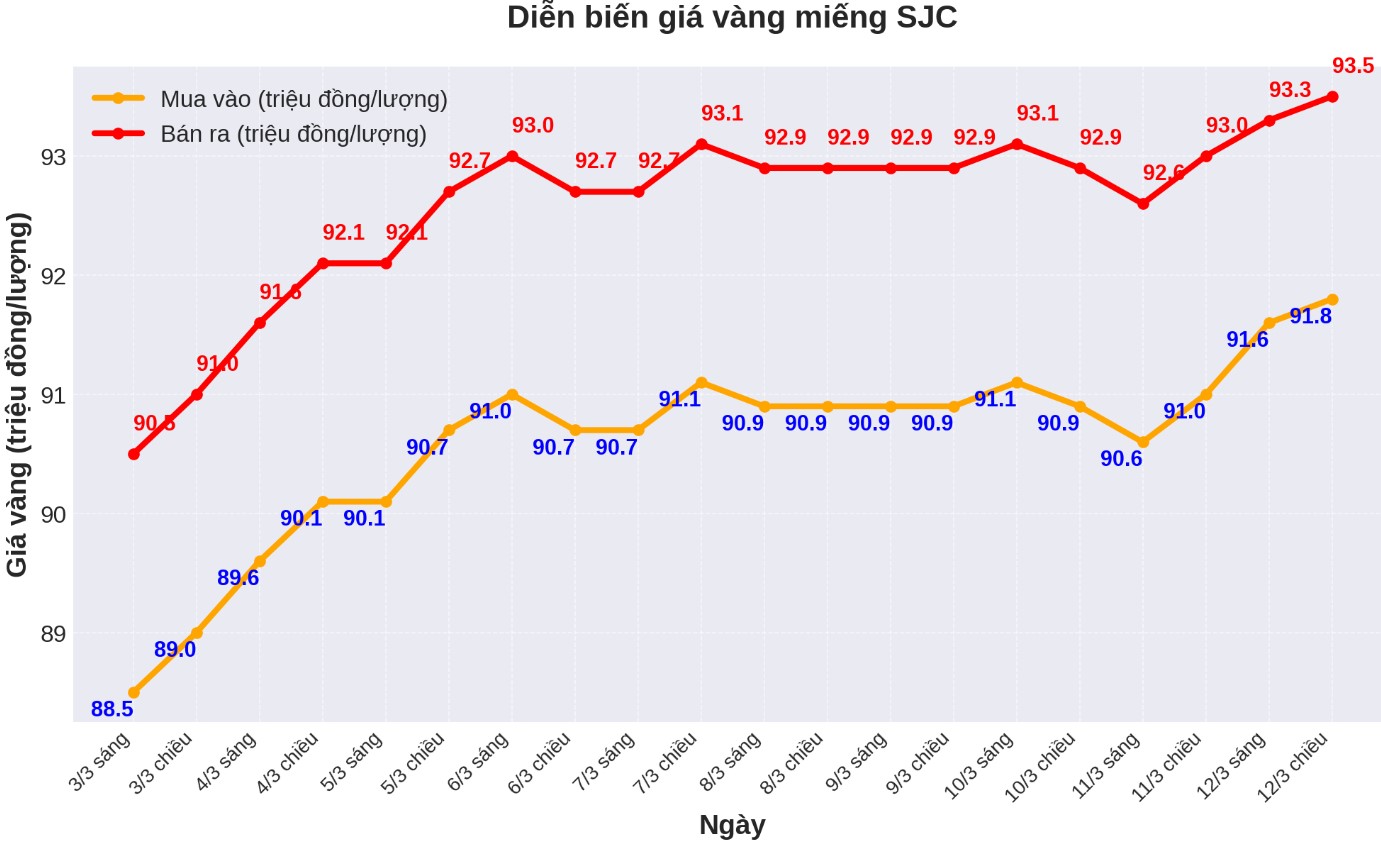

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND91.8-93.5 million/tael (buy - sell), an increase of VND800,000/tael for buying and VND500,000/tael for selling. The difference between buying and selling prices is at 1.7 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND91.8-93.5 million/tael (buy - sell), an increase of VND800,000/tael for buying and an increase of VND500,000/tael for selling. The difference between buying and selling prices is at 1.7 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 92-93.5 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold is listed at 1.5 million VND/tael.

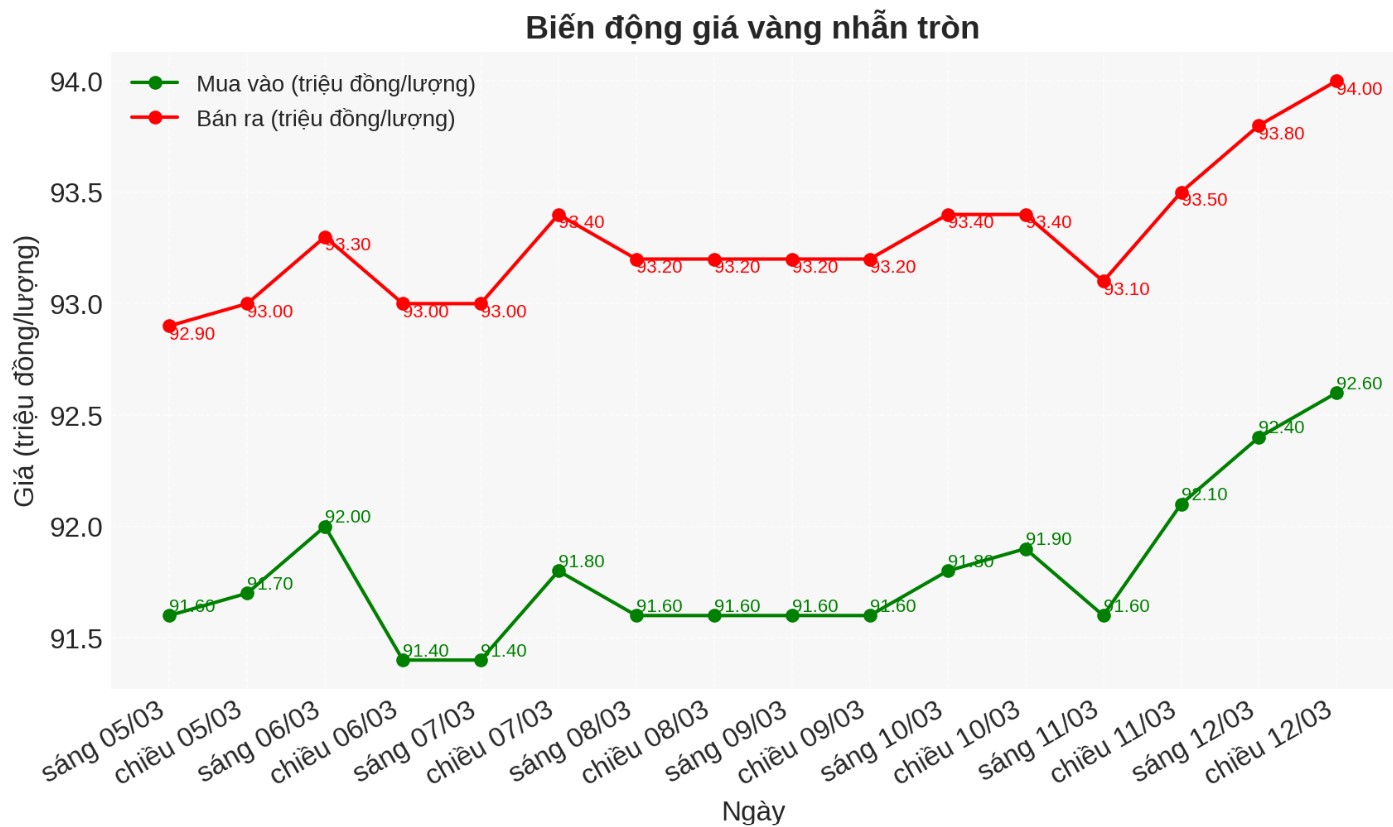

9999 round gold ring price

As of 5:45 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND92.6-94 million/tael (buy in - sell out); increased by VND500,000/tael for both buying and selling. The difference between buying and selling is listed at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 92.55-94.1 million VND/tael (buy - sell); increased by 650,000 VND/tael for buying and increased by 700,000 VND/tael for selling. The difference between buying and selling is 1.55 million VND/tael.

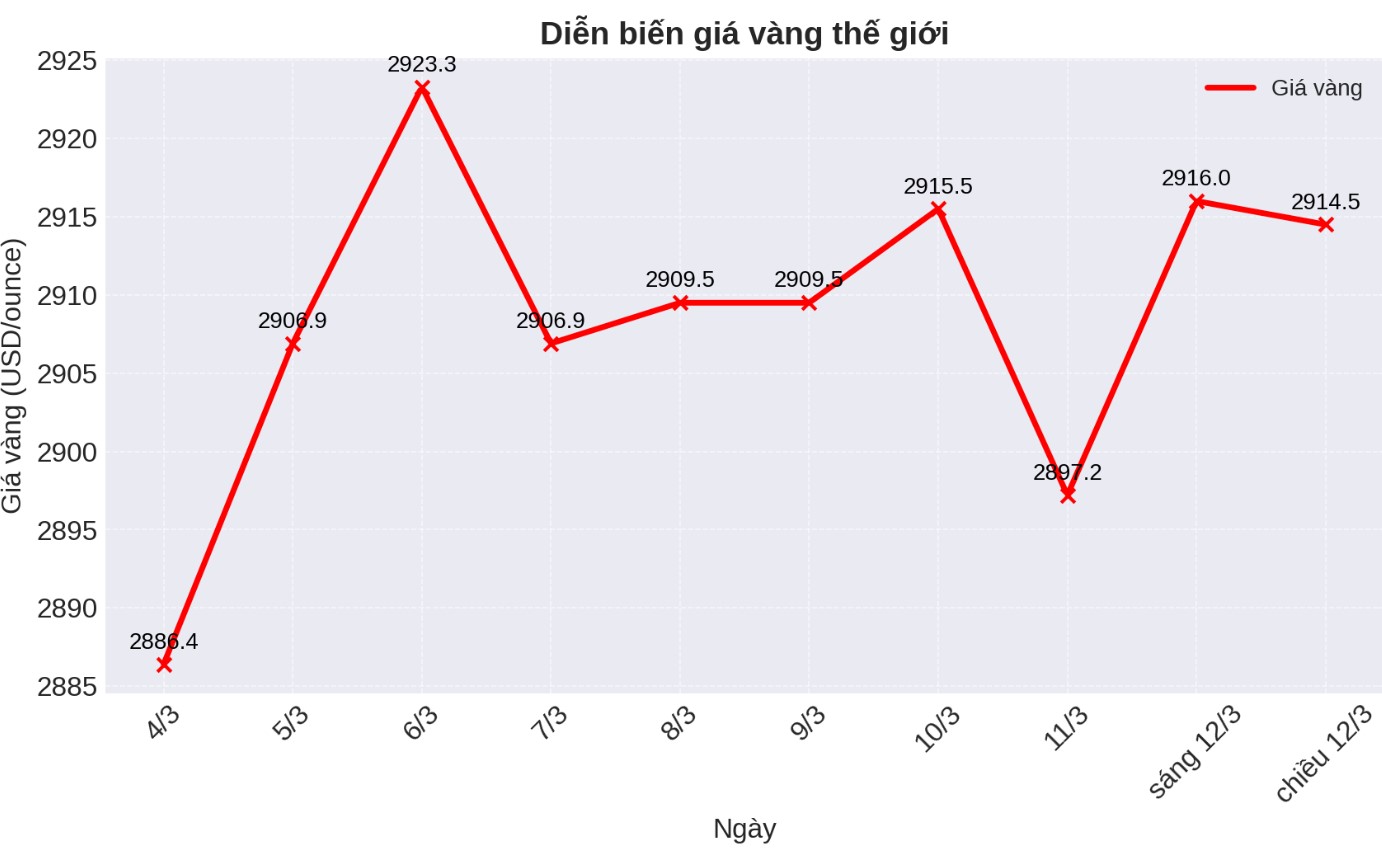

World gold price

As of 6:00 p.m., the world gold price listed on Kitco was at 2,914.5 USD/ounce.

Gold price forecast

World gold prices tend to decrease slightly in the context of the USD increasing. Recorded at 6:00 p.m. on March 12, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.527 points (up 0.25%).

Analyst James Hyerczyk at FX Empire commented that gold prices increased last night as concerns about trade tensions boosted safe-haven demand.

The USD index fell to a four-month low, making gold more attractive to foreign buyers. Currently, traders are focusing on upcoming US inflation data, which could influence US Federal Reserve (FED) policy expectations and gold price prospects.

Hyerczyk said market sentiment remains cautious amid constantly changing US trade policy. US President Donald Trump has changed his stance on tariffs, imposed and then delayed tariffs on Canada and Mexico, and increased tariffs on Chinese goods, disrupting the global market.

China and Canada have paid back with their own tariffs, increasing economic uncertainty, he said.

The US president also mentioned the possibility of the economy falling into recession, making investors even more worried. The US Treasury Secretary described the current period as the detoxification process of public spending cuts, while some analysts questioned the risk of recession.

This mixed outlook has helped gold maintain its position as investors seek shelter in volatile market conditions, Hyerczyk said.

Global X analyst Trevor Yates said that in the short term, investors will focus on the impact of policy changes, especially tariffs on US growth expectations and inflation. This will not only affect real interest rates but also further promote purchasing activities of global central banks.

Meanwhile, market analyst Zain Vawda of OANDA said that gold is still being supported as market instability drives demand for this safe-haven asset. However, Vawda also noted that any positive developments in negotiations between Russia and Ukraine could act as a safe-haven force.

Important economic data for the week

Wednesday: US consumer price index (CPI), monetary policy decision of the Bank of Canada.

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...