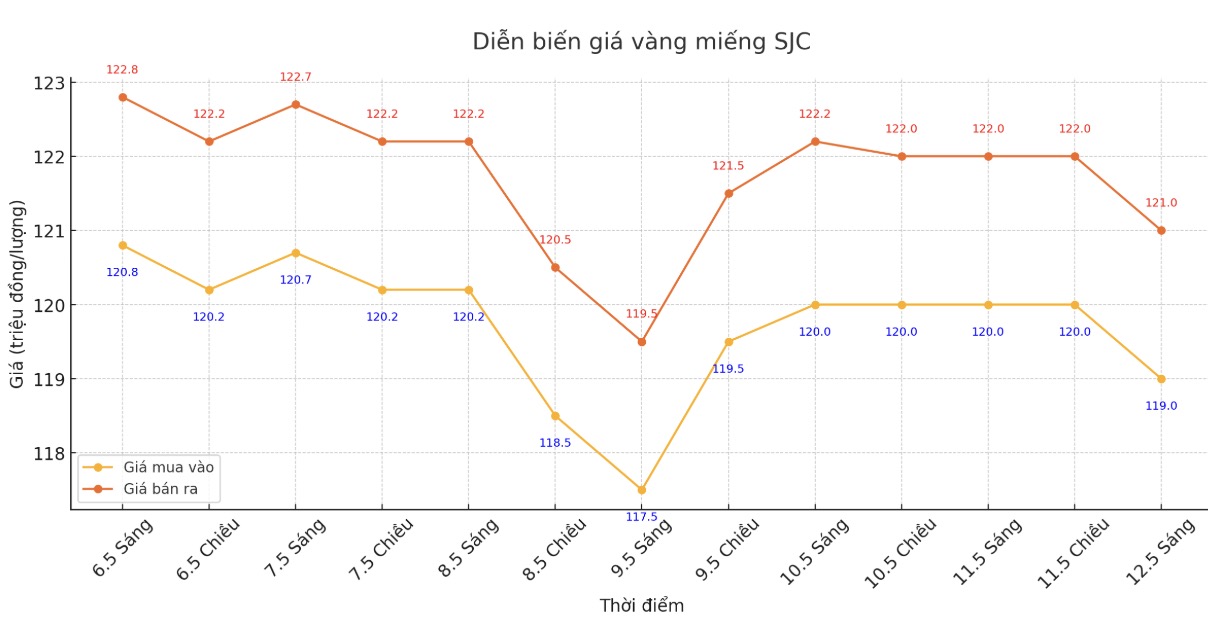

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy - sell), down VND1 million/tael for buying and down VND1.2 million/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), down 1 million VND/tael for buying and down 1.2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), down 1 million VND/tael for buying and down 1.2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118-121 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

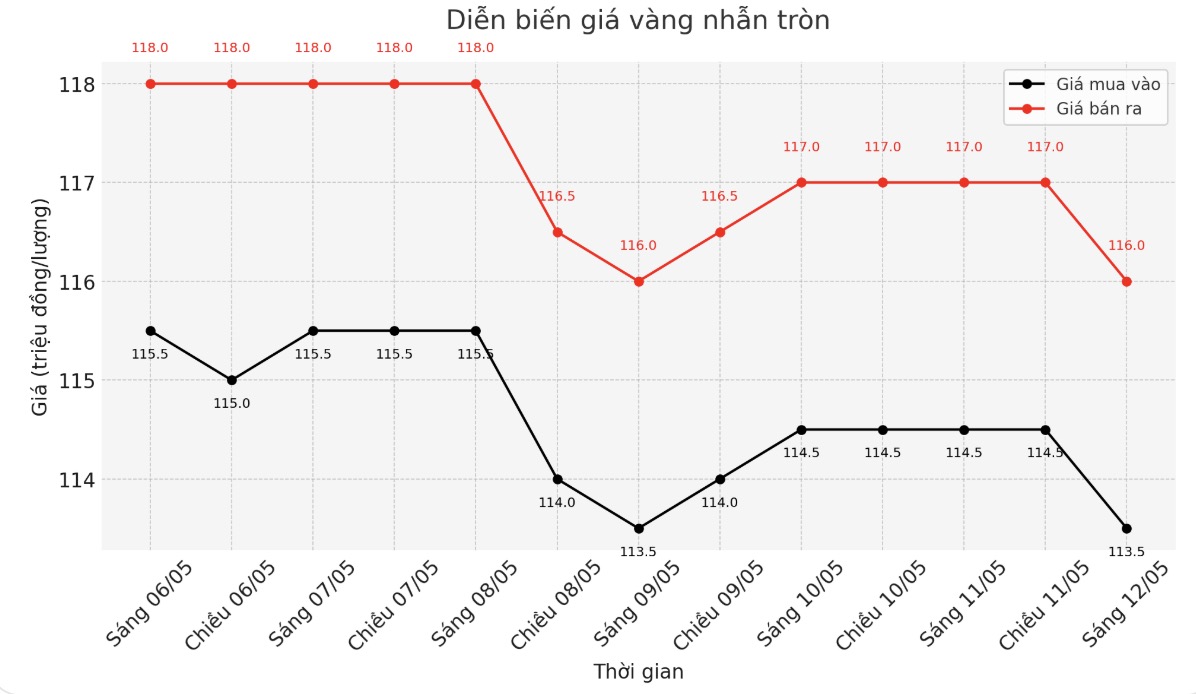

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-116 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), down 1 million VND/tael in both directions.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

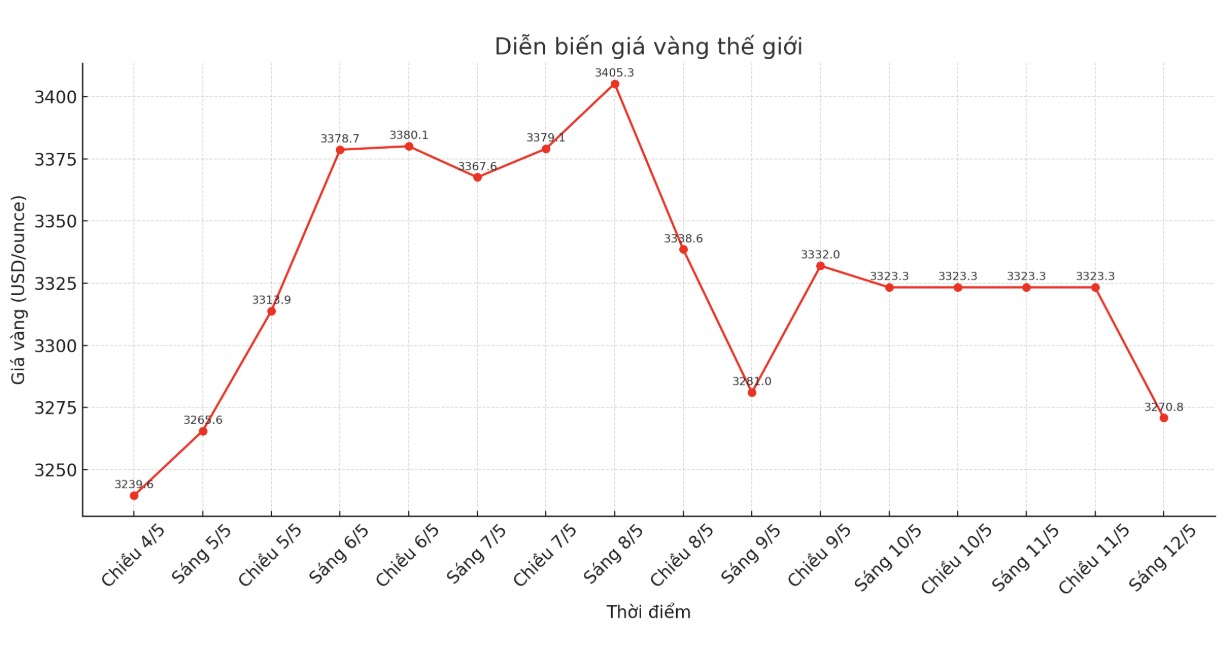

At 9:00 a.m., the world gold price listed on Kitco was around 3,270.8 USD/ounce, down 52.5 USD/ounce.

Gold price forecast

According to the latest survey by Kitco News, experts divided it into three groups of increases, decreases and stays.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is bullish on gold this week. According to him, the stable weakening of the USD is creating a solid push for gold.

The trade deal between the UK and the US as well as the US Federal Reserves move are not strong enough to turn the current trend around. It takes a big event to change the direction of the market, he said.

Darin Newsom - senior market analyst at Barchart.com - also predicted that gold prices will increase. If I had to give a brief message, I would have written: Precious metals should increase in price. I emphasize the right thing, because there is nothing absolute in the market. Honestly, last week I predicted a decrease based on technical analysis - but that has become outdated in today's algorithmic trading era."

On the other hand, some experts warn of the possibility of a deep correction if trade tensions between the US and China continue to cool down.

Alex Kuptsikevich, senior expert at FxPro, noted that the recent $3,500/ounce hit in the spot market has led to a strong sell-off.

The pattern of fluctuations last week was quite similar to last April, possibly related to crop factors. Last year, gold prices took three months to accumulate before rising again. This time, I think the most positive scenario is to go sideways, and there is still a possibility of prices falling sharply to the $2,800/ounce zone before the end of the year.

Some other experts are neutral, saying that the market is still in the accumulation phase after a major fluctuation. Adrian Day - Chairman of Adrian Day Asset Management - said that gold remains strong despite expectations of easing trade tensions and the risk of recession in the US. potential purchasing power is still huge, he said.

Marc Chandler - CEO at Bannockburn Global Forex - said that the market is in the accumulated adjustment phase. "At the beginning of the week, the weekend has been abolished.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...