In 2025, gold prices are forecast to continue to rise, although at a slower pace than in previous years. This is the opinion of the world's leading financial experts, in the context of a volatile global economy and politics. Important factors such as monetary policy, geopolitical instability and investor sentiment are creating a solid foundation for the precious metal.

In Asia, China and India remain the largest gold consumers. According to Capital Economics, China’s strong economic recovery from the pandemic will be the main factor driving up physical gold demand. At the same time, festivals and weddings in India are expected to continue to boost gold purchases, reinforcing the region’s role in the global gold market.

Central banks continue to play a key role in supporting gold prices. Data from the World Gold Council (WGC) shows that global central banks have purchased a total of 694 tonnes of gold net by the end of the third quarter of 2024, almost the same as in the same period in 2022.

While higher gold prices may have dampened buying demand and prompted some selling in recent months, the surge in buying in October 2024 suggests central banks remain keen to accumulate gold in their reserve portfolios, a trend that is forecast to continue into 2025, providing a strong impetus for higher gold prices, according to the WGC.

In another development, the US Federal Reserve (FED) is expected to maintain low interest rates or slightly reduce them in 2025 to support economic growth. This reduces the opportunity cost of holding gold, making this precious metal more attractive to investors. In the context of loose monetary policy, gold is considered an effective hedge against the risk of inflation.

In addition, geopolitical instability in the world is also a key factor driving gold demand. Conflicts in Ukraine and escalating tensions in the Middle East create a risky environment. Gold - as a safe haven asset - continues to attract large capital flows from international investors. If geopolitical tensions do not cool down, gold prices may rise even higher than forecast.

Investor sentiment also plays a decisive role in shaping gold price trends. With the constant fluctuations in financial markets, gold is still considered a safe investment option. Economic instability, the risk of recession and interest rate fluctuations are all factors that push investors to seek this precious metal.

Forecasts from major financial institutions also give impressive figures for gold prices in 2025. According to J.P. Morgan (one of the world's largest banks and financial institutions, headquartered in New York, USA), gold prices could reach $3,000/ounce by the end of the year, with an annual average of $2,950.

Capital Economics (a global economic consultancy that provides independent economic analysis and economic forecasts to financial institutions, businesses, and governments) predicts that the price will fluctuate around $2,750/ounce by the end of 2025, thanks to demand from China and gold purchases by central banks.

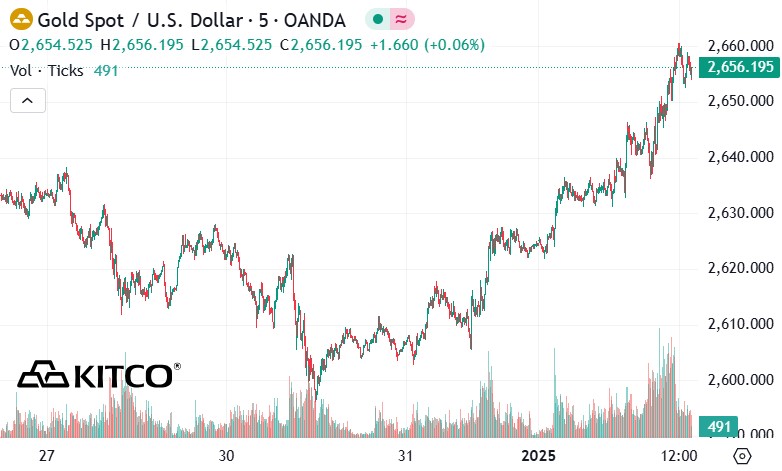

Meanwhile, State Street Global Advisors (one of the world's largest asset management companies, owned by the financial group State Street Corporation) believes that gold prices will remain in the range of 2,600 to 2,900 USD/ounce, depending on geopolitical variables and monetary policy.

However, the risk scenario also needs to be considered. If the global economy recovers faster than expected or interest rates rise, demand for gold could fall. In addition, the attractiveness of other assets such as real estate and stocks could also divert investment flows into gold.

One factor to consider is competition from the cryptocurrency market. Bitcoin and other digital currencies are growing in popularity, especially among younger investors. According to Bloomberg, the rise of cryptocurrencies could reduce the appeal of gold as a store of value.

Still, many experts believe that gold and cryptocurrencies can coexist, with each asset serving a different group of investors.

Overall, 2025 promises to be an exciting year for the gold market. With complex economic and political factors, gold prices are expected to continue their upward trend.

See more news related to gold prices on Lao Dong Newspaper HERE...