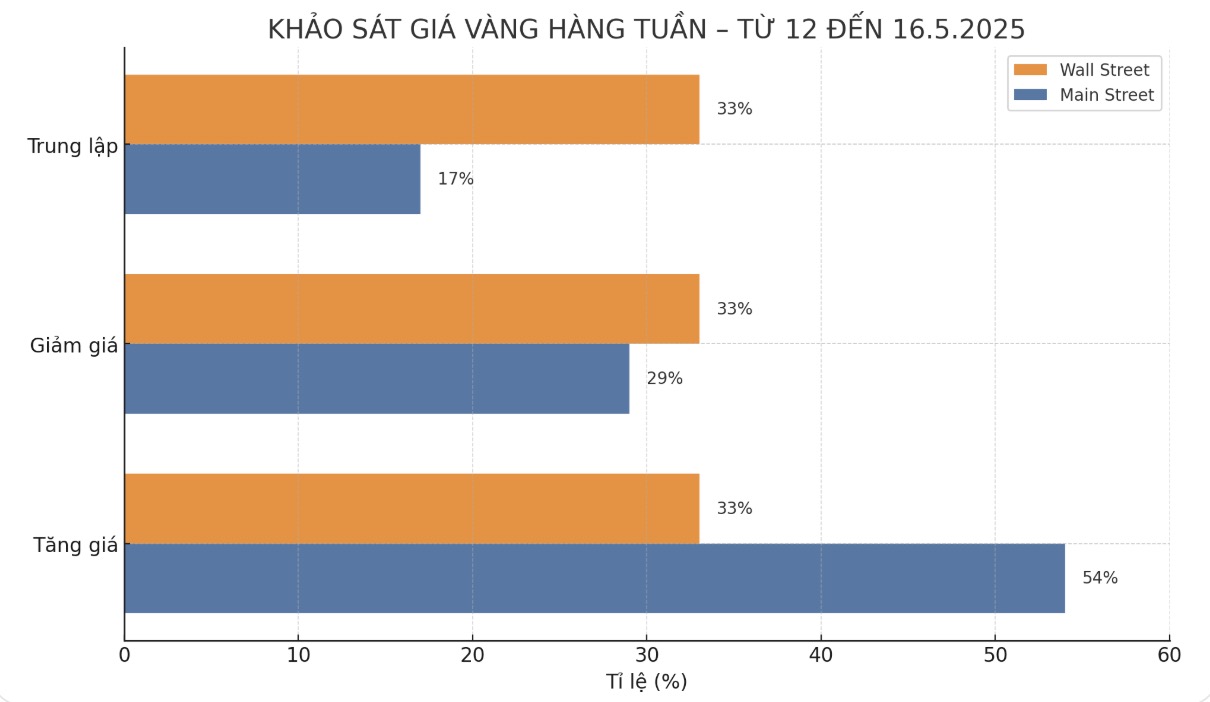

Purchasing power has not disappeared, many experts predict positively

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is bullish on gold this week. According to him, the stable weakening of the USD is creating a solid push for gold.

The trade deal between the UK and the US as well as the US Federal Reserves move are not strong enough to turn the current trend around. It takes a big event to change the direction of the market, he said.

Darin Newsom - senior market analyst at Barchart.com - also predicted that gold prices will increase. If I had to give a brief message, I would have written: Precious metals should increase in price. I emphasize the right thing, because there is nothing absolute in the market. Honestly, last week I predicted a decrease based on technical analysis but that has become outdated in todays algorithmic trading era.

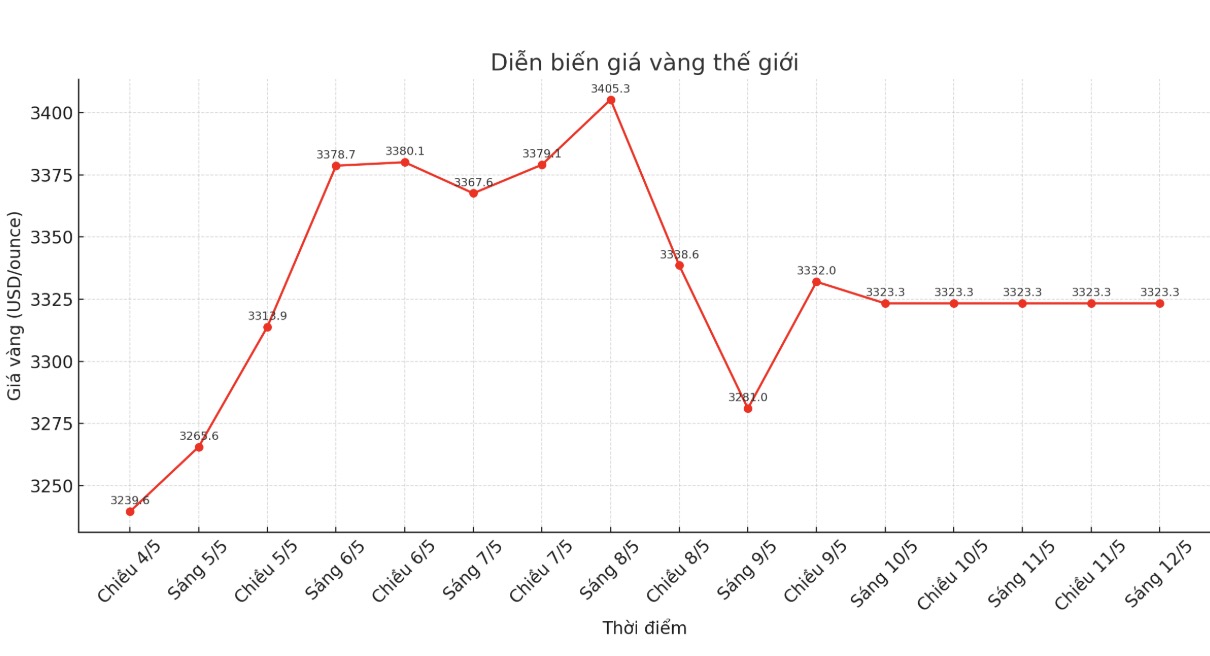

Similarly, James Stanley - market strategist at Forex.com - commented that the resistance level of 3,500 USD/ounce is a big challenge, but purchasing power has not disappeared. Last week, prices were held at $3,200, and this week at $3,300/ounce. That shows that the buyers have not withdrawn.

Potential to drop sharply if trade tensions cool down

On the other hand, some experts warn of the possibility of a deep correction if trade tensions between the US and China continue to cool down.

Alex Kuptsikevich, senior expert at FxPro, noted that the recent $3,500/ounce hit in the spot market has led to a strong sell-off.

This weeks fluctuations are quite similar to last April, possibly due to crop factors. Last year, gold prices took three months to accumulate before rising again. This time, I think the most positive scenario is to go sideways, and there is still a possibility of prices falling sharply to the $2,800/ounce zone before the end of the year.

Adam Button - Head of currency strategy at Forexlive.com - said that the resumption of trade negotiations between the US and China could undermine gold's upward momentum.

This weekends meeting is very important. If the results show that tariffs are reduced, gold could be sold off to make way for other risky assets such as stocks. Gold is now becoming a symbol of global trade when stress increases, gold increases, when it cools down, gold decreases.

The possibility of gold prices moving sideways cannot be ruled out

Some other experts are neutral, saying that the market is still in the accumulation phase after a major fluctuation. Adrian Day - Chairman of Adrian Day Asset Management - said that gold remains strong despite expectations of easing trade tensions and the risk of recession in the US. potential purchasing power is still huge, he said.

Marc Chandler - CEO at Bannockburn Global Forex - said that the market is in the accumulated adjustment phase. "At the beginning of the week, the weekend has been abolished.

Jim Wyckoff - senior analyst at Kitco - agreed with the above assessment and predicted that gold prices will continue to fluctuate within a wide range with the sideways trend dominating this week.

Daniel Pavilonis - senior commodity broker at RJO Futures - commented that gold prices are fluctuating within a wide range, reflecting investors' caution in the face of uncompromising factors such as the Fed's policy and trade negotiations with China.

If there is a deal in Switzerland, gold prices could be sold off. But otherwise, gold could return strongly, even reaching $4,500/ounce if the conflict escalates, he said.