Highest savings interest rate of 8.1%/year at Cake by VPBank

According to records on January 4, 2026, Cake by VPBank is implementing an extremely attractive interest rate incentive program to attract idle cash flow.

The actual interest rate received by customers can reach 8.1%/year thanks to the tiered interest policy. For customers who deposit savings from the next time with amounts from 20 million VND for terms from 6 months, the bank applies an additional level from 0.2% to 1%, bringing the total interest rate to a peak of 8.1%.

For customers who deposit for the first time (from 100,000 VND, term from 6 months), Cake by VPBank gives an additional 0.9%, raising the total actual interest rate to 8.0%/year.

In addition, the bank also launched valuable gift programs such as "iPhone 17 Hunt" for deposits from 5 million VND and "Tet 2026 Gift Set" for Top customers with balances from 300 million VND.

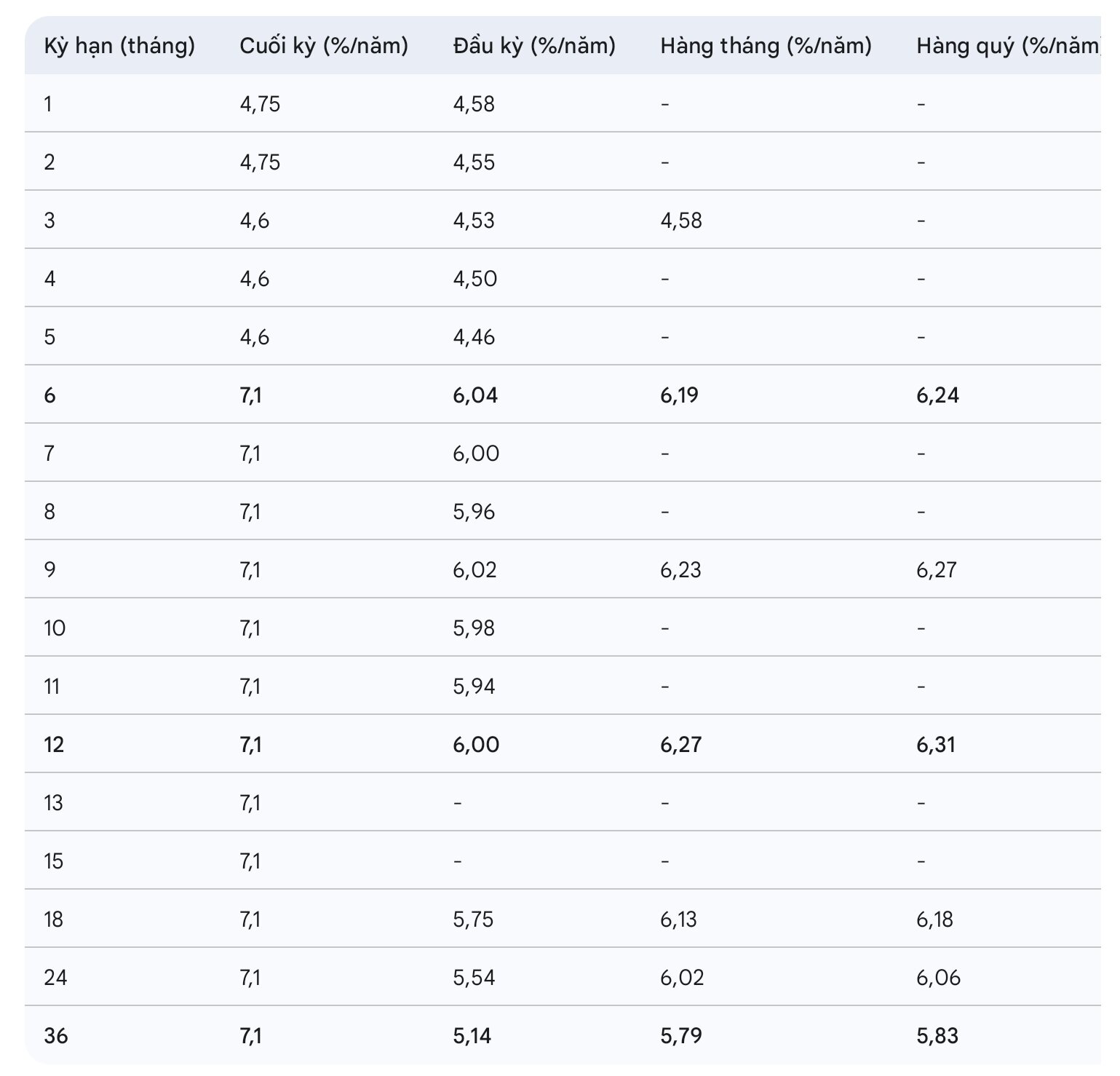

Online savings interest rates for individual customers

For customers who deposit ordinary savings through the application (excluding special installment interest), the officially listed interest rate schedule applied from December 25, 2025 also recorded a very high base level compared to the general level.

The highlight is that the interest rate of 7.1%/year is applied simultaneously for terms from 6 months to 36 months when receiving interest at the end of the term. This is a publicly listed interest rate (excluding incentives) belonging to the highest group in the market today.

Below is a detailed savings deposit interest rate table (%/year):

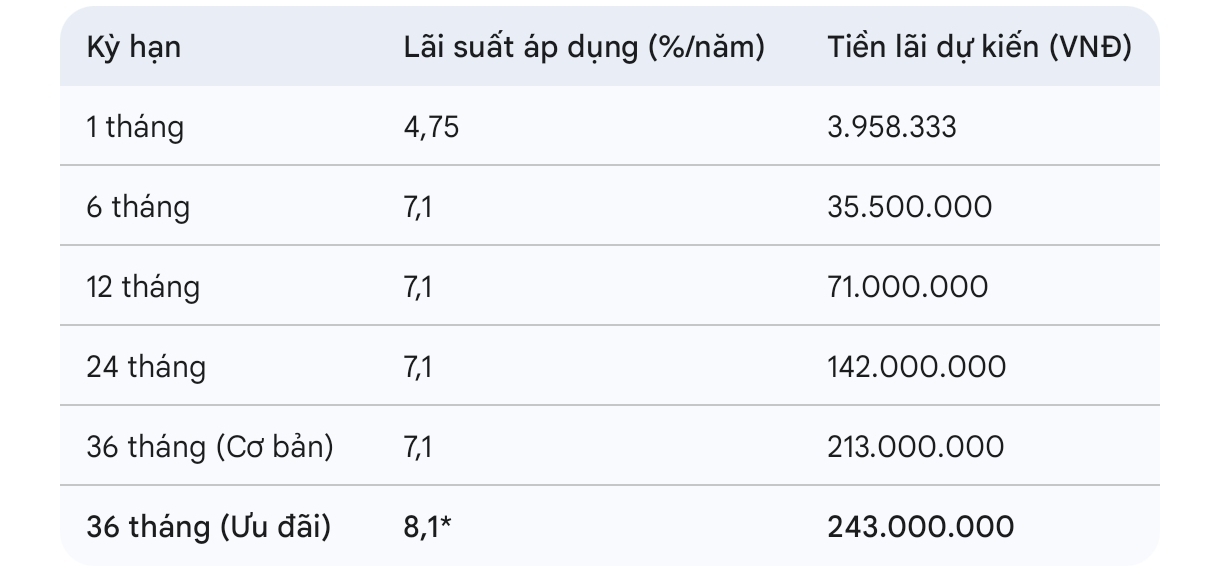

Deposit 1 billion VND online savings, how much interest will you receive?

With a deposit of 1 billion VND, choosing a deposit term will greatly affect the interest money customers receive. Based on the base interest rate (7.1%) and the highest preferential interest rate (8.1%), below is a detailed profit calculation:

*Note: The interest rate of 8.1% applies when customers meet the conditions to deposit savings for the next times and participate in a gradual interest rate increase program.

Thus, if you maximize the current incentives of Cake by VPBank, customers depositing 1 billion VND can receive a record interest amount of up to 243 million VND after 36 months.

Even when only applying the usual listed interest rate of 7.1%/year, the interest rate of 213 million VND for a 36-month term or 71 million VND for a 1-year term are also very impressive figures in the current financial market.

To optimize profits, customers should consider dividing deposits or sending long-term deposits from 6 months or more to enjoy a full high interest rate of >7%/year.

On January 12, 2021, the CAKE BANK application was launched under the license of the State Bank of Vietnam, under Vietnam Prosperity Joint Stock Commercial Bank (VPBank).

With the goal of building a comprehensive digital financial ecosystem, Cake provides practical products such as savings, investment, payment, credit cards and consumer loans.