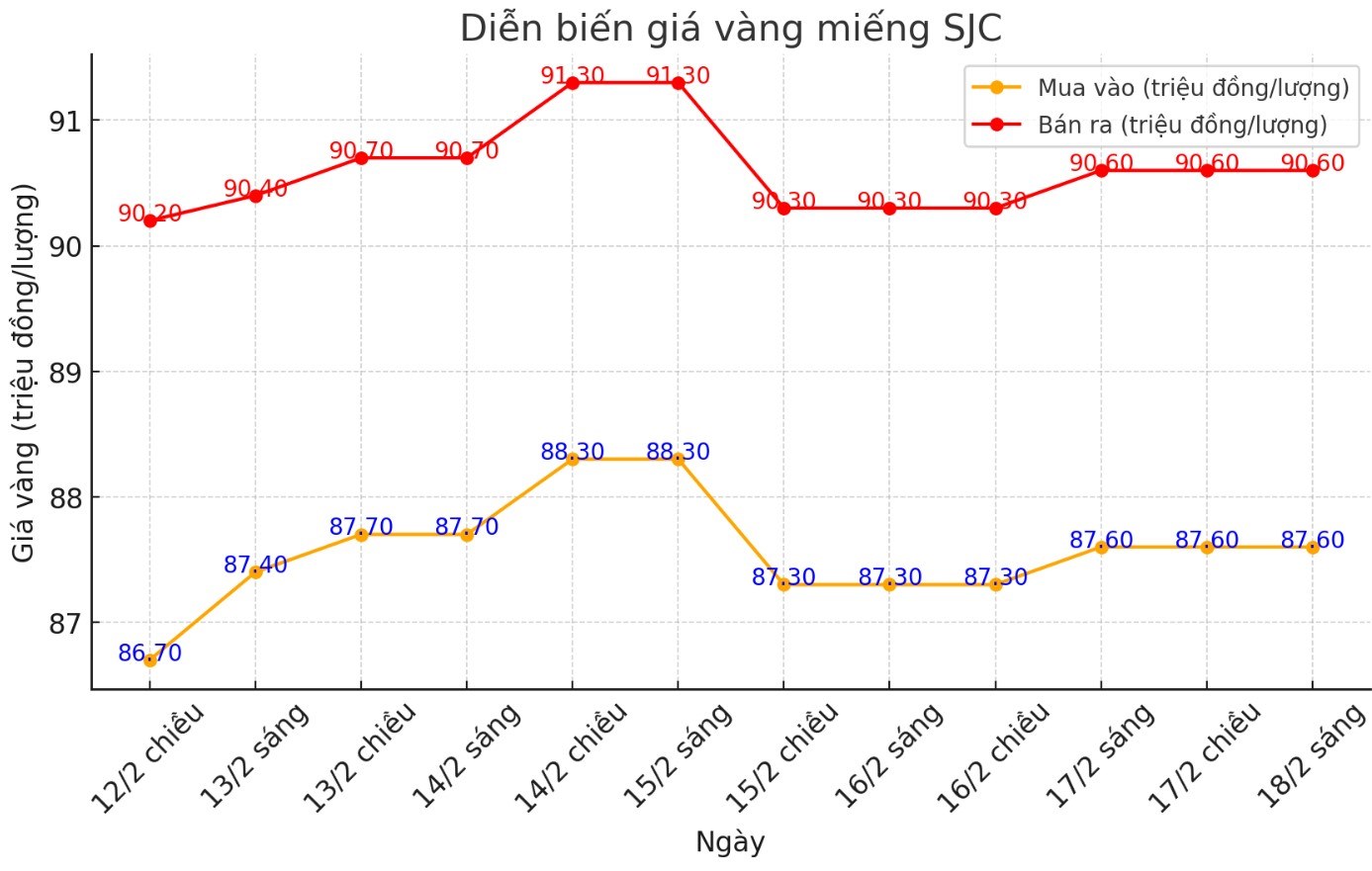

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 87.6-90.6 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 87.6-90.6 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 3 million VND/tael.

DOJI Group listed the price of SJC gold bars at 87.6-90.6 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 3 million VND/tael.

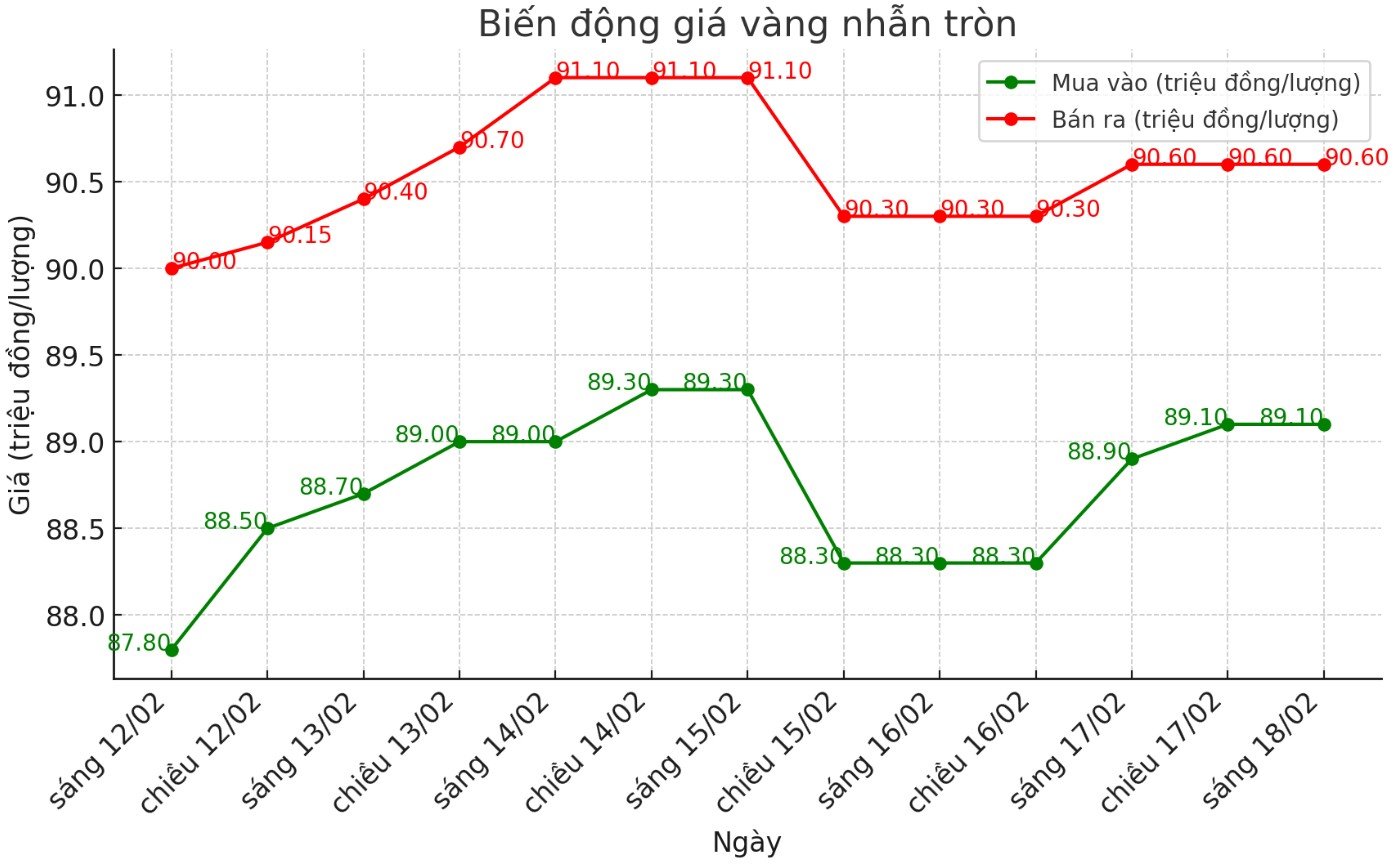

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND89.1-90.6 million/tael (buy - sell); increased by VND800,000/tael for buying and increased by VND300,000/tael for selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 89.15-90.6 million VND/tael (buy - sell); increased by 700,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling is 1.45 million VND/tael.

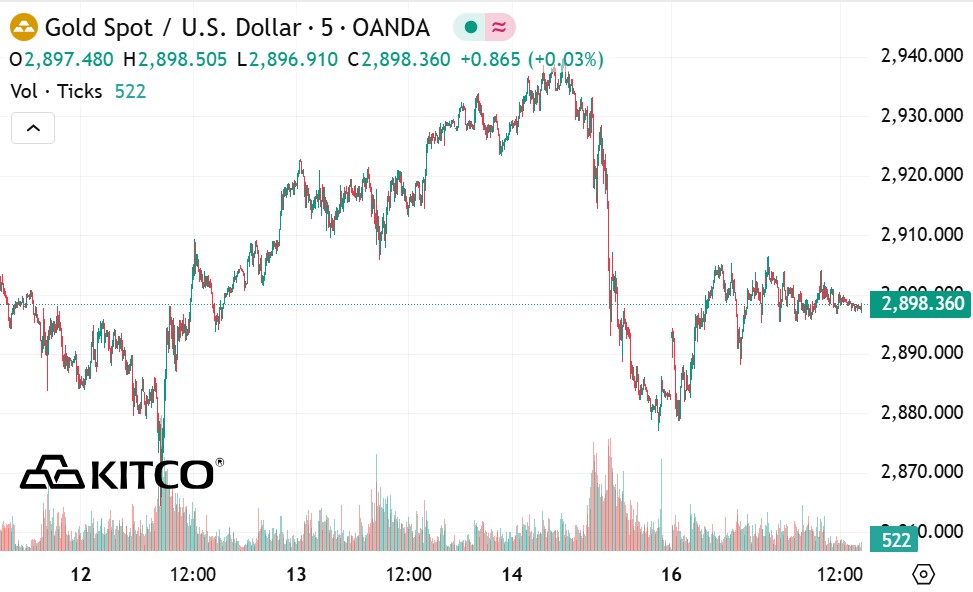

World gold price

As of 2:20 a.m. on February 18, the world gold price listed on Kitco was at 2,898.3 USD/ounce, up 15.9 USD/ounce.

Gold price forecast

World gold prices increased despite the increase of the USD. Recorded at 3:00 a.m. on February 18, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.625 points (up 0.05%).

According to Kitco, although gold and silver had a disappointing trading session last Friday, recording the strongest day's decline since mid-December, some analysts said that this decline did not have a big impact on the broader uptrend.

ActivTrades analyst Ricardo Evangelista said that gold is likely to remain above $2,900/ounce thanks to its role as a safe-haven asset. Investors are looking to gold to protect their portfolios from the risk of US tariffs, which could lead to a multilateral trade war and negatively impact the global economy. In addition, gold prices are also supported by geopolitical instability.

In the latest gold report, Tim Hayes - Director of Global Investment Strategy at Ned Davis Research - said that the weakening of the USD and falling bond yields are factors that benefit gold in the short term.

The potential risks of rising bond yields and a stronger US dollar have all declined. Our short-term USD index is showing a negative signal, which creates a positive momentum for gold.

In addition, the reversal in real-yield momentum over the past 10 years and anti-inflationary bond yields have brought these indicators closer to the new bullish signal zone, Hayes wrote in the report.

Today (February 18), US President Donald Trump's speech could disrupt the market. Although the speech is considered "temporary", the market will still closely monitor any statements related to the US economic strategy, fiscal stimulus, trade relations or tariff policies.

If President Trump supports low interest rates or delays tariffs, the USD could weaken. When this currency depreciates, gold becomes a more attractive store of value, potentially pushing gold prices up.

In case the speech raises concerns about economic policies that could strengthen the USD or tighten monetary conditions, gold prices may fall. Tougher tariff policies could also increase market volatility and demand for the US dollar, putting downward pressure on gold prices.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...