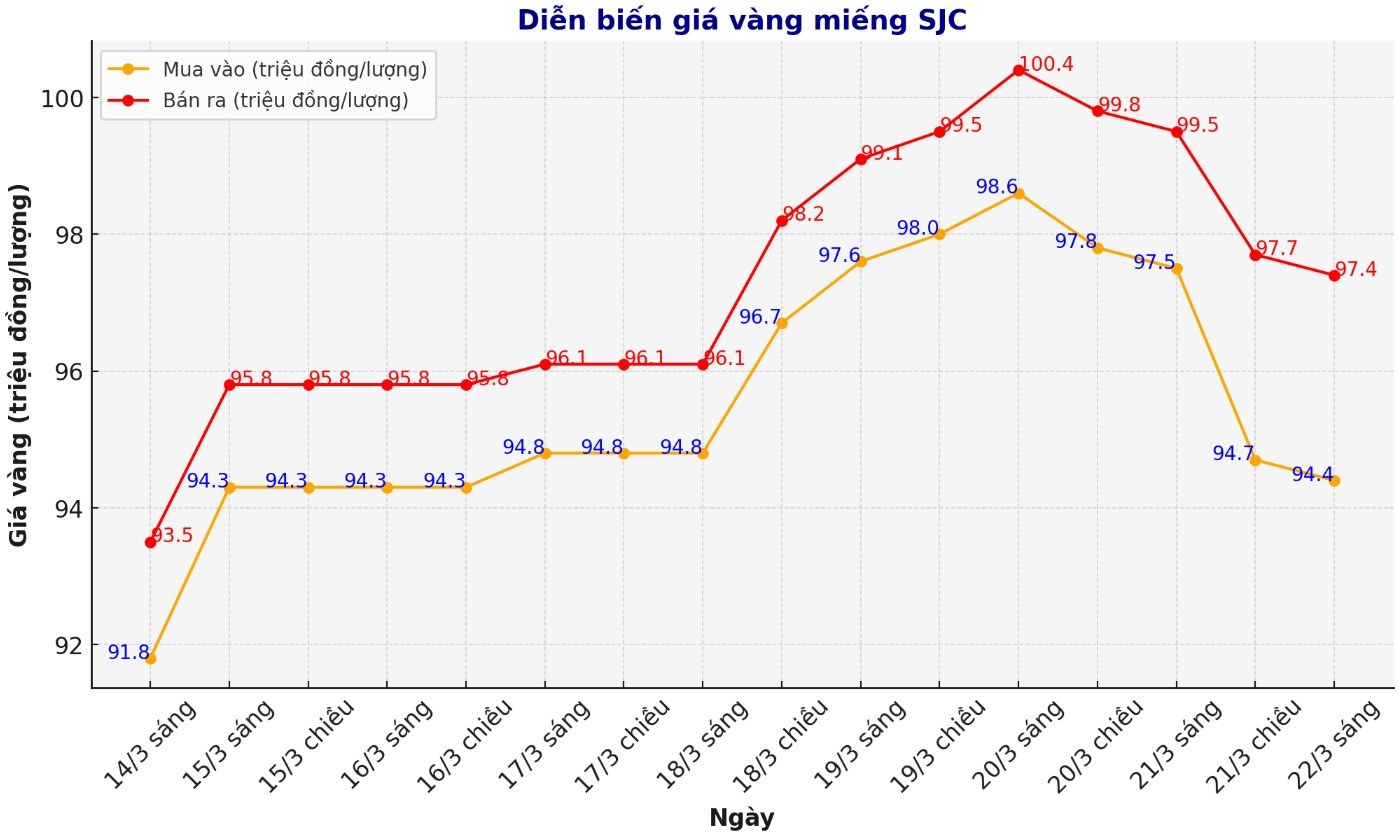

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at VND94.4-97.4 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND94.4-97.4 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.8-97.4 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.6 million VND/tael.

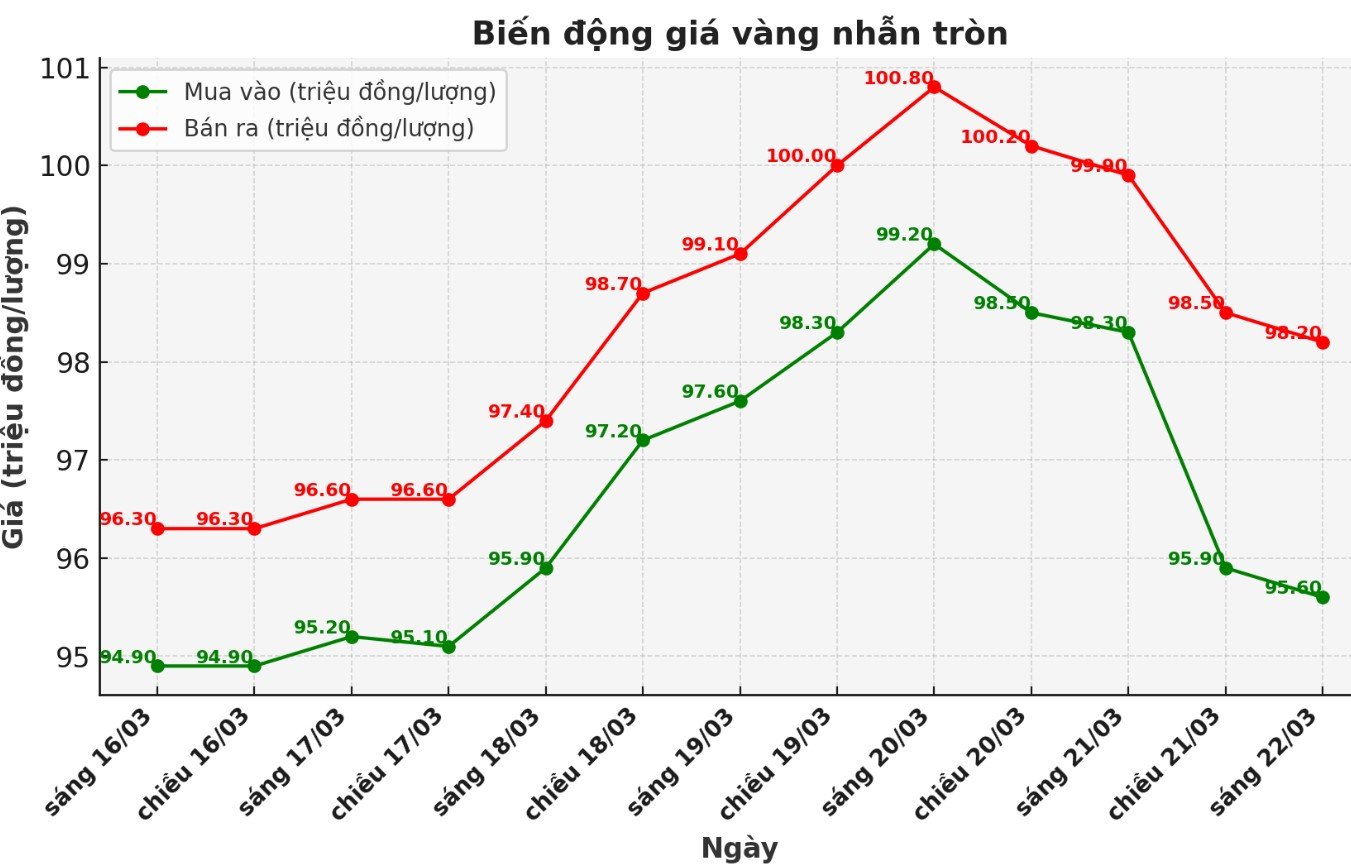

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at VND95.6-98.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling is listed at 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 95.8-98.5 million VND/tael (buy in - sell out). The difference between buying and selling is 2.7 million VND/tael.

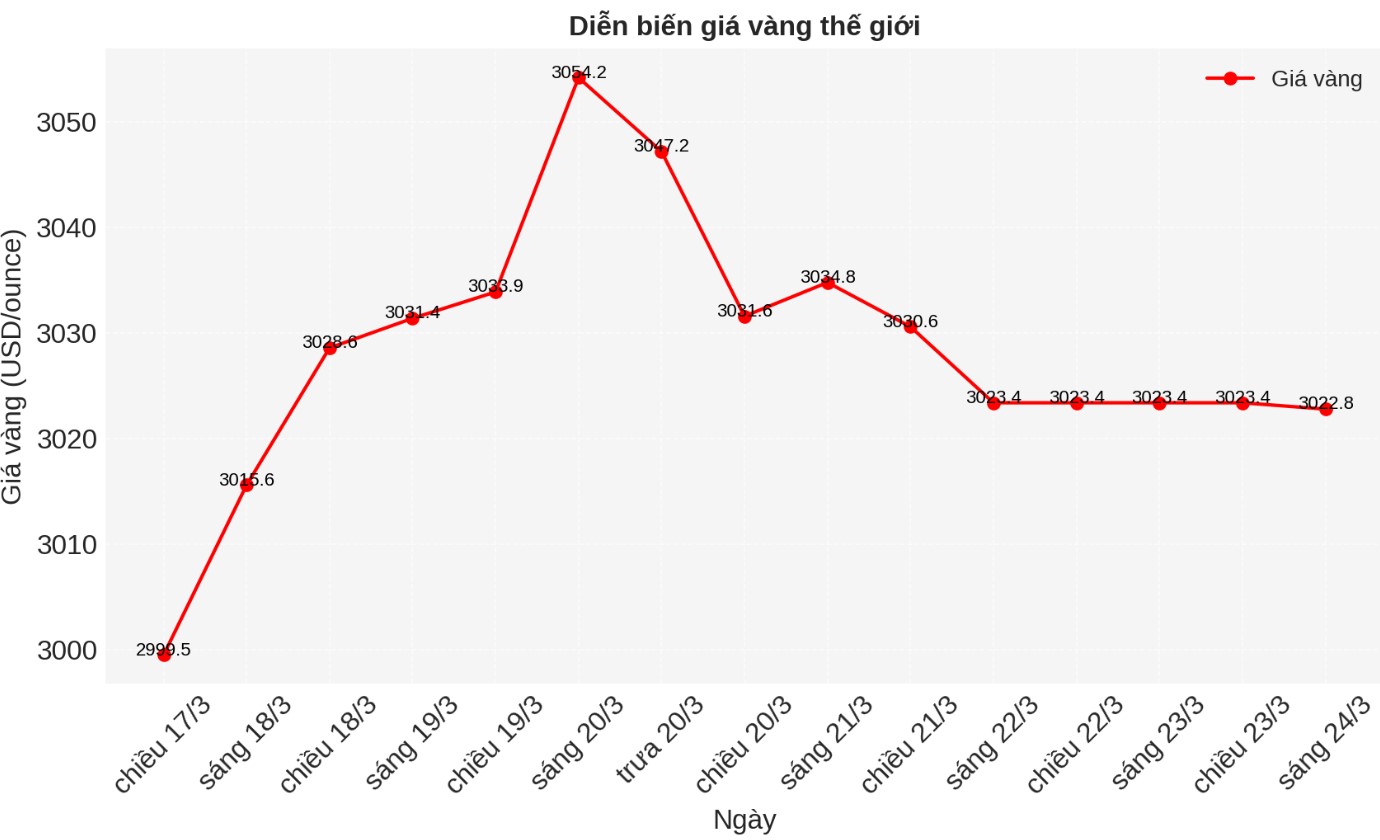

World gold price

At 9:00 a.m. on March 24, the world gold price listed on Kitco was around 3,022.8 USD/ounce, down 0.6 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

World gold prices fell in the context of the USD's recovery trend. Recorded at 9:30 a.m. on March 24, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.737 points (down 0.01%).

After a volatile week, many experts believe that gold prices will continue to grow this week. I think the gold market will continue to maintain its upward momentum in the coming time, said Darin Newsom, a market analyst. While $3,000 an ounce may have made buyers more cautious for some time, I have not seen any clear signs that the market is taking profits.

Therefore, I predict that gold prices will continue to increase in the short term, at least in the next few weeks. However, the fact that $3,000/ounce may reduce the short-term increase is not a cause for concern about the large decrease in gold prices at this time".

Sharing the same view, James Stanley from Forex.com affirmed: I still believe that gold speculators will continue to maintain their optimism in the coming time. Although the $3,000/ounce price may create some short-term barriers for investors to buy, I do not see any clear signs of strong profit-taking.

So I think we will continue to see growth in gold prices, especially in the short term. The $3,000/ounce price may make buyers a little hesitant, but I still expect a steady increase."

According to Adam Button from Forexlive.com, he commented that although he was not too worried about gold's price drop on Friday, he also noticed some notable new factors in the gold market: "One of the important factors is the weakness of the USD this year, which could increase gold prices more strongly.

In addition, political and commercial events could fuel a shift away from risky assets to gold, especially when there is no clarity on tariff issues. In general, I think gold will continue to increase in the coming time".

On the other hand, some experts believe that gold will face a short-term correction. Adrian Day, chairman of Adrian Day Asset Management, said: A break in golds strong rally is completely normal, and I think this will benefit the market in the long term.

While this adjustment could reduce gold prices in the short term, I believe it is just a short adjustment and will not last long. The gold market may continue to recover after a period of price increase suspension".

Economic data to watch this week

Monday: S&P Global (USA) preliminary manufacturing and service PMI.

Tuesday: US consumer confidence, New home sales (US).

Wednesday: long-term orders in the US.

Thursday: homes waiting for transactions (number of unclosed home purchase contracts), US Q4 GDP.

Friday: US core PCE Index, US personal income and expenses.

See more news related to gold prices HERE...