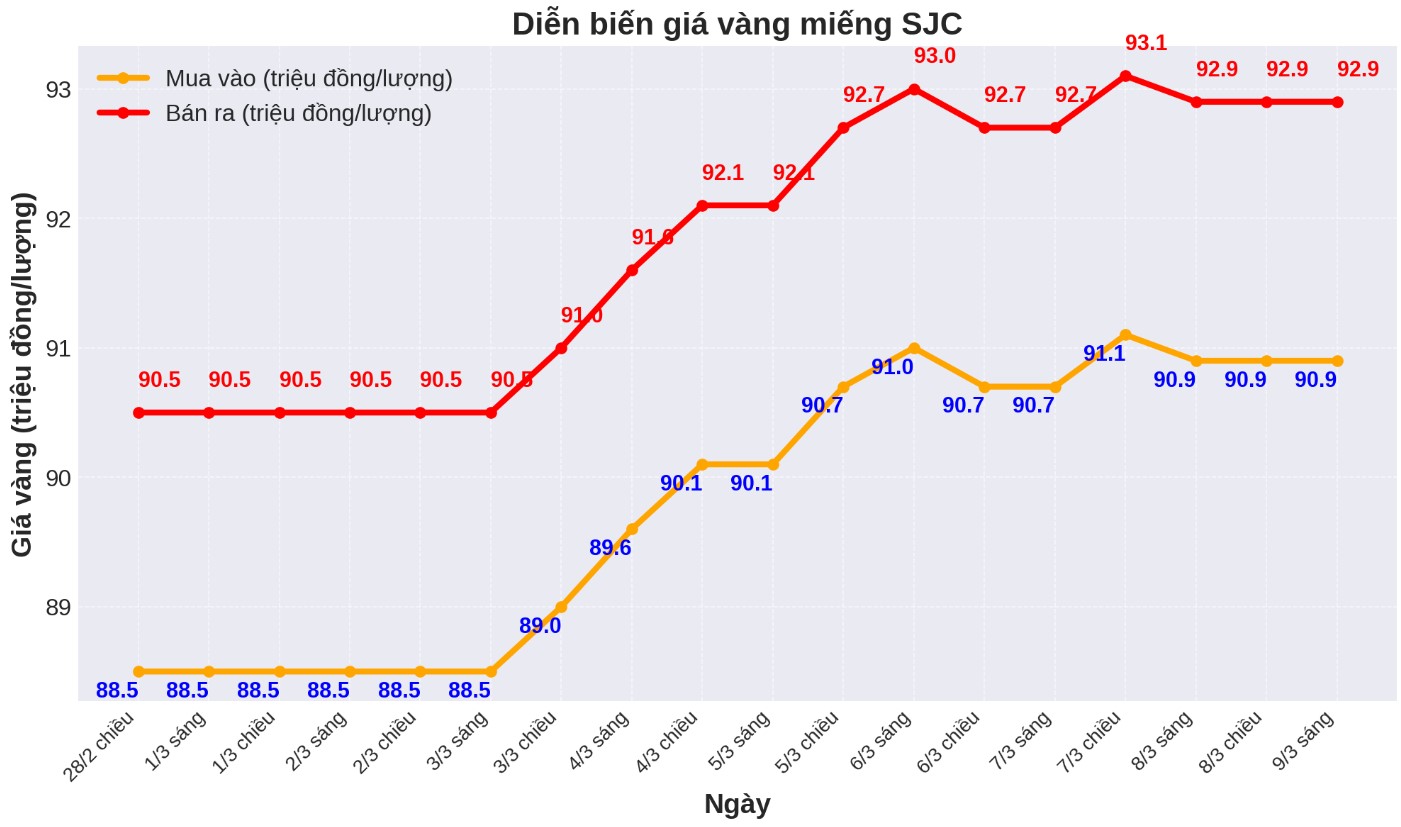

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at 90.9-92.9 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 23, 2025), the price of SJC gold bars at DOJI increased by 2.4 million VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 90.9-92.9 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 23, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 2.4 million VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company Group SJC is at 2 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of 2.3 and selling in today's session (9.3), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both make a profit of 400,000 VND/tael.

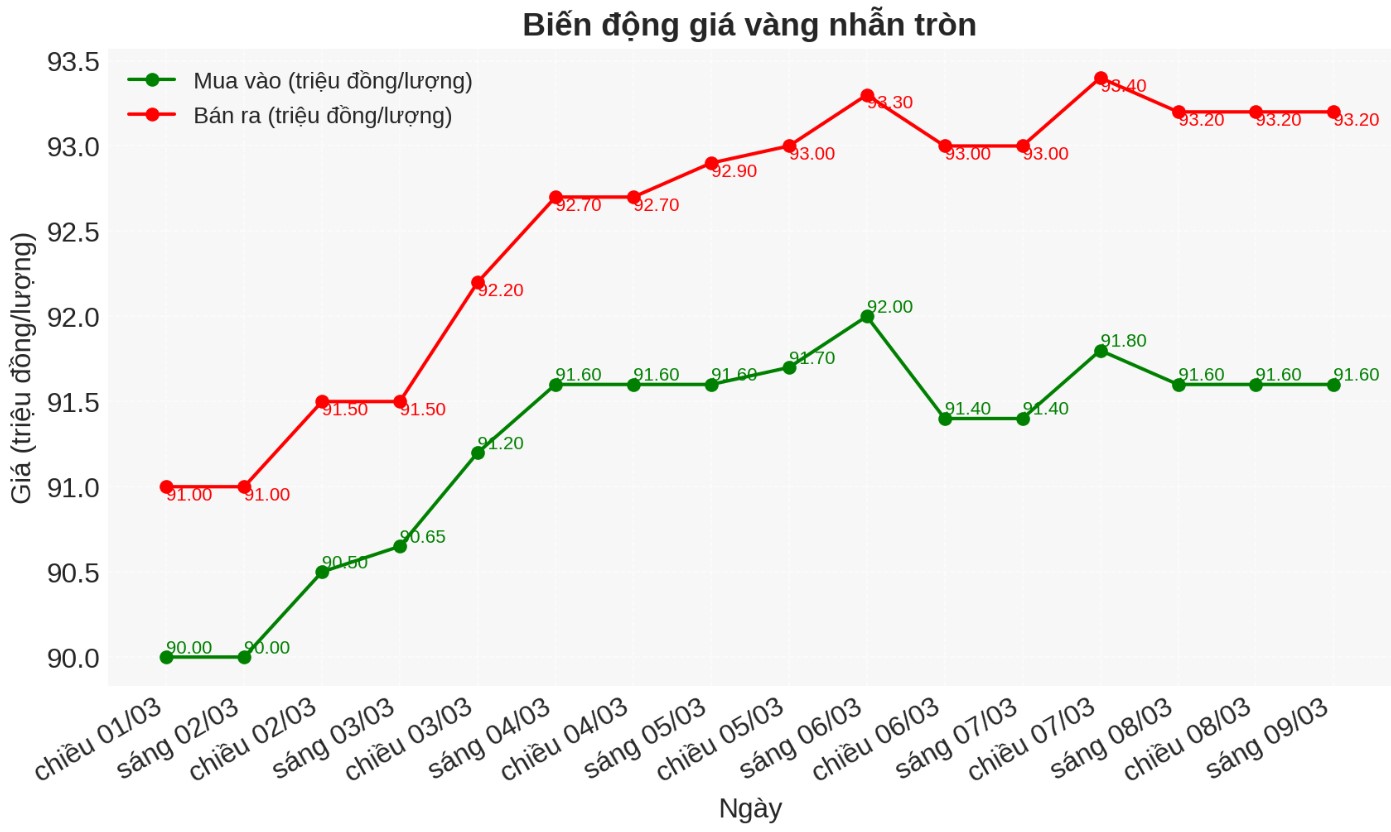

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 91.6-93.2 million VND/tael (buy - sell); an increase of 1.6 million VND/tael for buying and an increase of 2.2 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 91.7-93.3 million VND/tael (buy - sell); an increase of 1.6 million VND/tael for buying and an increase of 2 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.6 million VND/tael.

If buying gold rings in the session of 2.3 and selling in today's session (3.9), buyers at DOJI and Bao Tin Minh Chau will receive a profit of VND600,000 and VND400,000/tael, respectively.

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 2,909.5 USD/ounce, up 51.4 USD/ounce compared to the closing price of the previous trading session.

World gold prices remained high at the end of the week in the context of the USD going down. Recorded at 9:00 a.m. on March 9, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.810 points (down 0.21%).

Tavi Costa - macro strategist, partner of Crescat Capital, commented at the 2025 PDAC Conference in Toronto that the rare convergence of gold demand from the East and West is pushing gold prices up, while silver is expected to have a strong increase to return to an all-time high.

He believes that history may be repeating itself and a re-evaluation of gold is entirely possible. According to Costa, if we consider historical data, gold prices could increase to unprecedented levels if the US re-evaluates its gold reserves against the amount of government bonds in circulation.

Currently, the amount of US government bonds in circulation is about 36 trillion USD, while the value of the country's gold reserves only accounts for about 2% of that figure. For comparison, in the 1970s, this rate was 17%, but in the 1940s, this number was up to 40%.

"If the US returns this rate to 17%, gold prices could reach $25,000/ounce. If it returns to 40%, gold could reach 55,000 USD/ounce" - Costa analyzed.

He stressed that these are not price targets, but numbers that reflect the possibility that gold could be revalued based on economic factors.

Marc Chandler - CEO of Bannockburn Global Forex - commented that the gold trading model shows that the uptrend continues. He also noted that China and US inflation data will have an important impact next week. "This model shows an upward trend and the possibility that gold will retest the record high set on February 24, above $2,956/ounce, possibly next week."

Alex Kuptsikevich, senior market analyst at FxPro, believes gold could soon surpass $2,950 and reach $3,180 if the current trend continues.

"Caution in the US stock market is putting pressure on the selling side, while the weakening of the USD adds momentum to the buying side."

See more news related to gold prices HERE...