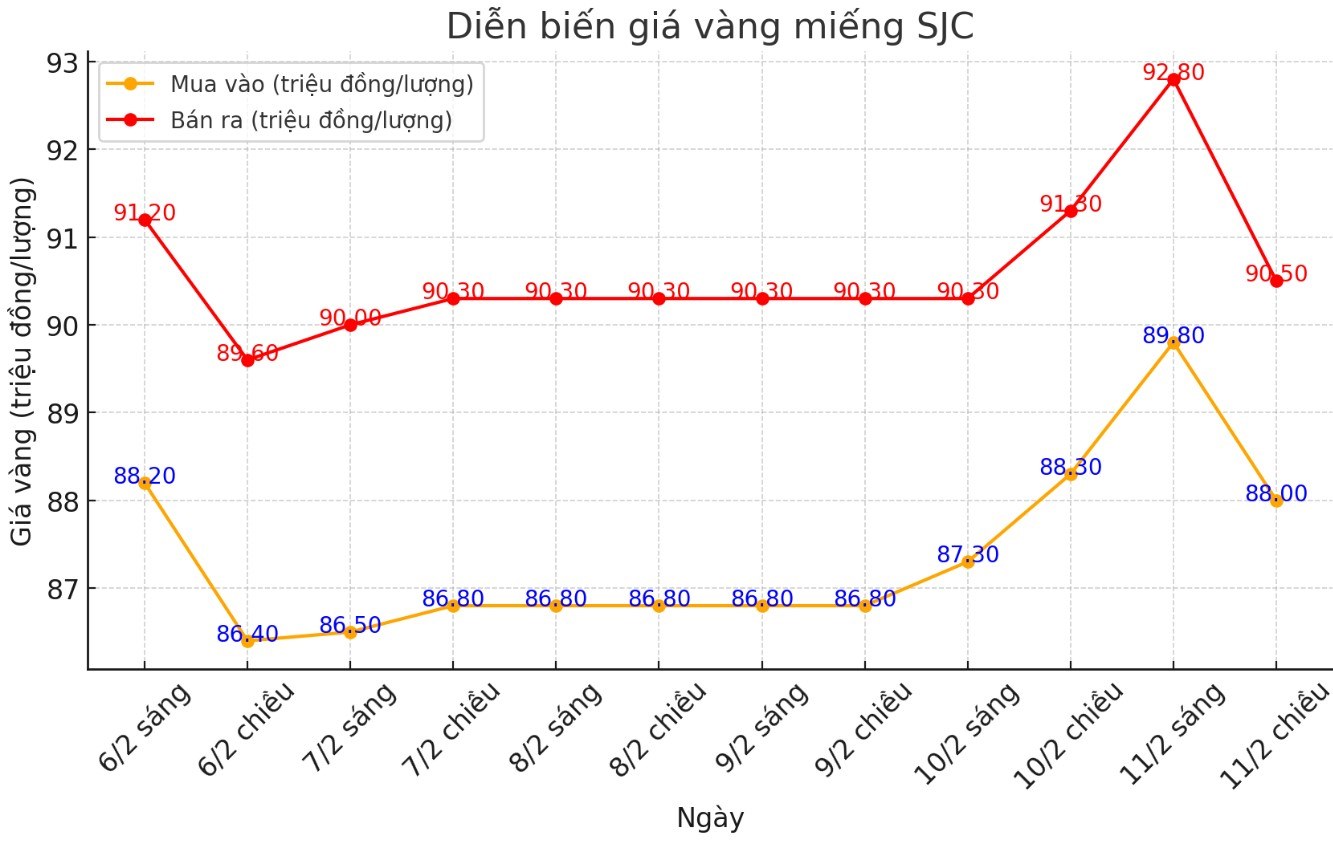

Update SJC gold price

As of 7:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND88-90.5 million/tael (buy - sell), down VND300,000/tael for buying and down VND800,000/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company is VND2.5 million/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 88.4-90.45 million VND/tael (buy - sell), down 450,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling is at 2.05 million VND/tael.

DOJI Group listed the price of SJC gold bars at 88-90.5 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold has been adjusted down to 2.5 million VND/tael.

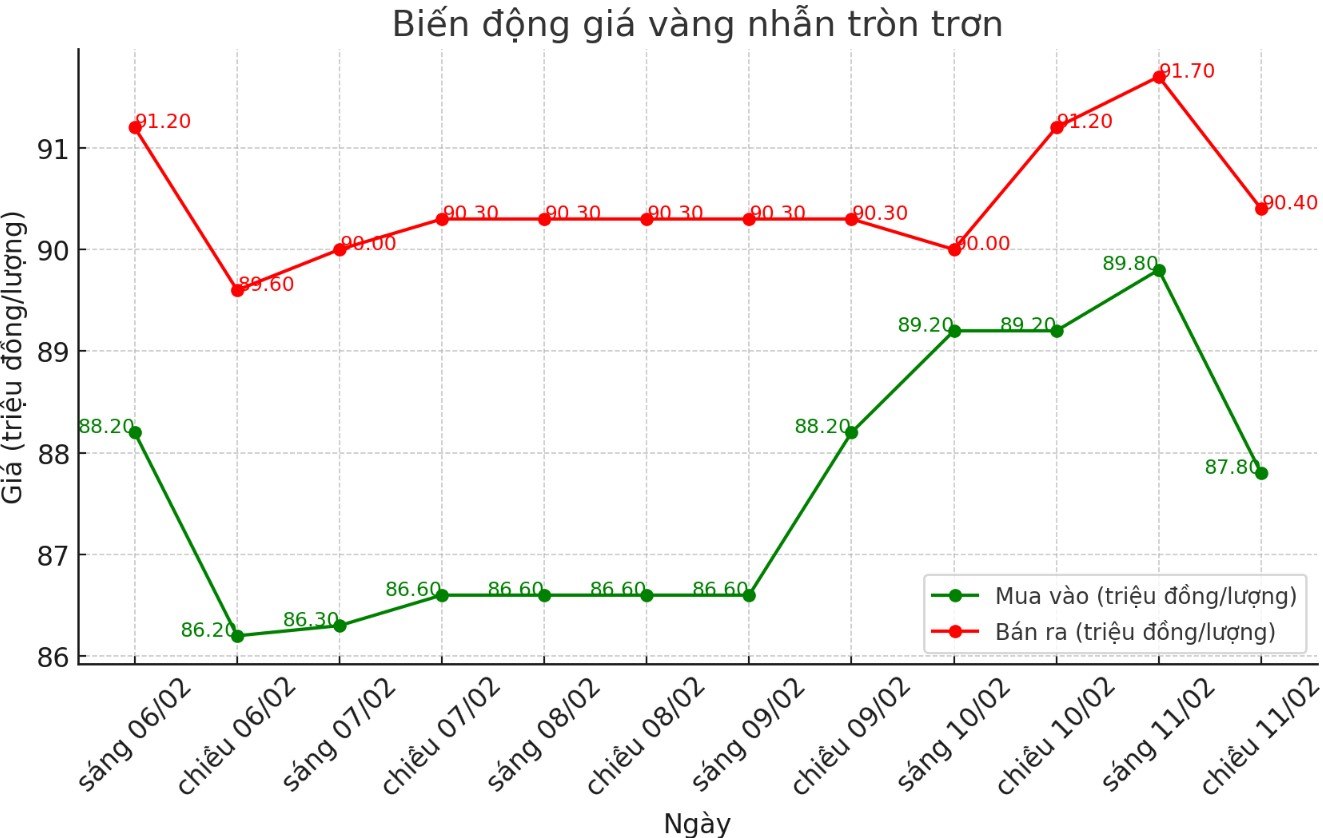

Price of round gold ring 9999

As of 7:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 87.8-90.4 million VND/tael (buy - sell); down 1.4 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling has decreased to 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 88.4-90.45 million VND/tael (buy - sell); down 450,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling decreased from 2.4 million VND/tael to 2.05 million VND/tael.

World gold price

As of 7:15 p.m., the world gold price listed on Kitco was at 2,903 USD/ounce, up 1.1 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased slightly as the USD cooled down. Recorded at 7:20 p.m. on February 11, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.125 points (down 0.06%).

According to Kitco - gold prices continue to rise due to inflationary pressures and signs of tariff policies from US President Donald Trump. Meanwhile, gold demand from central banks remains strong, according to a report from Heraeus (a global technology group based in Germany, specializing in precious metals, advanced materials and biotechnology - PV).

According to experts from Heraeus, gold demand from central banks in 2024 will reach nearly 1,050 tons. Although this figure is slightly down from 2023, it is still considered high, with gold demand distribution concentrated mainly in a few countries. Poland, Turkey and India are leading with a total of 235 tons of gold purchased from the beginning of the year to November, accounting for 68% of total central bank demand.

Poland raised the share of gold in its foreign exchange reserves from 12% in January to 17% in November, close to its target of 20%. The sharp rise in gold prices over the past month has helped lift the value of its gold reserves by more than $41 billion, pushing the share to 18%. This is the first time Poland has stopped buying gold in eight consecutive months, reflecting the possibility of a reduction in demand in the coming period.

In addition, capital flows into gold ETFs remained stable, supporting gold prices to maintain their upward momentum. Meanwhile, physical gold supply on the COMEX market recorded limited imports last month, indicating that physical gold demand remains high.

"Market movements were also affected by China's retaliation with a $14 billion tariff package imposed on US goods, along with a new pilot program allowing some Chinese insurance companies to invest up to 1% of their portfolios in gold - which could create additional demand of up to $27 billion," said experts at SP Angel (a financial services company based in London, UK - specializing in providing financial advisory, brokerage and market research services, especially focusing on the mining, natural resources and energy sectors).

Markets will also be closely watching Federal Reserve Chairman Jerome Powell's testimony before Congress on Tuesday and Wednesday.

Currently, gold investors still have good supporting factors, especially in the context of the US not being able to control inflation and tariffs are still a risk factor. Gold prices can maintain the upward momentum if inflation expectations continue to be inflated, especially when monetary policy shows no signs of loosening.

See more news related to gold prices HERE...