Updated SJC gold price

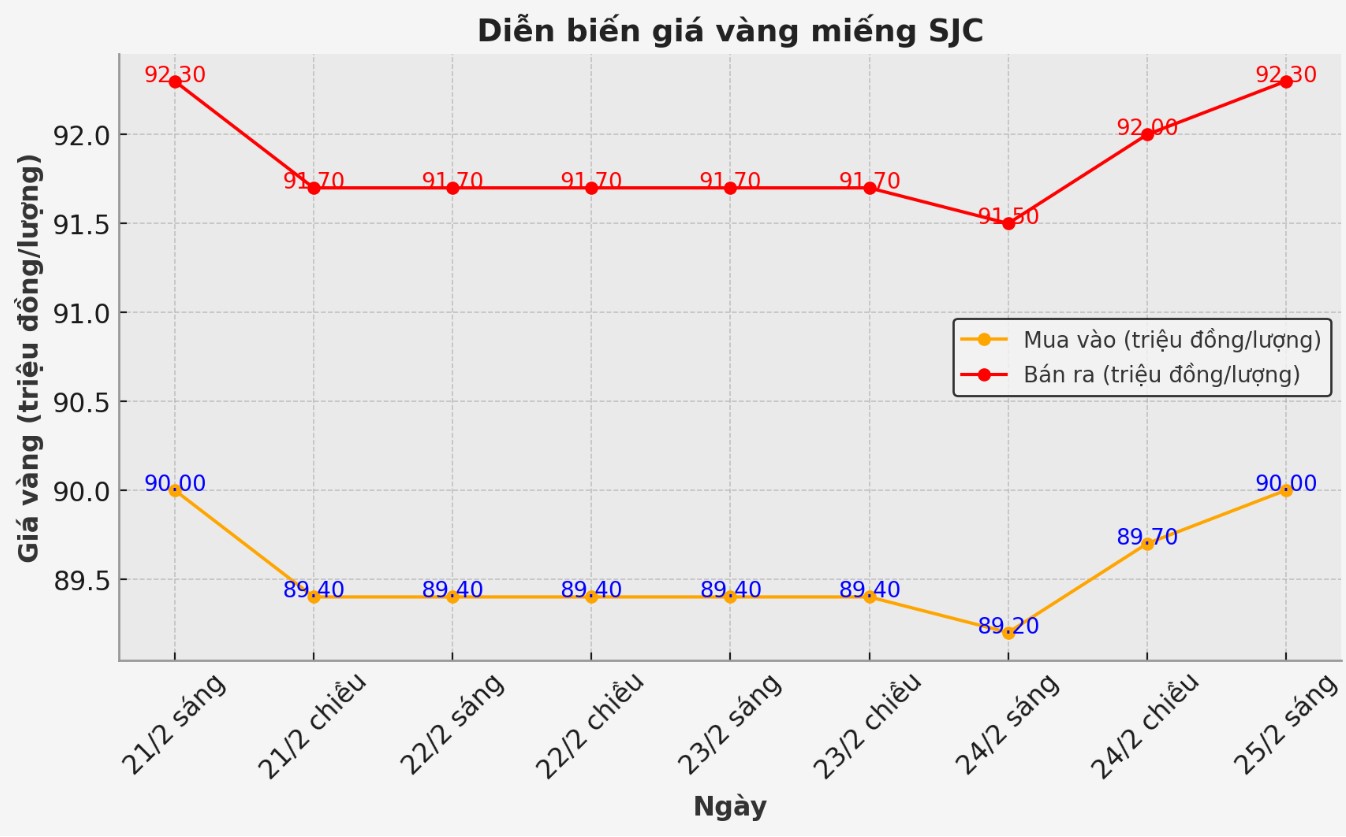

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND90-92.3 million/tael (buy in - sell out), an increase of VND800,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 90-92.3 million VND/tael (buy - sell), an increase of 800,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 90-92 million VND/tael (buy - sell); increased by 600,000 VND/tael for buying and increased by 500,000 VND/tael for selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

9999 round gold ring price

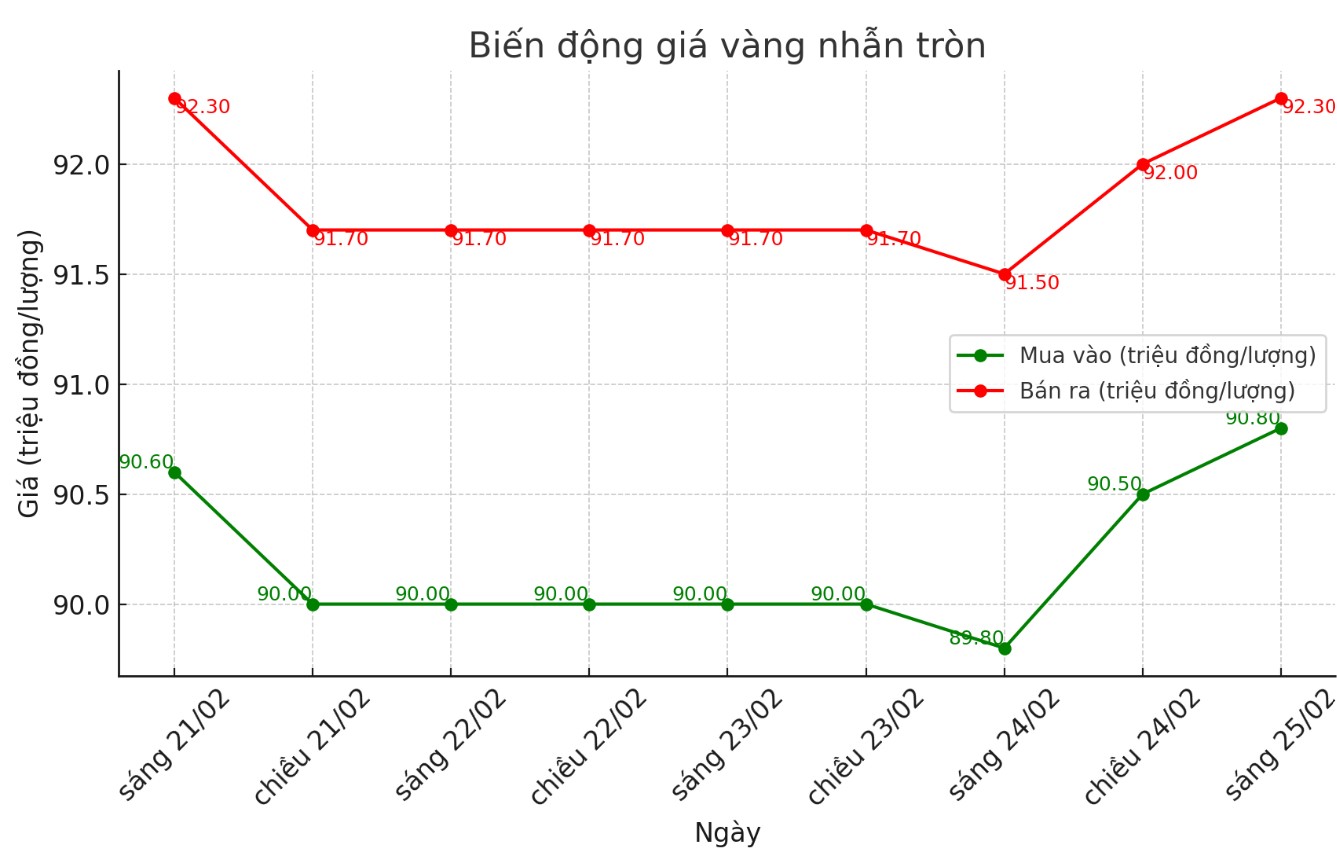

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 90.8-92.3 million VND/tael (buy - sell); an increase of 1 million VND/tael for buying and an increase of 800,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.6-92.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling compared to early this morning.

The difference between buying and selling is at 1.5 million VND/tael.

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,948.7 USD/ounce, up 17 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices increased despite the strong USD. Recorded at 9:00 a.m. on February 25, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.660 points (up 0.07%).

Data from the World Gold Council shows that last week, North American-listed gold ETFs recorded inflows of up to 48 tons of gold, worth $4.6 billion. This is the biggest weekly gain since early April. Investment demand increased again as gold prices recorded the eighth consecutive week of increase and set a new record high.

Some experts believe that it is only a matter of time before investment demand pushes gold prices to $3,000/ounce.

As of February 20, total holdings of gold ETFs reached 84.2 million ounces, the highest level since the beginning of 2024. It is not surprising if capital flows into gold ETFs continue to increase in 2025, especially if the US stock market is showing signs of correction and high interest rates continue to remain," said Mike McGlone - senior commodity strategist at Bloomberg Intelligence.

In a comment to Kitco News, Chris Mancini - Portfounder of Gabelli Gold Fund (GOLDX) - said that Western investors are pouring into gold ETFs to prevent economic risks or inflation due to the impact of tariffs. He also emphasized that investment demand still has room to continue to increase.

Gold is acting as a hedge against the depreciation of the US dollar and other currencies, he said. Tariffs could speed up this process as global commodity prices increase. In addition, if global central banks (including the US Federal Reserve - FED) cut interest rates or pump money to combat economic weakness, prices will tend to increase, making gold more attractive to investors".

James Stanley - senior strategist at Forex.com predicted gold prices will increase: "Buying has not shown any signs of slowing down and this week continues to be a strong candle on the weekly chart. I think there is a high chance that gold will reach $3,000/ounce in the near future, but there may also be a big change around that level."

Rich Checkan - chairman and CEO of Asset Strategies International commented that gold could soon test the $3,000/ounce mark due to the uncertainty in the market and geopolitics: "I believe that next week prices will continue to approach this threshold".

See more news related to gold prices HERE...