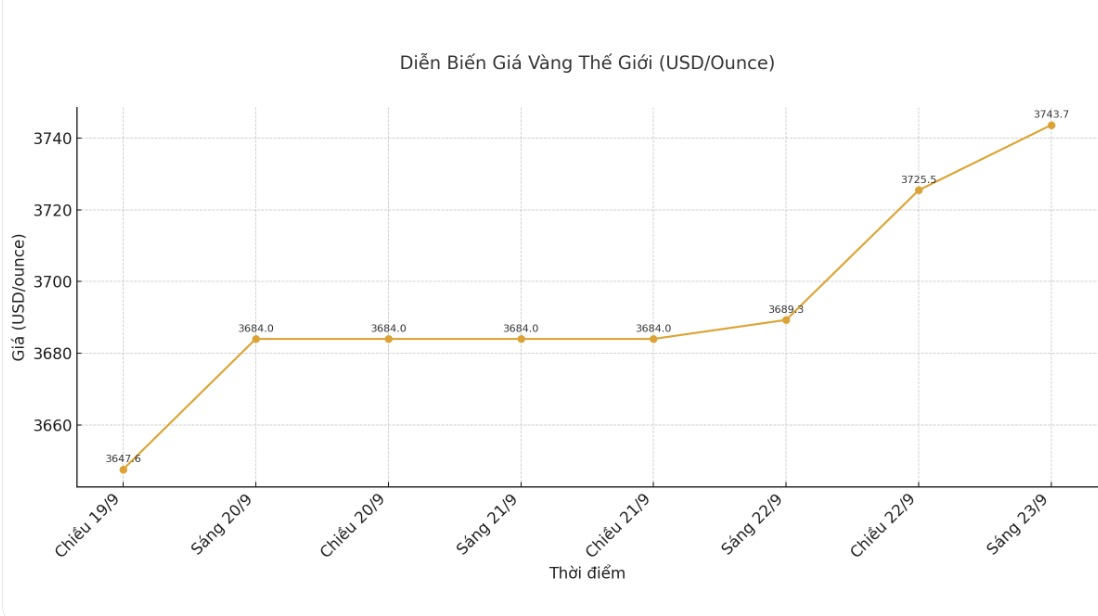

After a week of slight adjustments, the gold market broke out again, pushing prices above the $3,700/ounce mark. The latest spot gold price was recorded at 3,743.7 USD/ounce, up more than 1.6% on the day.

In the new report, Michael Hsueh - Analyst of Deutsche Bank said he raised his gold price forecast and expected the average price to reach 4,000 USD/ounce in 2026. Gold has previously hit the target of $3,700/ounce set by the bank for 2025.

He said that although gold prices have increased by more than 40% since the beginning of the year, this precious metal has not been overvalualized. Although gold appears to be above reasonable value, the majority of the reason comes from central bank buying and this trend will continue, Hsueh said.

According to him, the easiest way to explain the $4,000/ounce forecast is to see the impact of formal demand (net buying from central banks) on the unadjusted gold price model.

According to consulting firm Metals Focus, from 2022 to now, each year, central banks have net bought more than 1,000 tons of gold. In 2025, this figure is expected to be about 900 tons, double the average of 457 tons/year in the 2016-2021 period.

Several developing countries seek to diversify away from the US dollar after the West froze nearly half of Russia's foreign exchange reserves in 2022.

German bank experts said that since 2022, gold prices have been higher than the unadjusted model by an average of 13% per year. Applying this increase to the 2026 forecast (11% + 13%) will average the price of 4,000 USD/ounce, with the assumption that official demand is still strong.

Regarding central bank demand, Michael Hsueh predicts that purchases will remain double the average annual 400 tons in the period 2011-2021, in which China plays a leading role.

At the same time, investment demand continues to be an important pillar. ETFs in developed markets are still 17 million ounces lower than their peak in 2020, while speculative positions in the futures market have not been pushed up, he said.

Although optimistic, Hsueh also noted some risks. The monetary policy of the US Federal Reserve (FED) is both an opportunity and a challenge for gold. The new easing cycle will support gold because low interest rates reduce the cost of holding gold - a non-yielding asset. However, the FED may not cut interest rates as strongly as expected due to high inflationary pressure.

The US economic groups basis forecast at Deutsche Bank is that the Fed will not cut interest rates further in 2026 because the inflation outlook and labor market do not match the below-neutral interest rate. This is in contrast to the 70 basis point cut that the market is betting on, he added.

In addition, uncertainties surrounding the Fed's independence from growing political pressure are also unpredictable, but in the long term, they will still benefit gold prices.

See more news related to gold prices HERE...