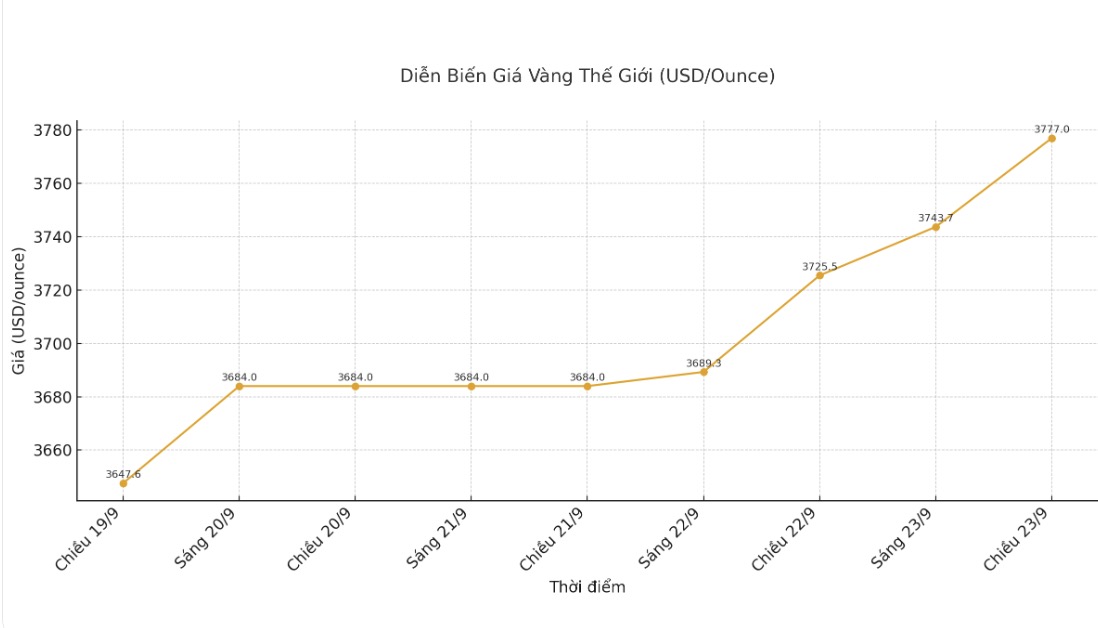

Recorded at 4:10 p.m. on September 23 (Vietnam time), spot gold prices increased to $3,777/ounce. December gold delivery contracts on COMEX also added 0.3% to $3,787.4/ounce.

The US dollar continues to depreciate, making gold cheaper for investors holding other currencies. It is worth mentioning that the gold price increase has not shown any signs of stopping.

Kyle Rodda, an analyst at Capital.com, said: The main driver of the rally comes from monetary policy expectations, the possibility of the US Federal Reserve (FED) cutting interest rates and inflation risks.

Meanwhile, Kelvin Wong - senior expert at OANDA - said that the uptrend is still solid but there may be short-term technical adjustments.

Investors are now paying attention to Fed Chairman Jerome Powell's speech scheduled for 11:35 p.m. tonight (Vietnam time), as well as the personal consumption expenditure price index (PCE) report - the Fed's preferred inflation measure - due on September 27.

The market forecasted that the Fed possibly decreased by 25 basic points in the October meeting up to 90% and 75% likely to continue cutting in December, according to the CME Fedwatch Tool.

Previously, new FED Governor Stephen Miran said that the agency was mis assessing the level of tightening and could put the job market at risk if it did not cut interest rates strongly, although many other officials were still cautious.

Other precious metals moved in opposite directions: silver fell 0.6% to $43.82/ounce but remained around the 14-year peak; platinum lost 0.3% to $1,412.64/ounce; palladium increased 0.3% to $1,182.24/ounce. ANZ forecasts that the silver market will continue to fluctuate strongly due to tight supply.

See more news related to gold prices HERE...