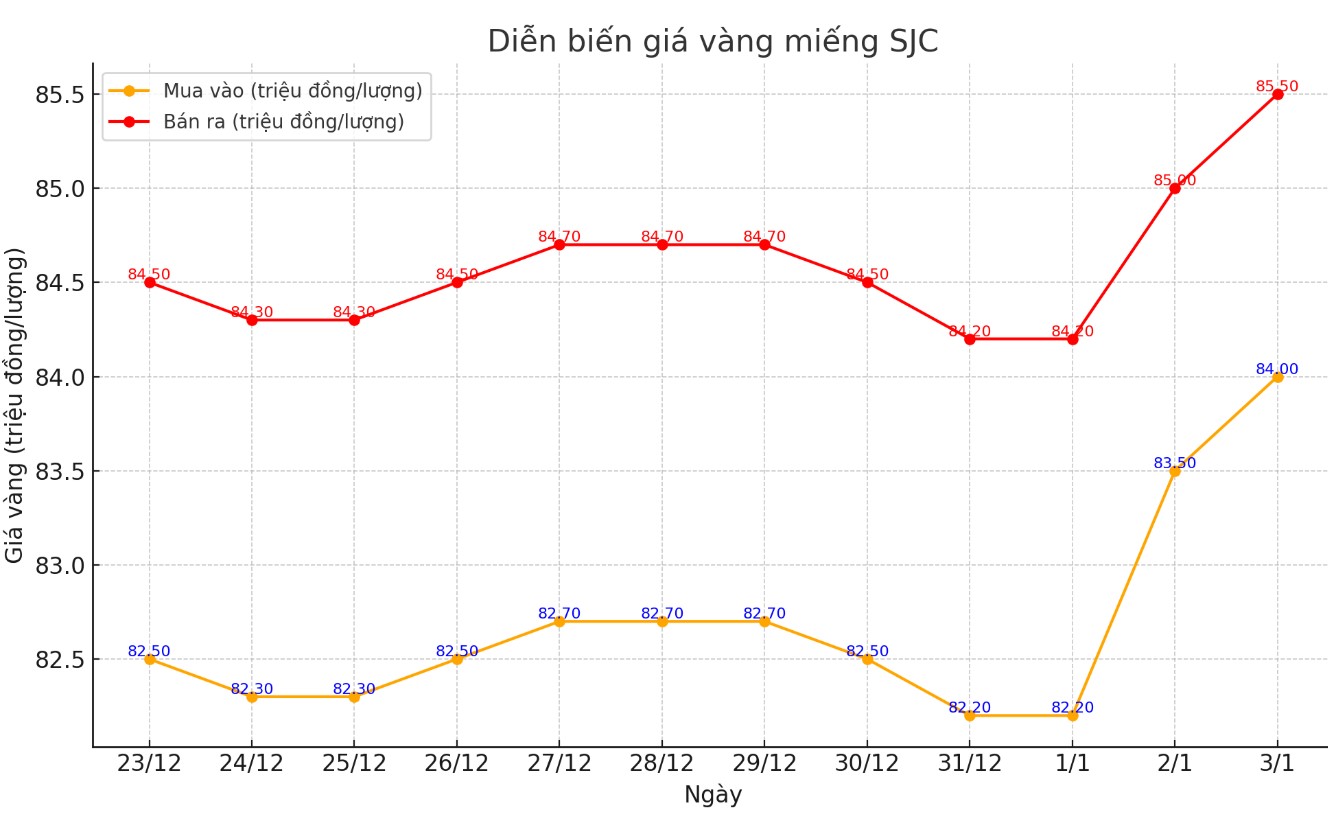

Update SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84-85.5 million/tael (buy - sell); an increase of VND500,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84-85.5 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.5-85 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 1.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

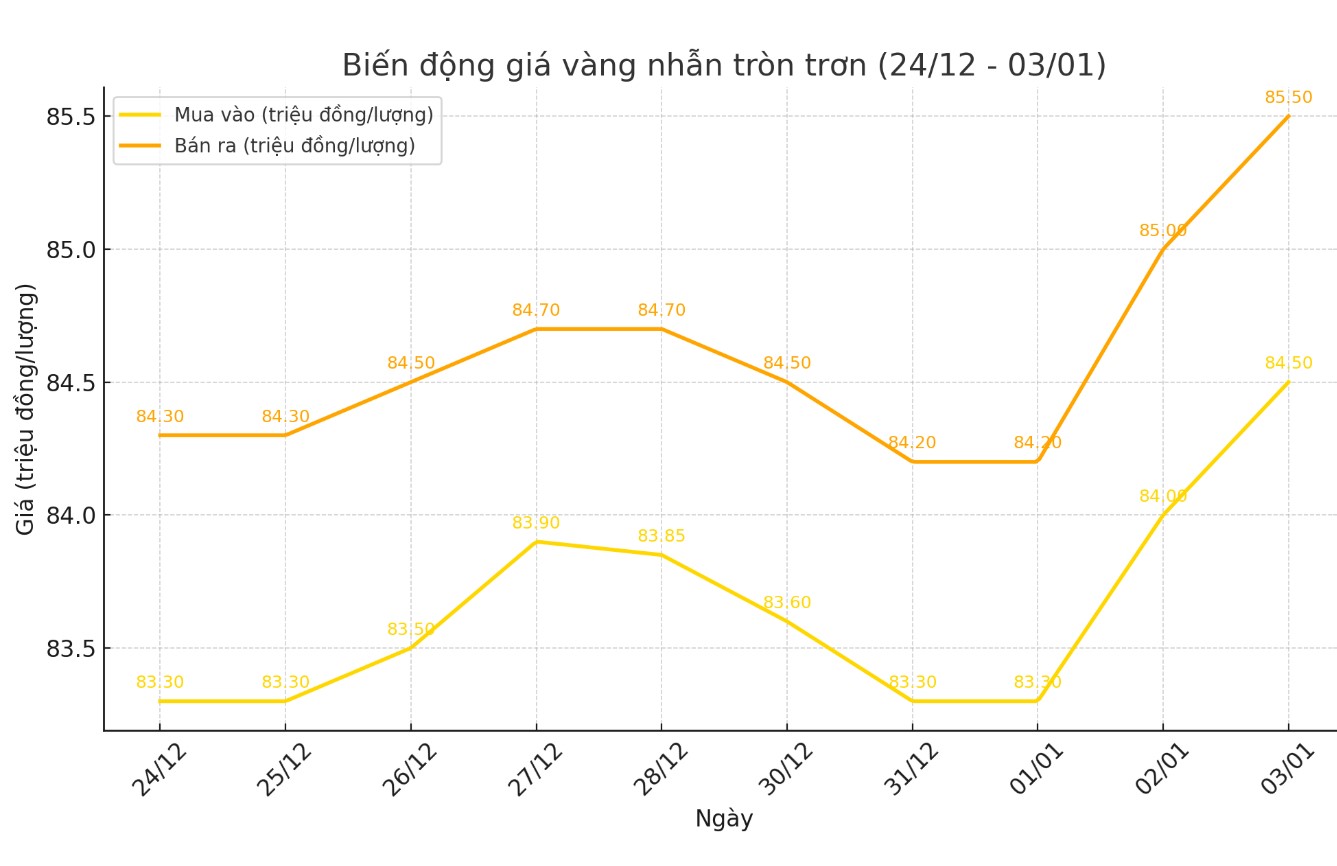

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.5-85.5 million VND/tael (buy - sell); an increase of 500,000 VND/tael for buying and an increase of 700,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.4-85.5 million VND/tael (buy - sell), an increase of 1.8 million VND/tael for buying and 1.3 million VND/tael for selling compared to early this morning.

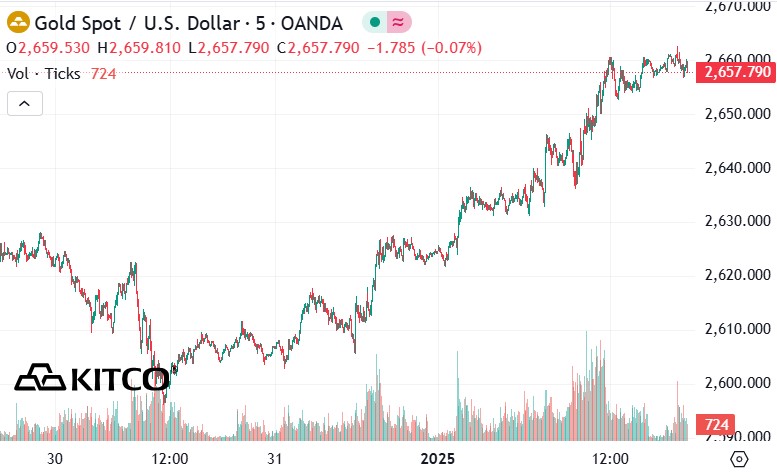

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,657.7 USD/ounce, up 23 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased in the context of the USD's downward trend. Recorded at 9:40 a.m. on January 3, the US Dollar Index, which measures the greenback's fluctuations against 6 major currencies, was at 109,000 points (down 0.06%).

Gold prices hit a more than two-week high, with technical chart buying gaining traction as the precious metal’s short-term technical signals have improved recently, according to Kitco. In addition, buying support in the first trading days of 2025 also comes from rising crude oil prices, a closely related commodity.

January is typically the best month of the year for gold, but 2025 is expected to bring a number of factors that will make the precious metal different, said ForexLive currency analyst Justin Low.

Gold prices rose nearly 27% in 2024, but the cooling period in November and December was the result of political factors. The US election results affected the interest rate policy of the US Federal Reserve (FED), which put pressure on the price of the precious metal in the final days of the year.

Investors are now considering the impact of the Fed's hawkish stance at its policy meeting in late 2024. The pace of interest rate cuts in 2025 is likely to slow down, which is not considered very positive for gold.

Michael Widmer, an analyst at Bank of America, said that gold is still a safe haven asset in the face of political instability in many regions of the world. According to Widmer, gold prices could reach $3,000/ounce in the next 8 months.

Bullionvault, a UK-based precious metals exchange, predicts that gold prices will reach a peak of $3,070 an ounce in 2025. Geopolitical uncertainties are driving investor interest.

Although central bank gold purchases slowed in the third quarter of 2024, economists at ING expect central banks to continue their “gold thirst” in 2025. The Reserve Bank of India (RBI) and the National Bank of Poland are seen as leading the trend.

See more news related to gold prices HERE...