Gold price hits peak, surpassing 3,045 USD/ounce

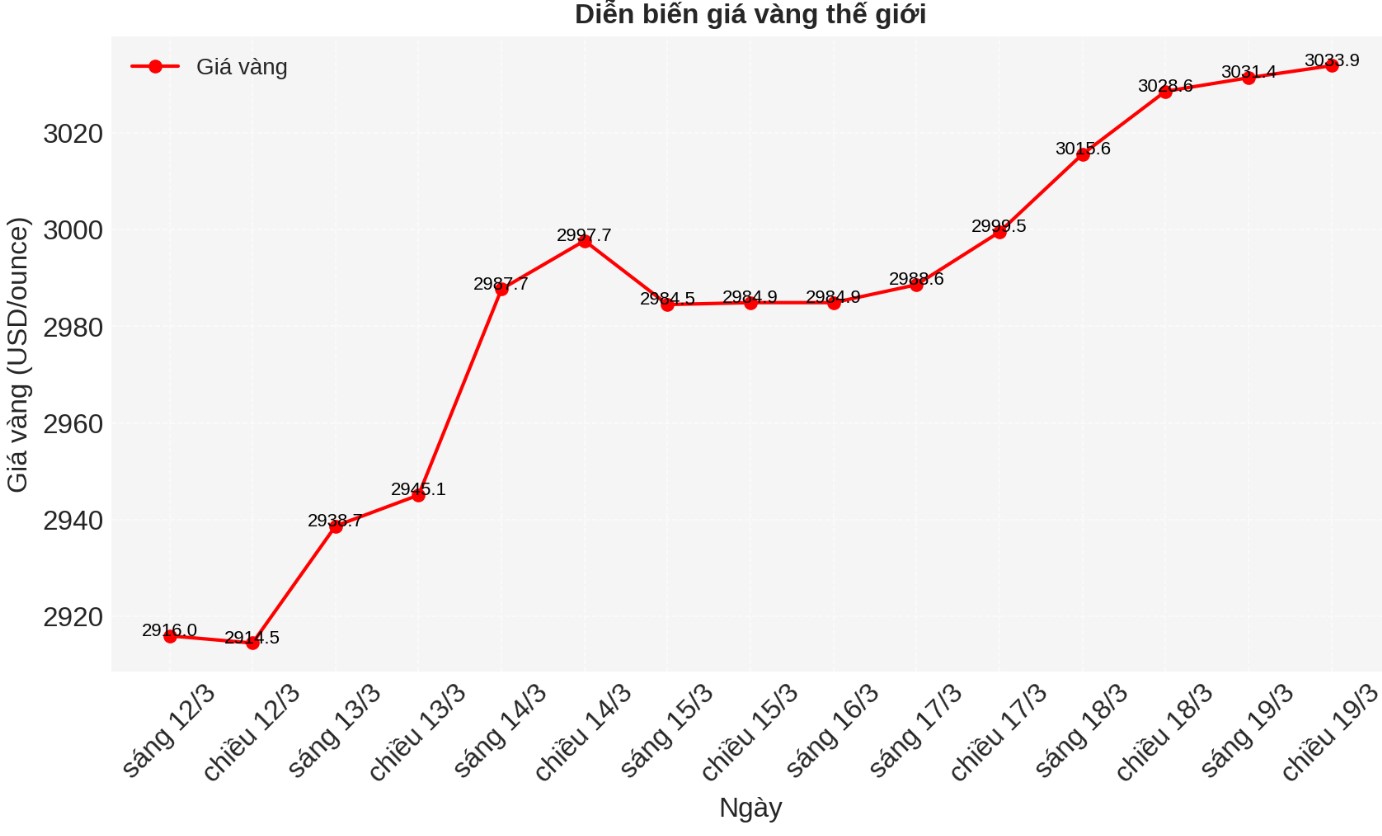

At 7:45 a.m. GMT, spot gold rose 0.2% to $3.039.38 an ounce. During the session, there was a time when gold prices hit an all-time high of 3,045.24 USD/ounce, marking the 15th peak this year.

US gold futures increased 0.2% to $3,046.4/ounce.

"According to current developments, gold futures could reach $3,200 in the next month. Although there may be a few corrections, I think buyers are still waiting for an opportunity to enter an order at a lower price, even a little bit" - Matt Simpson, senior analyst at City Index, commented.

Investors are concerned about the risk of an economic recession due to US President Donald Trump's tariff policies, which could increase inflation.

These tariffs have increased trade tensions, including a 25% tax rate on steel and aluminum effective from February, along with counterpart and industry-by- industry tariffs expected to take effect from April 2.

"There seems to be no stopping gold's rally as escalating geopolitical tensions in the Middle East, rising global economic risks and tariff uncertainties are strengthening gold's position as a safe haven asset to market volatility," said Yeap Jun Rong, market strategist at IG.

Israel launched an airstrike across the Gaza Strip on the morning of March 18, killing more than 400 Palestinians, according to local health officials. This was the bloodiest attack in the entire 17-month war, mainly claiming the lives of women and children, according to the Gaza Ministry of Health.

Prime Minister Benjamin Netanyahu said the attack on Gaza was just begun and would continue until all targets were achieved.

Market awaits FED decision

Investors are waiting for the US Federal Reserve's decision on the day. The Fed is expected to keep policy interest rates unchanged at around 4.25%-4.5% at the end of the two-day meeting later today.

"If the Federal Open Market Committee (FOMC) meeting speaks in a moderate tone in response to growing uncertainty about the impact of tariffs on growth... then this could be a signal for gold to surpass the $3,050/ounce mark" - Tim Waterer, market analyst at KCM Trade, said.

Gold does not yield, so it often benefits in a low interest rate environment. The market is also waiting for Fed Chairman Jerome Powell's speech at 6:30 p.m. GMT for more clues on monetary policy prospects.

Meanwhile, spot silver fell 0.4% to $83.89/ounce, platinum fell 0.7% to $989.95/ounce, while palladium lost 0.7% to $960.68/ounce.

See more news related to gold prices HERE...