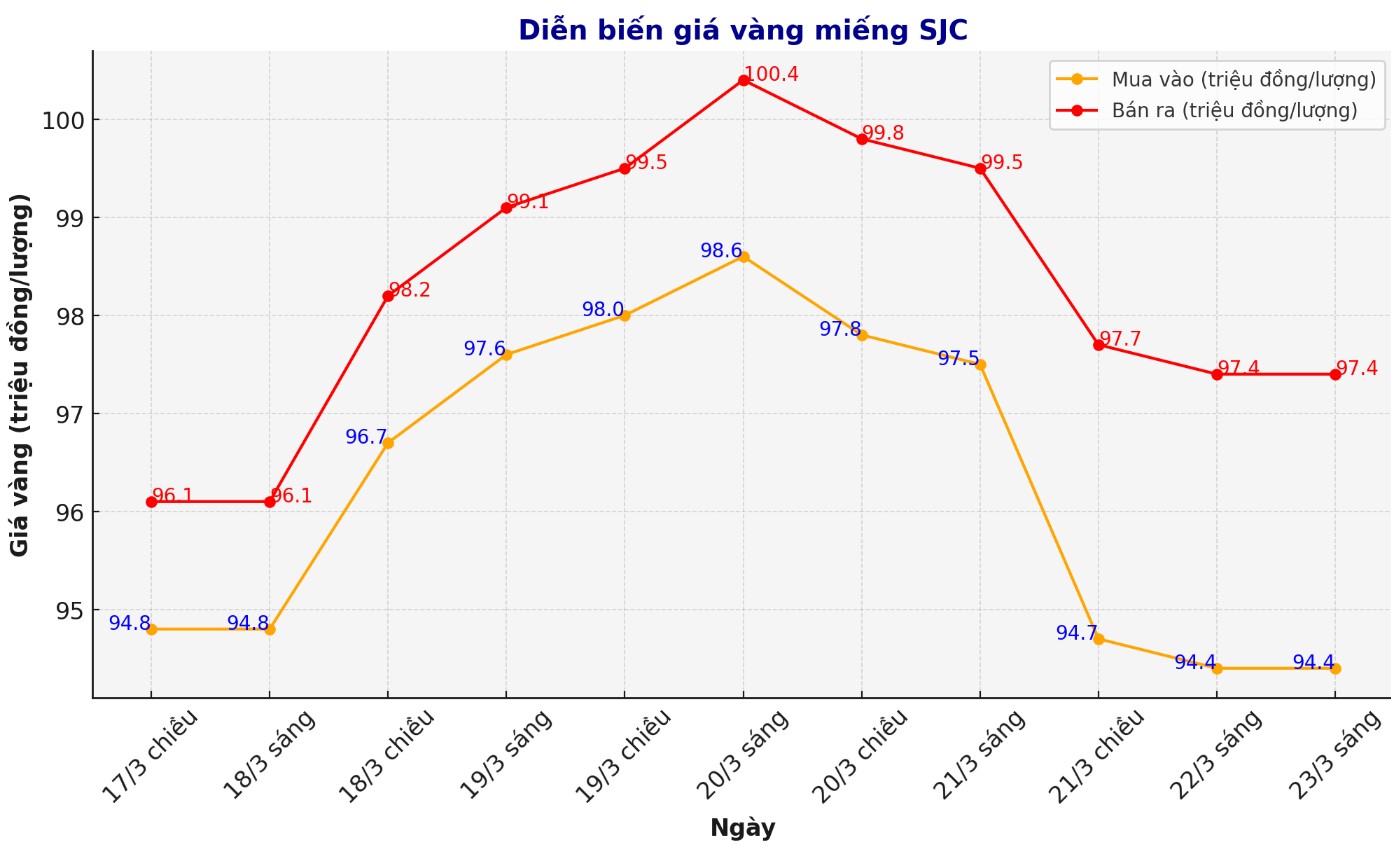

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at VND94.4-97.4 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 16, 2025), the price of SJC gold bars at DOJI increased by VND100,000/tael for buying and VND1.6 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group increased from 1.5 million to 3 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at VND94.4-97.4 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 16, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by VND100,000/tael for buying and VND1.6 million/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company Group SJC also increased from 1.5 million to 3 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of March 16 and selling it in today's session (March 23), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 1.4 million VND/tael.

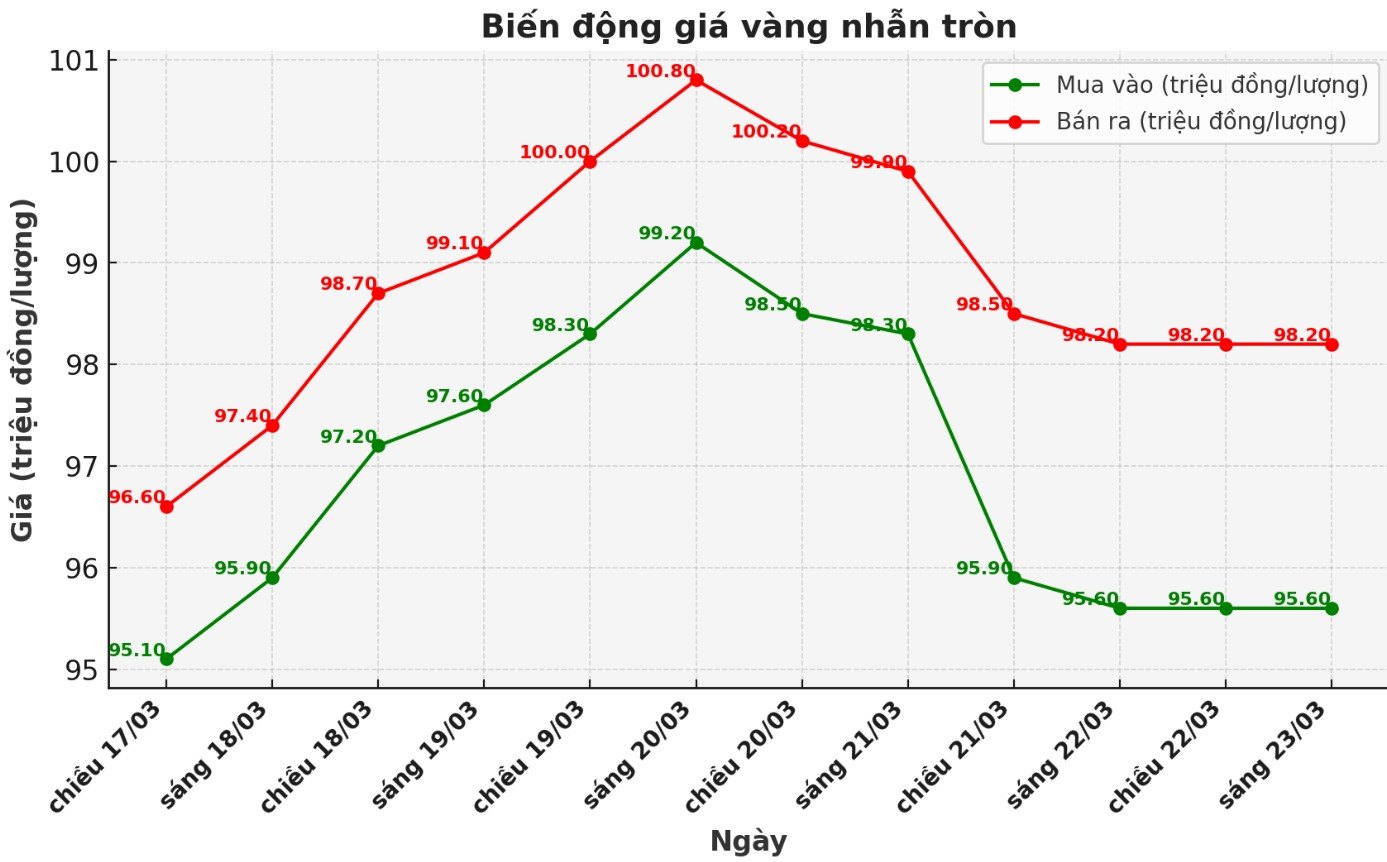

9999 gold ring price

This morning, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND95.6-98.2 million/tael (buy - sell); an increase of VND700,000/tael for buying and an increase of VND1.9 million/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96.1-98.6 million VND/tael (buy - sell); an increase of 1.1 million VND/tael for both buying and an increase of 2 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 2.5 million VND/tael.

If buying gold rings in the session of March 16 and selling in today's session (March 23), buyers at DOJI will lose 700,000 VND/tael, while buyers at Bao Tin Minh Chau will lose 500,000 VND/tael.

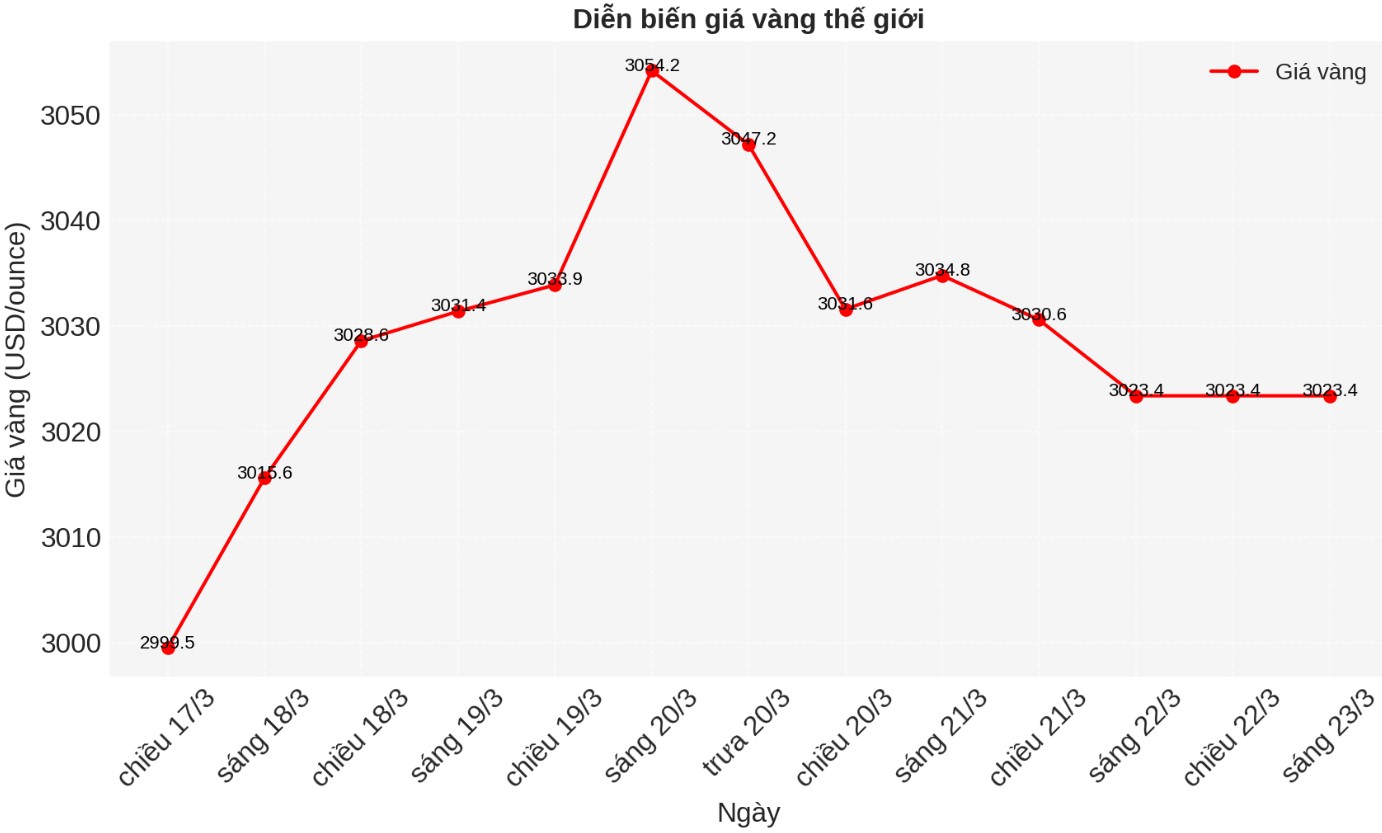

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,023.4 USD/ounce, up 38.5 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices fell at the end of the week as the USD increased. Recorded at 6:00 a.m. on March 23, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.740 points (up 0.24%).

Darin Newsom - Senior market analyst at Barchart.com said: "I think gold prices will continue to increase in the near future. I predict this trend will continue despite the current price, and $3,000/ounce will still be an important resistance point."

Sharing the same view, Alex Kuptsikevich - Senior Market Analyst at FxPro predicted: "Gold has been on an uptrend since the beginning of March, with the possibility of reaching a new high of 3,180 USD/ounce. Investors expect gold to reach the target of $3,400/ounce in the next few months."

Rich Checkan - President and COO at Asset Strategies International said: "I predict that gold prices will challenge below $3,000/ounce at least once before holding steady. Next week may be the first test."

Colin Cieszynski - Chief Strategist at SIA Wealth Management commented: "I am neutral on gold prices next week. It seems that gold wants to continue to consolidate at $3,000/ounce until the end of the month. There may be further fluctuations in early April as the US begins to take the tariff measures more seriously."

Meanwhile, Marc Chandler - CEO at Bannockburn Global Forex: "With the current developments, I think gold will continue to fluctuate around $3,000/ounce. Despite the support of external factors, gold may still fluctuate within a narrow range in the coming time, before a clearer breakthrough."

Economic data to watch next week

Monday: US manufacturing and services PMI (S&P Global).

Tuesday: American consumer confidence, new home sales in the US.

Wednesday: Orders for durable US goods.

Thursday: Waiting for home sales, US Q4 GDP.

Friday: US core PCE, US personal income and expenses.

See more news related to gold prices HERE...