Gold futures increased sharply on Tuesday as investors sought a safe haven against market instability caused by US President Donald Trump's expanded tariff policy.

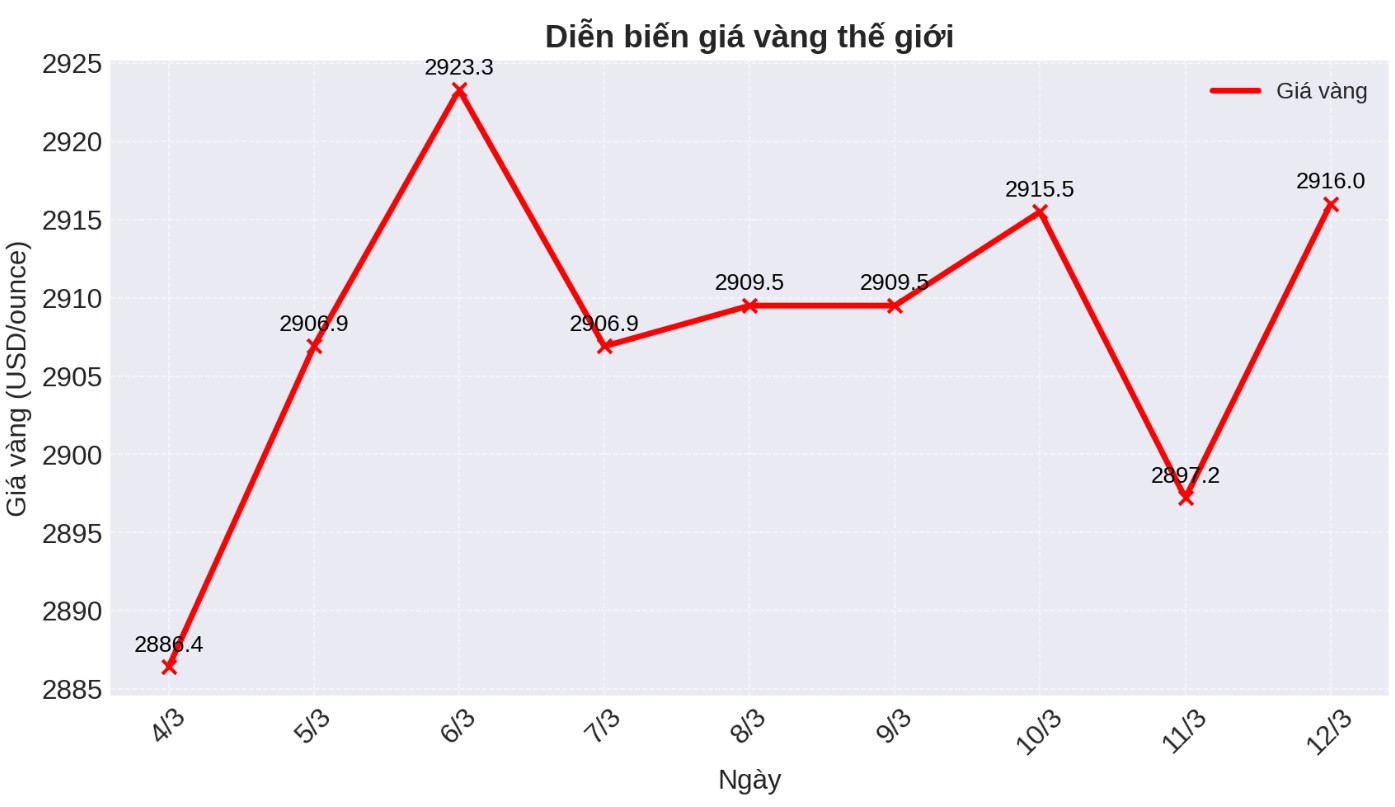

By 3:55 p.m. EST, the price of gold for April delivery increased by 23.6 USD (0.81%) to 2,923.1 USD/ounce.

The financial market continues to fluctuate strongly as the US adjusts trade policies with many countries. Investors are more concerned after the US government announced plans to increase the import tax on metals from Canada to 50%, expected to take effect from Wednesday, according to a social media post.

"These escalating trade measures are raising real concerns about the possibility of a recession in the US," market analysts said.

The tariff policies on China, Canada and Mexico have been changing continuously since taking effect last week, causing great fluctuations in the market.

A weakening USD also supported gold prices, as the USD index fell 0.52% to 103.355 - the lowest level since November 5, 2024, after only increasing slightly by 0.04% in the previous session.

Investor's Business Daily said that Mr. Trump's announcement of imported steel and aluminum taxes from Canada, along with a plan to increase taxes on imported cars from April 2, has caused a stir in the market.

However, some late-day information helped the market ease tensions, after a report appeared that Prime Minister Ontario Doug Ford had postponed a plan to impose a 25% tax on electricity exported to the US, in the context of US Secretary of Commerce Howard Lutnick showing signs of readiness to negotiate trade.

US stocks continued to plummet but the decrease was more slight than the sell-off session on Monday. The Dow Jones index fell 478.23 points (1.1%) to 41,433.48 points, after the previous session fell to its lowest level since November 2023. The S&P 500 lost 42.49 points (0.76%) to 5,272.07 points, while Nasdaq decreased slightly by only 32.23 points (0.18%).

After two consecutive days of decline, gold prices have recovered and found technical support. Although still below the record of 2,963.2 USD/ounce set on February 24, gold prices currently have a chance to hit a new peak as investors increasingly seek this precious metal as a safe haven asset in the face of many economic fluctuations.

Important economic data for the week

Wednesday: US consumer price index (CPI), monetary policy decision of the Bank of Canada.

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.