The risk of a short-term decline still exists

According to James Hyerczyk from FX Empire, gold traders are paying attention to $3,150/ounce. Gold prices are currently fluctuating within a certain range after a recent sharp decline. Traders are focusing on US PCE inflation data and new tariff information to decide the next direction for the gold market.

Gold prices were steady at the beginning of the week, suspended after a sharp decline of two days last week, Hyerczyk wrote.

Monday trading is still within Fridays range, showing hesitation as traders await new stimulants. The precious metal remains in a general uptrend, but the risk of a short-term correction still exists, especially as important macro data and tariff headlines are approaching.

The US dollar is supporting gold prices at current levels, as the US dollar index fell 0.1% on Monday, combined with a 3.4% decline in March. A weaker US dollar typically supports gold prices by making gold more accessible to international investors. The weakness of the US dollar has helped stabilize gold prices after the recent decline, providing short-term support around $3,000/ounce, he noted.

Tax instability causes strong demand for shelter

The uncertainty surrounding US tariffs has also kept safe-haven demand strong, Hyerczyk said.

The market remains vigilant for possible economic impacts from the proposed tariffs by US President Donald Trump, expected to take effect on April 2. Although Mr. Trump suggested flexibility, there were still concerns that retaliatory measures could increase inflation and slow economic growth.

Analysts say a tougher tariff stance could push gold prices to $3,100 an ounce. While the less serious outcome could create an opportunity for short losses below $3,000 an ounce, he wrote.

Regarding the interest rate environment, Hyerczyk said gold prices are still well supported by the rather dovish stance of the US Federal Reserve (FED), as the central bank still forecasts a double interest rate cut in 2025.

Traders are now paying close attention to releasing the US personal spending (PCE) report on Friday the Feds preferred inflation measure for further policy clues. Lower interest rates reduce the opportunity cost of holding non-yielding assets such as gold, increasing the attractiveness of gold, he said.

Hyerczyk said gold is currently accumulating after reaching an all-time high of $3,057.59/ounce last week. If it breaks that level, the uptrend will continue with unlimited upside potential. Important short-term support is at $2,968.92/ounce, while the 50-day moving average is still at $2,874.97/ounce, which is still important for long-term buyers, he wrote.

Commenting on the future, Hyerczyk said he expects gold demand to remain strong with support from a weak US dollar, central bank dovish policies and uncertainty about tariffs.

Unless inflation data exceeds expectations or concerns about tariffs drop sharply, the price cuts may not be deep. As long as gold stays above $2,968.92 an ounce, the large growth structure remains intact, holding it at $3,100 an ounce and possibly $3,150 in the short term view," the expert said.

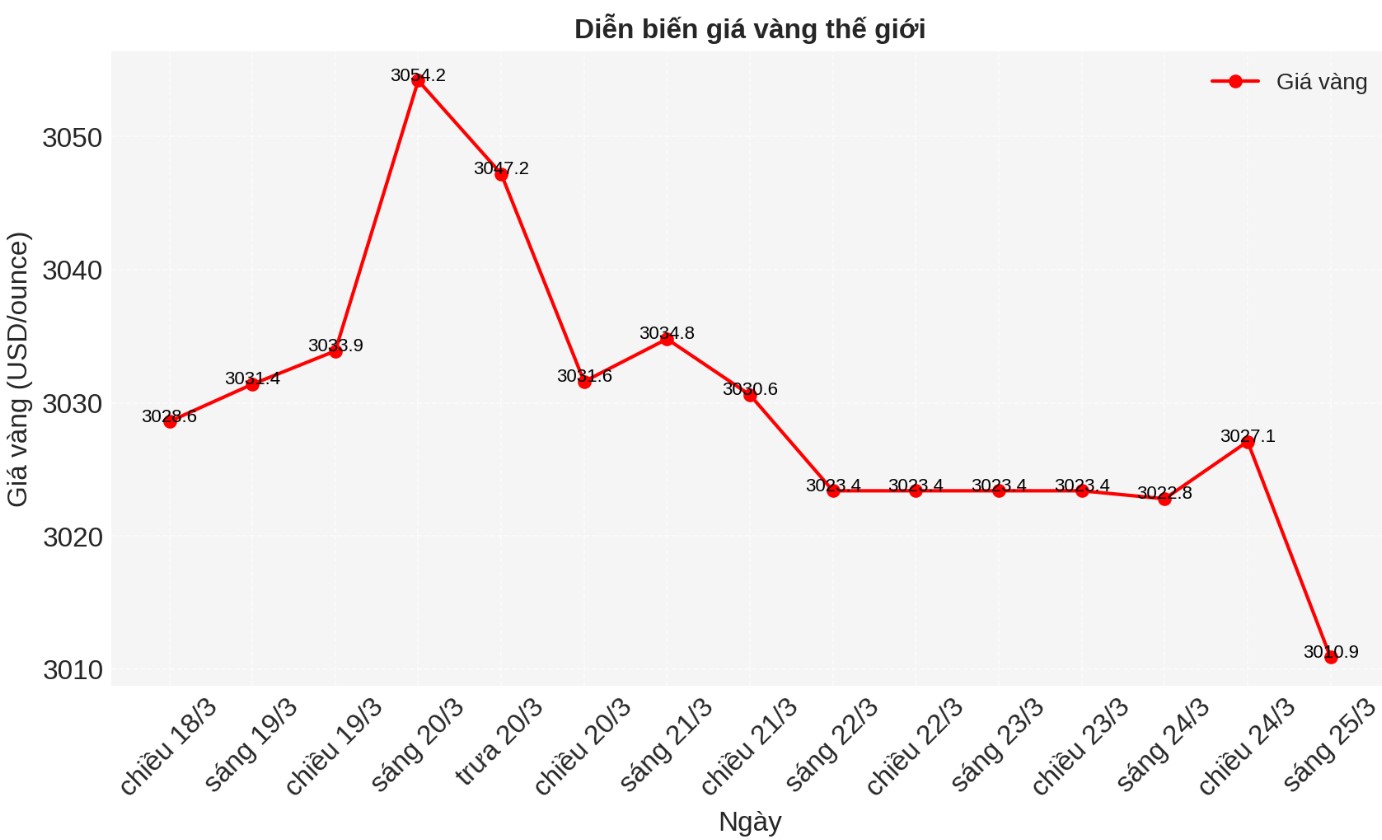

Gold prices have seen a significant increase since the beginning of the week, with spot gold testing short-term support at $3,014/ounce late on Sunday night before trading up to $3,033/ounce at 6:30 a.m. EDT.