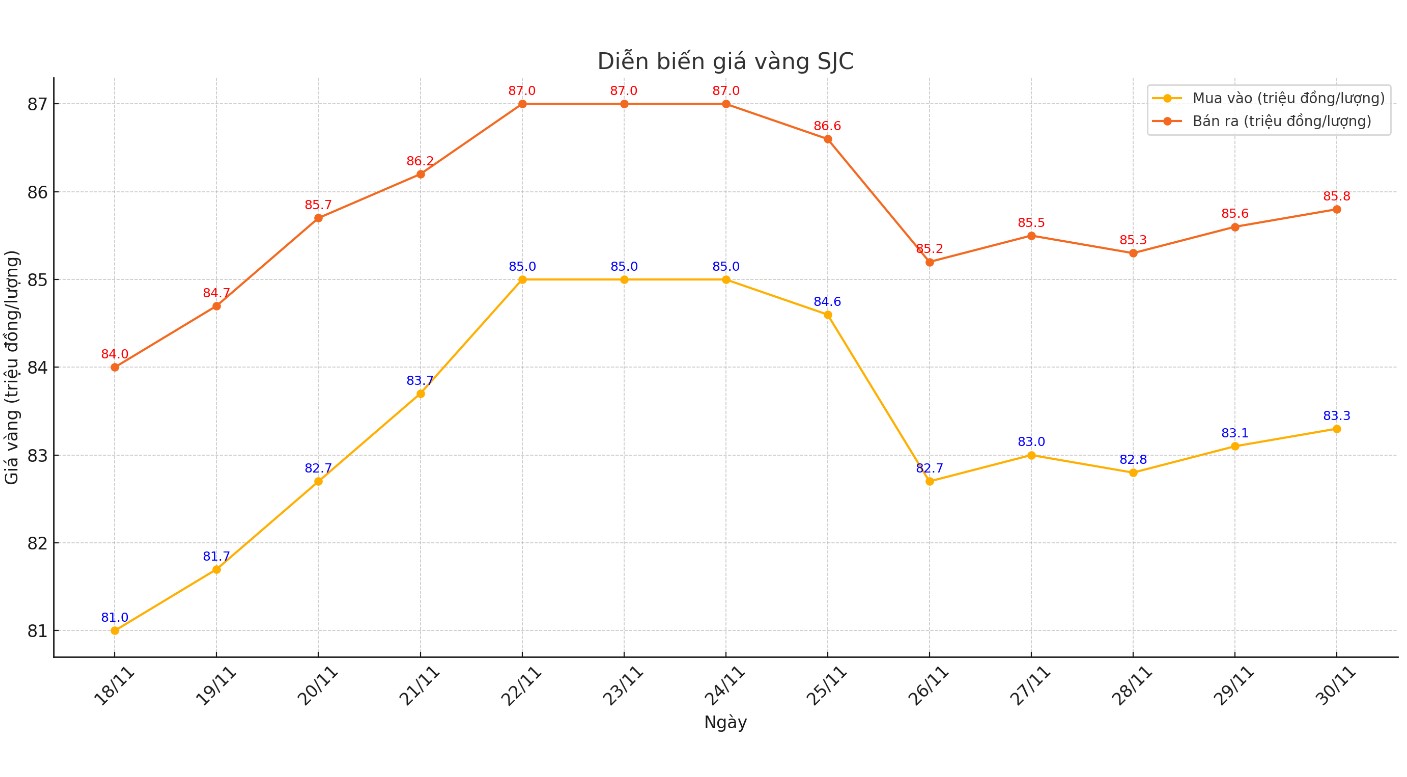

Update SJC gold price

As of 9:30 a.m., DOJI Group listed the price of SJC gold bars at VND83.3-85.8 million/tael (buy - sell); an increase of VND400,000/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83.3-85.8 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.3-85.8 million VND/tael (buy - sell); increased 200,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

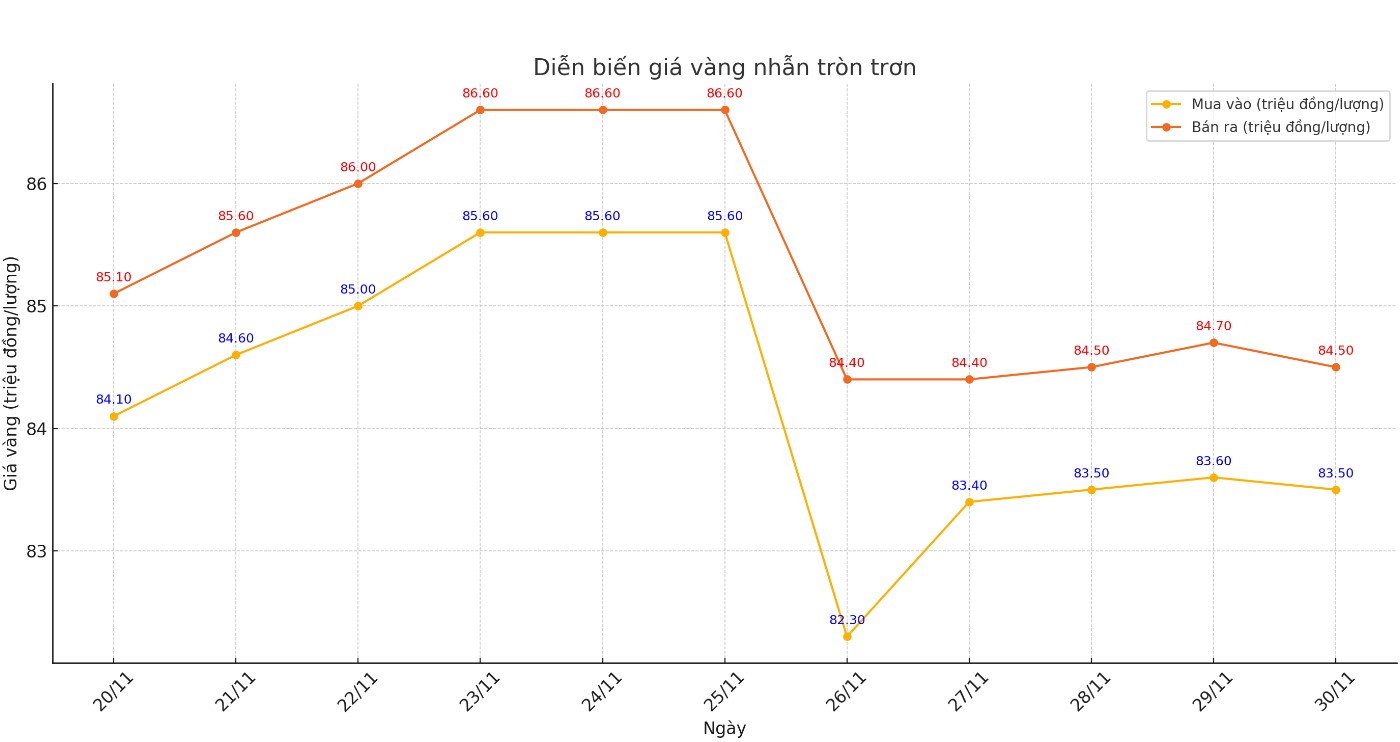

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.5-84.5 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 200,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.68-84.78 million VND/tael (buy - sell), an increase of 100,000 VND/tael for both buying and selling compared to early this morning.

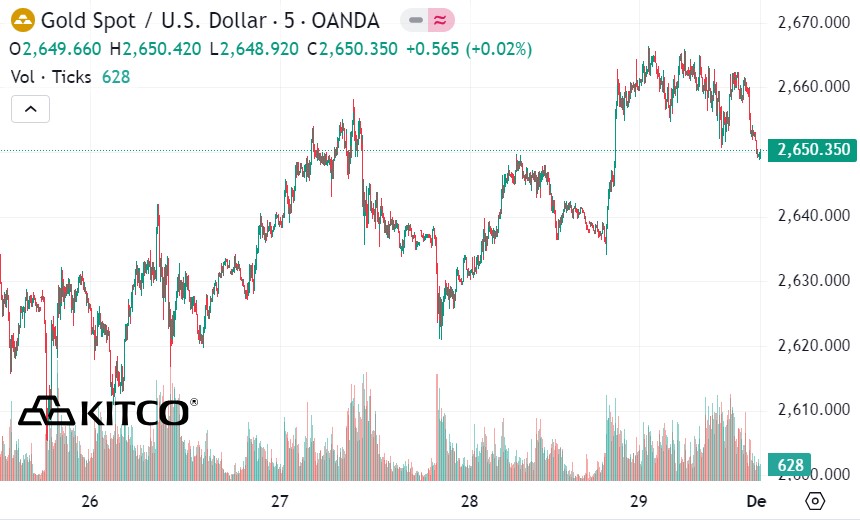

World gold price

As of 9:30 a.m., the world gold price listed on Kitco was at 2,650.3 USD/ounce, down 6.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell despite the decline of the USD. Recorded at 9:30 a.m. on November 30, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 105.795 points (down 0.24%).

According to experts, as geopolitical uncertainties continue to rise, gold prices may continue to rise in the coming time. Gold is often considered a safe investment in times of economic and geopolitical uncertainty such as trade tensions or conflicts.

Financial markets are still waiting for the next move from the US Federal Reserve (FED). According to the FedWatch tool of CME Group, the futures market is betting on the possibility of the Fed cutting interest rates by 0.25% at the December meeting with a probability of 66%.

However, President-elect Donald Trump's announcement of tariffs on imports from China and Mexico is weighing on the market. Trump's tariff plans are also seen as a potential source of inflation, which could prompt the Fed to slow its rate hikes. This could limit any further gains in gold...

In the latest report, Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that gold prices have recorded a strong increase in December for seven consecutive years.

While gold's recent correction could attract bargain hunting in the final month of 2024, Hansen said the precious metal's current high prices still pose risks.

“Gold’s biggest hurdle this year is the sharp 28.3% rally, which is close to the 29.6% rally in 2010 and 31% in 2007. While the underlying support outlook through 2025 remains unchanged, this significant rally could attract profit-taking and rebalancing before year-end,” Hansen wrote in the report.

Roukaya Ibrahim, a commodity strategist at BCA Research, said the new US administration's policies could impact economies, causing central banks to increase their gold reserves. This could spur a sharp increase in gold trading by central banks, which have been the biggest gold buyers in the market recently.

BCA Research recommends buying gold on dips due to its long-term outlook. “Gold is a beneficiary of the new US administration’s policies. Increased global policy uncertainty will support demand for gold,” Ibrahim said.

See more news related to gold prices HERE...