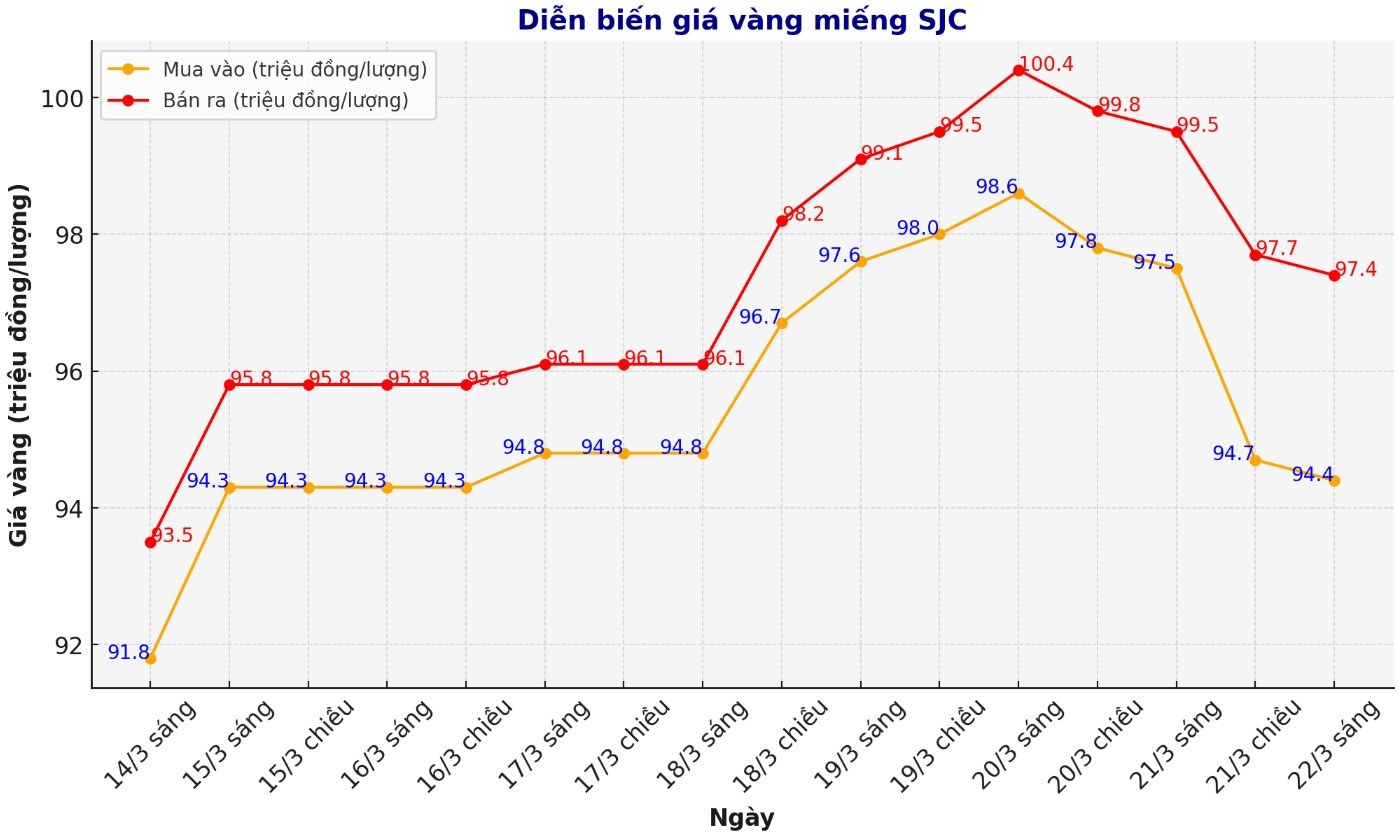

Updated SJC gold price

As of 9:55 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at VND94.4-97.4 million/tael (buy - sell), down 3.1 million VND/tael for buying and down 2.1 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND94.4-97.4 million/tael (buy - sell), down VND3.1 million/tael for buying and down VND2.1 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.8-97.4 million/tael (buy - sell), down VND3.2 million/tael for buying and down VND2.4 million/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

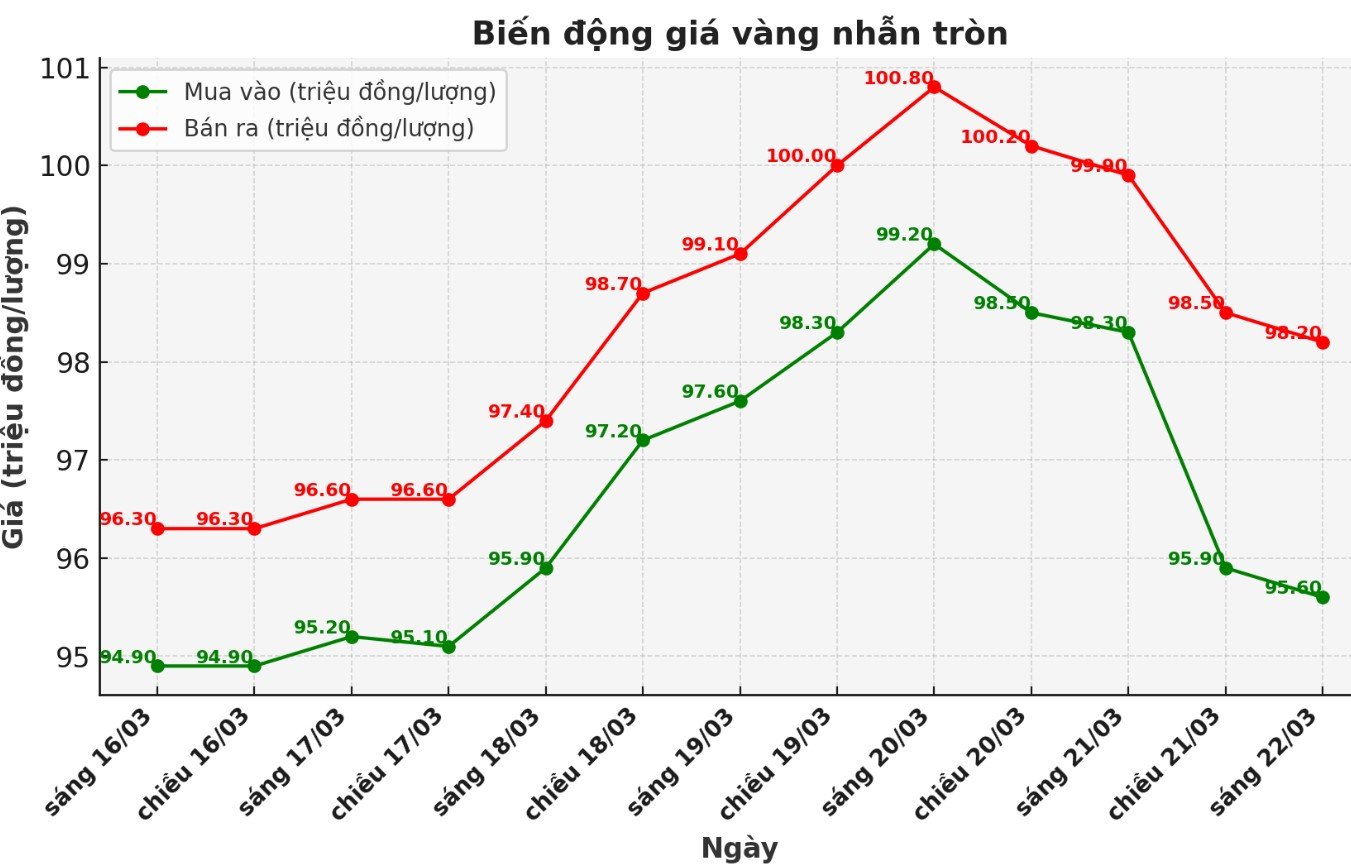

9999 round gold ring price

As of 8:50 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND95.6-98.2 million/tael (buy - sell), down VND2.7 million/tael for both buying and down VND1.7 million/tael for selling. The difference between buying and selling is listed at 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96.1-98.6 million VND/tael (buy - sell); down 2.5 million VND/tael for buying and down 1.8 million VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

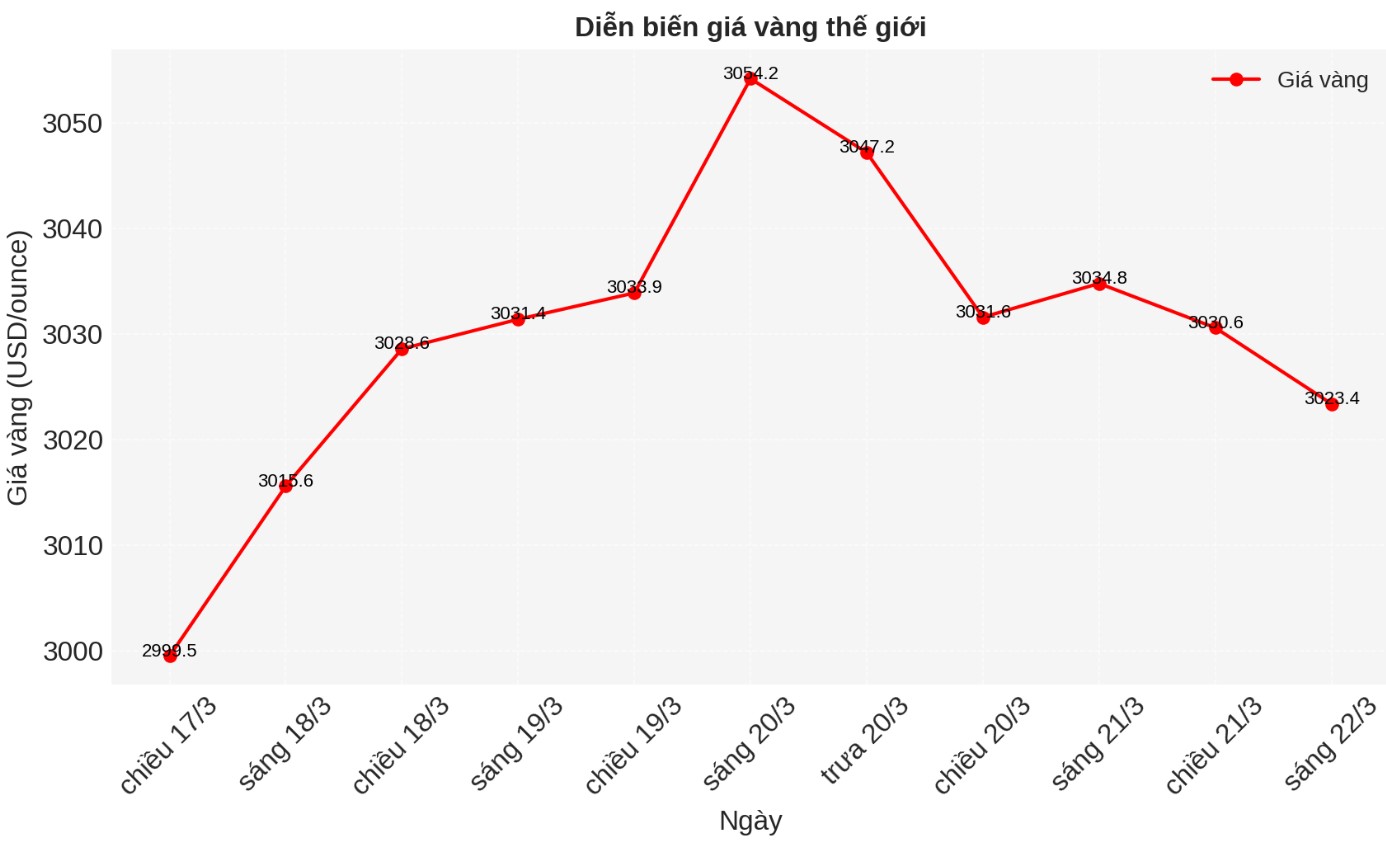

World gold price

At 10:00 on March 22, the world gold price listed on Kitco was around 3,023.4 USD/ounce, down 11.4 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

World gold prices fell in the context of the USD's recovery trend. Recorded at 9:15 a.m. on March 21, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.740 points (up 0.24%).

According to Kitco, gold prices still have room to increase in the short term, however, the market is gradually lacking momentum as prices remain above $3,000/ounce.

In the latest study, analysts at Metals Focus said gold remains an attractive safe haven asset as US President Donald Trump continues to promote the "America First" policy and global import tariffs on April 2.

However, analysts also note that at some point, geopolitical tensions and economic uncertainty will stabilize, and demand for safe-haven assets will begin to decline.

There is a risk of further escalation in the trade war between the US and key trading partners, which could increase concerns about recession. With the current weak sentiment, another correction in the global stock market, especially in the US, cannot be ruled out.

In this context, gold investment flows may continue from institutional investors looking for portfolio diversification in the coming weeks, the study points out.

In an interview with Kitco News, Rob Haworth - Senior Strategist at U.S. Bank Wealth Management (USBWM) said its team has discussed gold more in the past six months than at any time in history. However, he also said that the risk for gold is not only that market instability must be maintained but also that it must be escalated to support higher gold prices.

Haworth said that with a price of $3,000/ounce, he predicted that the gold market reflected a lot of bad news about the global economy and the USD.

There is reason to say that economic instability will remain high, but at some point it will stabilize. There will be a rebalancing in trade and a reduction in global trade, but the markets will adjust, he said.

Economic calendar affecting gold prices next week

Some important economic data will be released next week, including S&P Global's manufacturing and services PMI on Monday and the US consumer confidence index on Tuesday, which will give the market a clearer view of the US economic trend.

However, the most important data for investors will be the US Federal Reserve's priority inflation index, the core personal consumption expenditure (PCE) index on Friday morning.

Other notable figures include new home sales on Tuesday, long-term orders on Wednesday, and pending home sales, weekly unemployment and Q4 GDP US figures on Thursday.

See more news related to gold prices HERE...