Central bank buying and investor demand have pushed gold prices to record highs in recent months. However, the recent pullback has some questioning whether the precious metal can continue its rally. But gold still has medium- to long-term support as there are several supporting factors, said Axel Rudolph, senior technical analyst at IG in London.

Rudolph analyzed the stability of gold's long-term uptrend. The first major factor he looked at was government buying.

“Central bank gold purchases have reached historic levels, with nearly 400 tonnes purchased in the first half of 2022 alone – the fastest pace in 55 years. By July 2024, global gold purchases reached their highest level in nearly 14 years,” he said.

The surge is “a significant shift,” Rudolph said, as central banks have shifted “from net sellers to active buyers” over the past decade. Major institutions in Russia, China, India, Poland and Hungary have significantly increased their gold reserves.

The main driver behind this trend is diversification. Central banks are looking to reduce their exposure to currencies and bonds. With global debt at record levels, gold serves as an important hedge against market risks. Central bank purchases have put sustained upward pressure on gold prices, contributing to a record high of nearly $2,800 an ounce just a few weeks ago," the expert analyzed.

Geopolitical tensions and rising inflation have boosted gold’s appeal as a safe haven in recent years. A spike in inflation from 2021 to mid-2023 has also added to the appeal of gold. Major economies such as the US and Europe have experienced their highest inflation rates in 40 years.

Despite a gradual decline in inflation from mid-2023, Rudolph believes investors will continue to view gold as a safe haven for cash flows: "The combination of geopolitical uncertainty and inflation concerns, even after President-elect Donald Trump's victory in the US presidential election last week, has created a solid foundation for gold demand among both institutional and retail investors.

The possibility of another bout of inflation is also present. "Trump's pledge to impose tariffs of 10% to 60% on imports, even from US allies, could lead to retaliatory tariffs on US exports. This could create another inflationary spiral leading to higher gold prices," he said.

Another factor supporting gold prices is the recovery in jewelry demand. The recovery from the COVID-19 pandemic has fueled a significant recovery in the gold jewelry industry as global lockdowns ease and consumer confidence returns to the market. Cultural factors have played a key role in maintaining strong jewelry demand, especially in regions where gold has a traditional role in weddings and gifting.

The World Gold Council forecasts that annual jewelry demand will continue to grow, driven by rising wealth in developing countries. The large populations of India and China represent a significant untapped demand for gold products.

Meanwhile, gold supply remains limited, which will also support the market.

“Despite rising prices, gold production has remained relatively flat over the past decade, creating a significant supply-demand imbalance,” he said. “A number of factors have constrained output, including declining ore grades, a dearth of large new discoveries, and rising political risks in key producing regions. Environmental concerns have also constrained mining expansion.”

This combination of supply constraints and strong demand “suggests higher gold prices in the near term,” Rudolph said. Technical analysis also supports a positive long-term outlook for the precious metal.

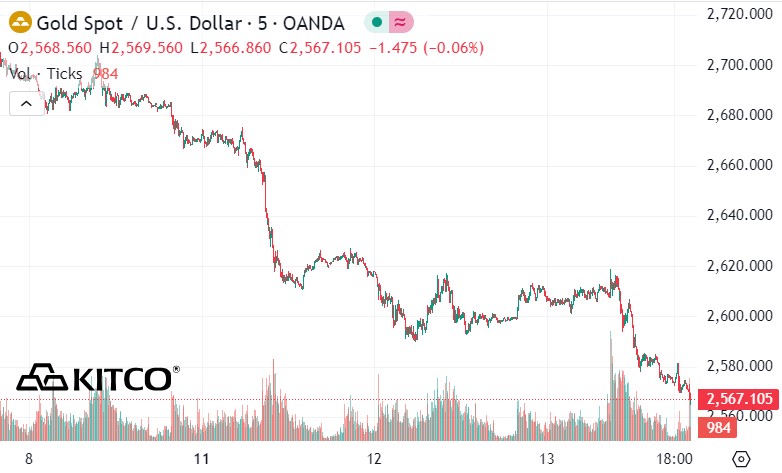

From a technical perspective, Rudolph said that $2,600 an ounce could be attractive to investors. However, he warned that "a continued decline and a weekly close below the September 18 low of $2,546.86 an ounce could lead to a deeper correction."