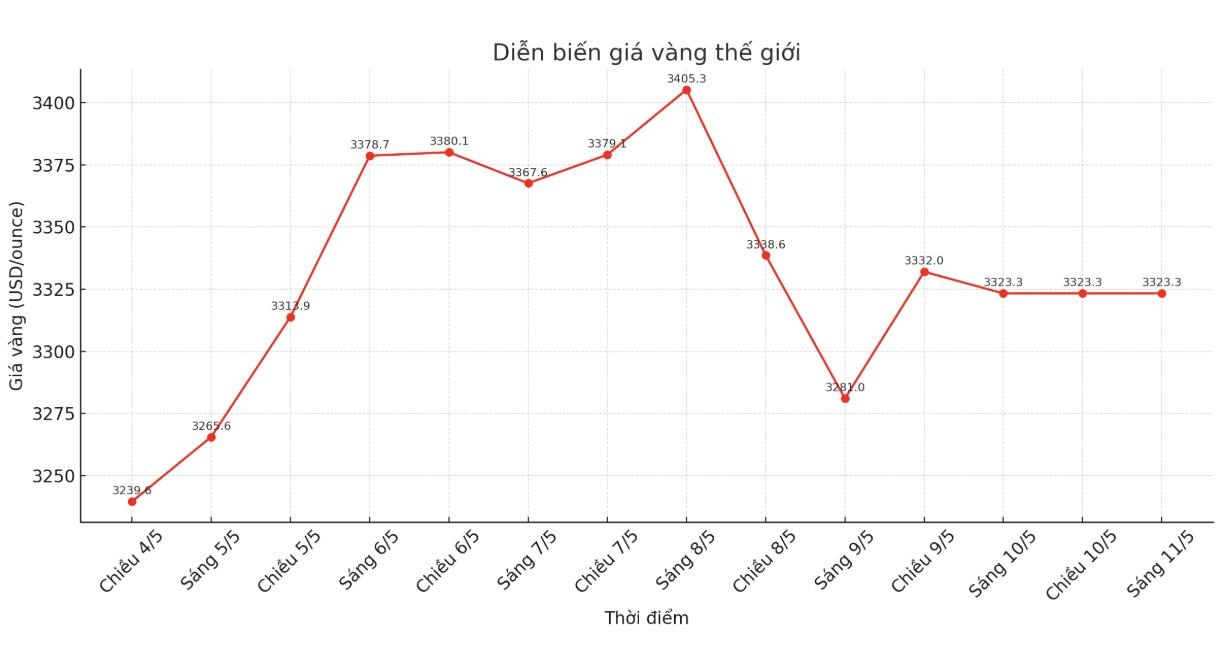

World gold prices are still above $3,300/ounce, despite falling significantly from the peak of $3,400/ounce at the beginning of the week. However, gold has still recovered most of last week's decline. As of the end of the week, the spot price was at 3,323.3 USD/ounce.

Experts say that although the long-term trend is still positive, the increase in gold shows signs of slowing down. James Stanley - market strategist at Forex.com - commented that gold may still stay in the high range, but not enough to surpass the 3,500 USD/ounce mark in the short term.

I dont think buyers have withdrawn yet, but I dont expect a new breakout, he said.

Gold prices last week did not have any breakthrough fluctuations when the US Federal Reserve (FED) confirmed that it was in no rush to lower interest rates. Many investors believe that the expectation of the FED to cut interest rates in July was previously taken into account by the market, so it is no longer a new factor to push gold prices up further.

According to Naeem Aslam - Investment Director of Zaye Capital Markets - this has caused gold's increase to fall into a "waiting" state.

In the short term, Naeem Aslam believes that gold may adjust slightly but is still bought when depreciating. In the long term, he expects gold prices to surpass the $3,500/ounce mark as geopolitical uncertainty continues.

The factor that analysts are especially monitoring is the trade talks between the US and China this weekend in Switzerland. This could be the first step towards ending a prolonged trade war, especially as the Donald Trump administration has just reached a preliminary agreement with the UK to reduce tariffs on some goods.

Michael Brown - an expert at Pepperstone - warned that if the US - China make positive progress, gold could be under downward pressure to the $3,000/ounce range.

However, he still sees this as a good buying opportunity, because in the context of many risks globally, gold is still a reliable safe haven asset, especially when many emerging countries are increasing their gold reserves in foreign exchange reserves.

Next week, the market will pay attention to a series of US economic data, especially the consumer price index (CPI) released on Tuesday. If inflation continues to stay high, the Fed could keep interest rates high for a while, creating volatility in gold prices. Rising inflation could also reduce real interest rates, supporting gold prices.

US economic data calendar next week

Tuesday: Consumer Price Index (CPI) April.

Thursday: Producer Price Index (PPI), retail sales, weekly jobless claims, Empire State manufacturing survey and FED Philadelphia survey. FED Chairman Jerome Powell speaks in Washington.

Friday: University of Michigan preliminary consumer confidence index for May.