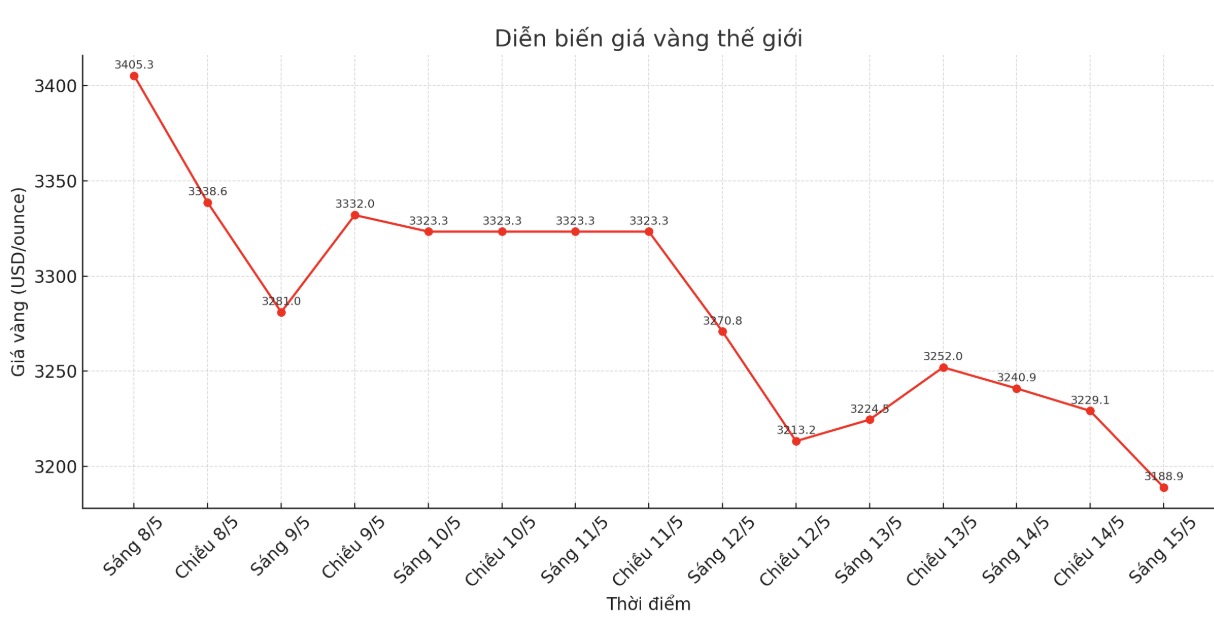

According to Reuters, spot gold prices fell 2.1% to $3,180.29/ounce at 11:45 p.m. on May 14 (Vietnam time), reaching their lowest level since April 11.

Earlier in the session, gold fell to $3,174.62/ounce at one point. US gold futures also fell nearly 2%, to $3,184.2/ounce.

The recovery in the global market due to sharp cuts in tariffs by the US and China has caused gold prices to break technical thresholds and adjust down, said Tai Wong, an independent metals trader.

The main indicators on Wall Street all increased points when opening, thanks to positive information from the tariff agreement and expectations for many other trade agreements.

Washington and Beijing have agreed to cut taxes sharply and postpone escalation measures for 90 days to complete the details of the deal.

US President Donald Trump said he could directly negotiate with Chinese President Xi Jinping, while revealing potential deals with India, Japan and South Korea that are being promoted.

Gold - which is considered a safe haven in times of geopolitical and economic uncertainty - hit a record peak of $3,500.05/ounce last month. Since the beginning of the year, gold prices have increased by 21.2%.

Fawad Razaqzada - market analyst at City Index and FOREX.com - predicted: "Although the long-term trend is still increasing, I will not be surprised if the short-term decline continues in the next few days. The first support level is $3,136/ounce, followed by $3,073/ounce and the important level is $3,000/ounce.

Investors are now waiting for US producer price index (PPI) data to be released on Thursday, after the consumer price index was lower than expected, to predict the direction of interest rate policy from the US Federal Reserve (FED).

Low interest rates are often beneficial for gold because gold does not yield interest.

Spot silver prices fell 1.9% to $22.27 an ounce. platinum fell 0.8% to $980.21/ounce, while gold fell 0.6% to $950.7/ounce.