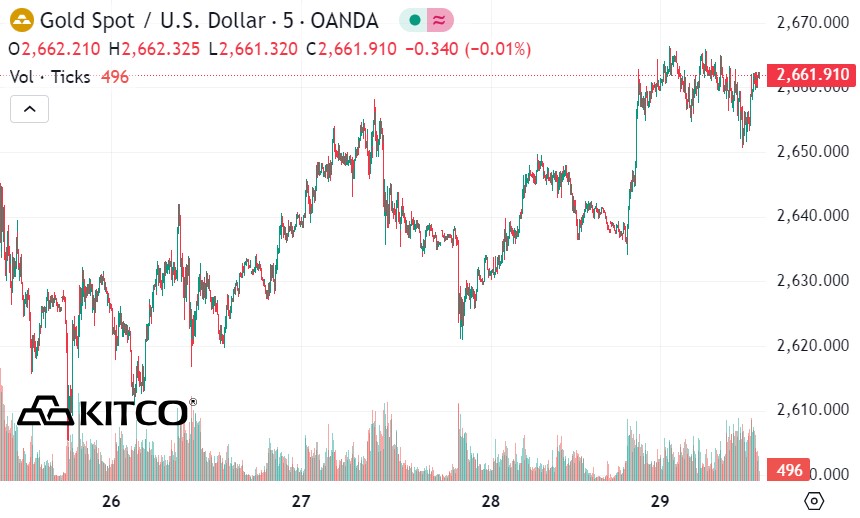

Gold prices pose short-term risks

The “Santa Claus rally” is a financial term that refers to the tendency for prices (usually stocks or other assets, including gold) to rise towards the end of the year, especially in December or early January. The phenomenon is named after the modern figure of Santa Claus, a symbol of good luck and prosperity during the holiday season.

In the latest report, Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that gold prices have recorded a strong increase in December for seven consecutive years.

While gold's recent correction could attract bargain hunting in the final month of 2024, Hansen said the precious metal's current high prices still pose risks.

“Gold’s biggest hurdle this year is the sharp 28.3% rally, which is close to the 29.6% rally in 2010 and 31% in 2007. While the underlying support outlook through 2025 remains unchanged, this significant rally could attract profit-taking and rebalancing before year-end,” Hansen wrote in the report.

More positive outlook in the long term

While gold may struggle to reach new highs in December, Hansen remains bullish for 2025, predicting prices will hit $3,000 an ounce by the new year. He also said geopolitical uncertainty will continue to support the precious metal.

“The news that the US will impose trade tariffs on imports next year is seen as a positive for the USD. However, the knock-on effects of a stronger USD could spread through the global economy, particularly hurting countries that rely on debt, commodity trade and export-led growth in USD, which could continue to support alternative investments such as gold and silver.

President-elect Donald Trump’s plans for tariffs, tax cuts and deportations highlight the risk that inflation and debt could rise higher than expected — two factors that gold investors seek to protect against,” he said.

Hansen also noted that gold will benefit from continued central bank buying and the US Federal Reserve's (FED) loose monetary policy.

Hansen’s long-term bullish view comes as gold has held key support around $2,600 an ounce despite strong selling pressure. In the short term, Hansen said gold remains vulnerable to potential Trump policies.

Hansen pointed out that gold prices fell 3% earlier this week after Trump announced his intention to nominate Scott Bessent, a traditional financier from Wall Street, to head the US Treasury. The market expected Mr. Bessent to be a safe and stable choice for the US economy, which reduced the appeal of gold as a safe haven asset.

But Mr Trump later announced plans to impose 25% tariffs on Mexico and Canada, along with a 10% tariff on all products from China. Economists say the potential trade war could push the global economy into recession.

See more news related to gold prices HERE...