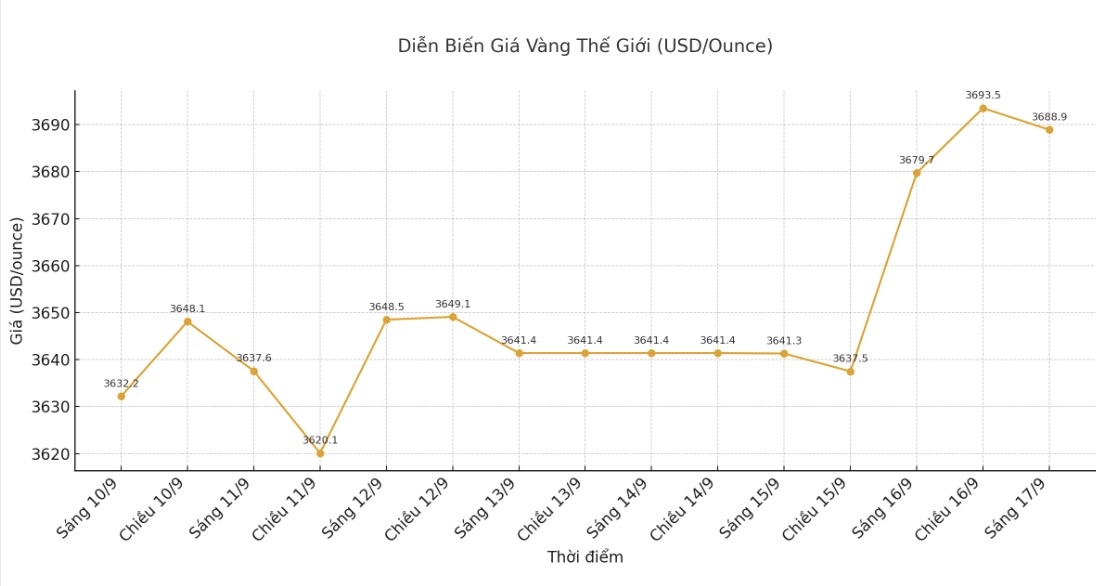

The precious metals market has seen a spectacular series of breaks in recent sessions, when the most recent monthly gold contract closed at a record $3,688.9/ounce, up 0.2%. This is the third consecutive session that world gold has set a new price peak, demonstrating the impressive increase of this metal in the current economic context.

This solid increase comes as investors are ahead of the possibility that the US Federal Reserve (FED) is about to lower interest rates - a monetary policy that has always been favorable for non-interest-bearing assets such as gold.

Price developments show growing confidence in gold's role as an anti-inflation "shield" and a safe haven during times of monetary easing.

Bank of America experts say the current economic context is especially favorable for gold. The bank stressed the risk of stagflation as a key driver of demand for precious metals.

In fact, as high inflation comes with slow growth, the intrinsic value of gold becomes more attractive to both institutional and individual investors.

In further strengthening this trend, the US consumer price index (CPI) in August increased by 2.9% - high enough to continue supporting gold prices. Bank of America said that since 2001, there has never been a period of gold price decline when US inflation exceeded 2% while the FED pursued a loose policy. This statistic shows that the current environment may continue to create a driving force for precious metals.

The increase in gold is even more impressive when looking back at previous price levels. Compared to the 52-week low of $2,564.30/ounce recorded on September 17, 2024, gold prices have surged 43.86%.

If calculated from the lowest level in 2025 of 2,638.4 USD/ounce (January 6), gold has increased by 39.82%, showing that buying pressure from organizations and state reserve funds is strengthening.

Short-term data also confirm the upward trend. Since the beginning of September, gold prices have increased by 6.20%, while since the beginning of the year, the increase has reached 1,059.70 USD/ounce, equivalent to 40.31%. This is the most prominent increase in the commodity group in 2025.

The above developments reflect broader concerns about fiscal sustainability, geopolitical tensions and the long-term impact of the expansionary monetary policy. As central banks continue to seek to balance growth and inflation control, golds role as a value safe haven is increasingly valued by investors to diversify portfolios and prevent monetary risks.

The combination of technical momentum, fundamentals and favorable monetary policy expectations shows that gold's rally is not simply a speculative phenomenon. This could be a signal of a reassessment of value and risks in the changing global economy, where traditional safety assets are of greater concern.

See more news related to gold prices HERE...