Update SJC gold price

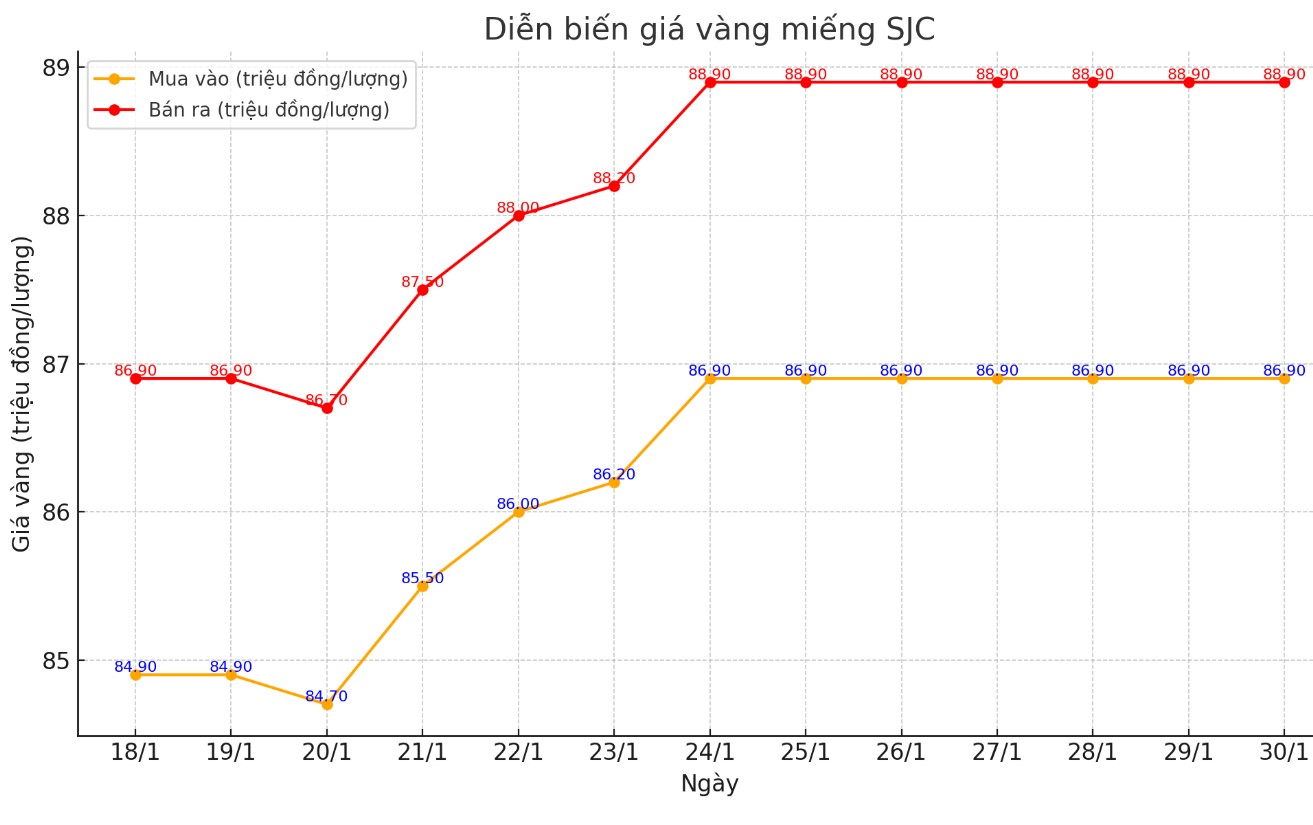

Up to now, the price of SJC gold bars listed by Saigon Jewelry Company SJC is at 86.8-88.8 million VND/tael (buy - sell); both buying and selling prices remain unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

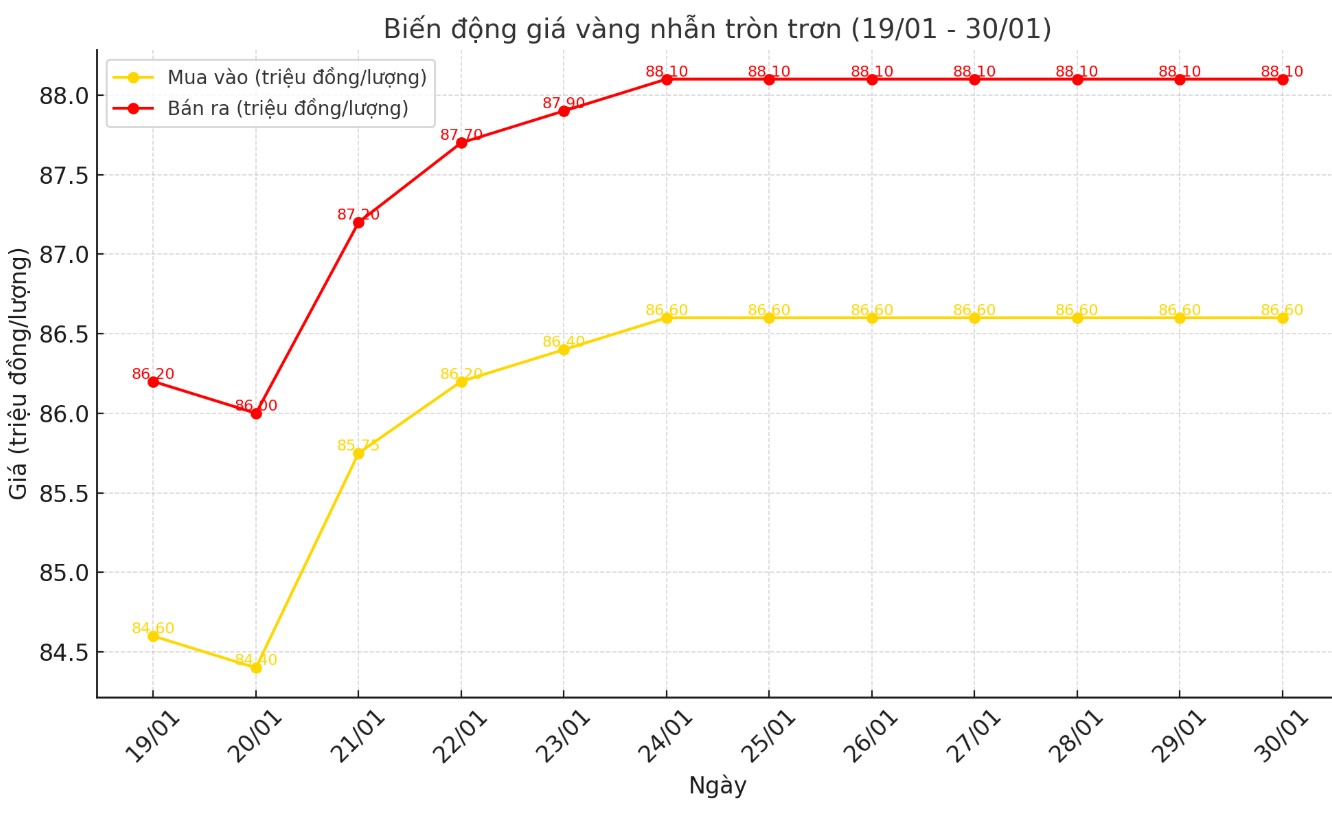

As of 6:15 p.m. today, the price of round gold rings listed by DOJI Group is at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain unchanged compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to the closing price of yesterday's trading session.

World gold price

As of 6:15 p.m., the world gold price listed on Kitco was at 2,777.7 USD/ounce, an increase of 21.3 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased despite the increase in the USD index. Recorded at 6:15 p.m. on January 30, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 107.925 points (up 0.11%).

Gold prices fluctuated after the US Federal Reserve (FED) kept interest rates unchanged and did not provide much information about the monetary policy easing cycle.

As widely expected, the Fed kept the federal funds rate unchanged in a range of 4.25% to 4.50%.

The central bank's monetary policy statement was largely unchanged from its December meeting, when the Fed signaled a shift toward an easing cycle through 2025, with just two rate cuts expected.

Following the Fed decision, gold prices fell below key support levels and are now trading near session lows.

One notable change in the monetary policy statement this time around is that the Fed appears to be more concerned about inflation. “Inflation remains elevated,” the January statement said, marking a change from the December statement, when the central bank acknowledged that consumer price pressures were moving closer to its 2% target.

Michael Brown, senior analyst at Pepperstone, said the statement showed the Fed, under Chairman Jerome Powell, was trying to buy time to maintain high flexibility as policymakers continue to assess the progress of reducing inflation and the resilience of the US labor market.

However, Brown also noted that the Fed is facing higher levels of economic uncertainty in 2025, which will increase market volatility.

“As a result, the Fed’s ‘safety cushion’ that has provided stability to risk assets over the past 18 months or so is now gone. The Fed’s support is being reduced each month as economic data remains solid.

This, coupled with greater uncertainty about monetary policy, could make stocks more volatile this year. However, with solid economic growth and continued expansion in corporate profits, the overall trend remains upward,” he said.

Notable economic data this week:

Thursday: ECB monetary policy decision, US Q4 GDP, US weekly jobless claims, US pending home sales.

Friday: US PCE index, personal income and spending.

See more news related to gold prices HERE...