According to the US Bureau of Labor Statistics on Wednesday, the Consumer Price Index (CPI) increased by 0.2% last month, lower than the 0.5% increase in January. This figure is weaker than economists' forecasts, who expect a 0.3% increase.

In the 12 months to October, core inflation increased by 2.8%, down from 3.0% in the previous month. This figure is also lower than the general forecast of 2.9%.

The core CPI - an index that eliminates volatile food and energy prices - increased by 0.4% in February, equal to the increase in January. Economists forecast this figure to increase by only 0.3%. The report also showed that core CPI increased 3.1% over the past 12 months.

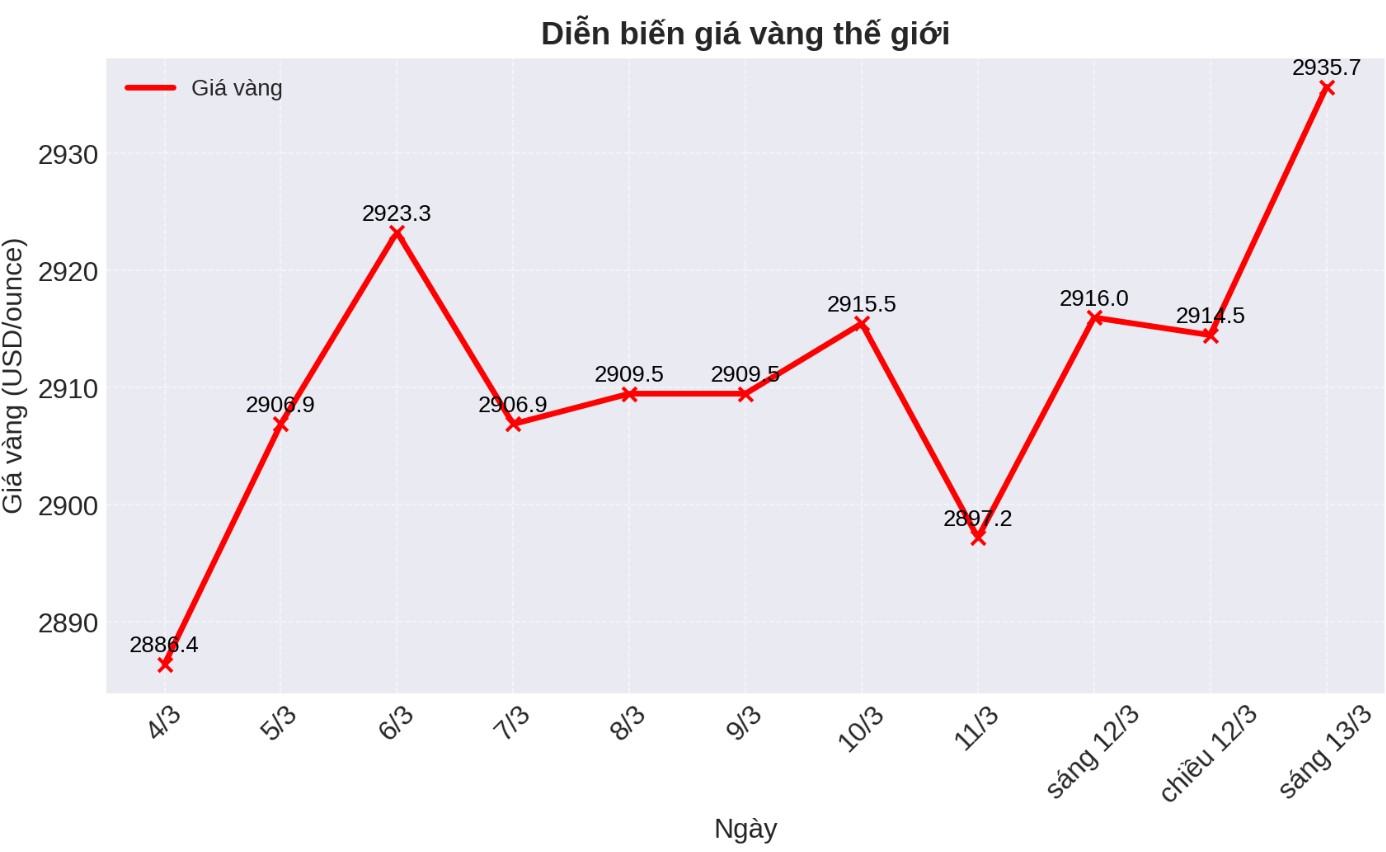

The gold market increased ahead of inflation data. Recorded at 6:30 a.m. on March 13 (Vietnam time), the world gold price listed on Kitco was at 2,935.7 USD/ounce, up 18 USD/ounce compared to the same time of the previous session.

Some analysts believe that US CPI data could support higher prices. If consumer prices increase more slowly, the US Federal Reserve (FED) may soon cut interest rates more than expected, especially due to concerns about increased economic recession.

However, the Fed has repeatedly stressed that it is in no rush to cut interest rates, as the US labor market remains relatively strong and the risk of high inflation has not completely disappeared.

Although general inflation is lower than expected, some economists note that consumer prices are still a major risk for the economy. The report said that the majority of the decline was due to falling airfares, while housing costs continued to increase.

In addition, energy prices have mixed developments. The petroleum index fell 1% last month, but the overall index still increased by 0.2% due to rising electricity and gas prices.

The report also recorded a widespread increase in many items in the core CPI, including medical services, used cars and trucks, household furniture, entertainment, clothing and personal care products.

Although high inflation may prevent the Fed from cutting interest rates hastily, some commodity experts believe that gold can still maintain upward momentum. High inflation will reduce real yields, thereby making gold more attractive when the opportunity cost of holding non-yielding assets decreases.

See more news related to gold prices HERE...