The Government issued Resolution No. 07/2025/NQ-CP on policies and regimes for subjects affected by the implementation of the reorganization of the apparatus and administrative units at all levels according to Conclusion No. 183-KL/TW dated August 1, 2025 of the Politburo and the Secretariat.

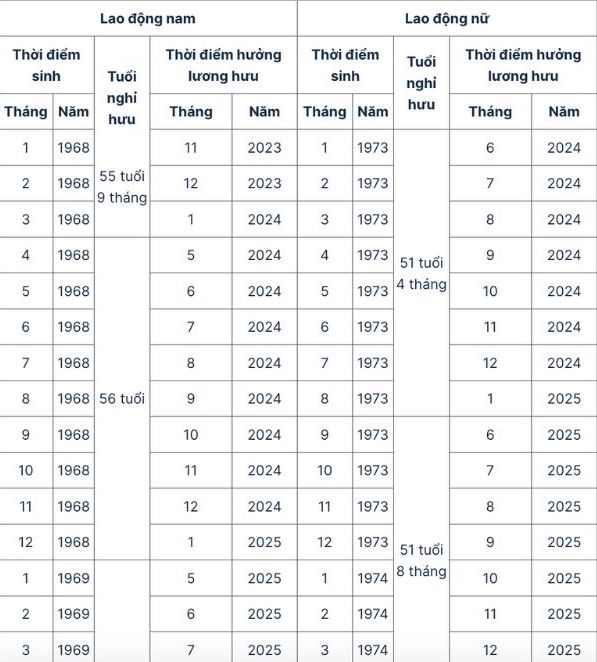

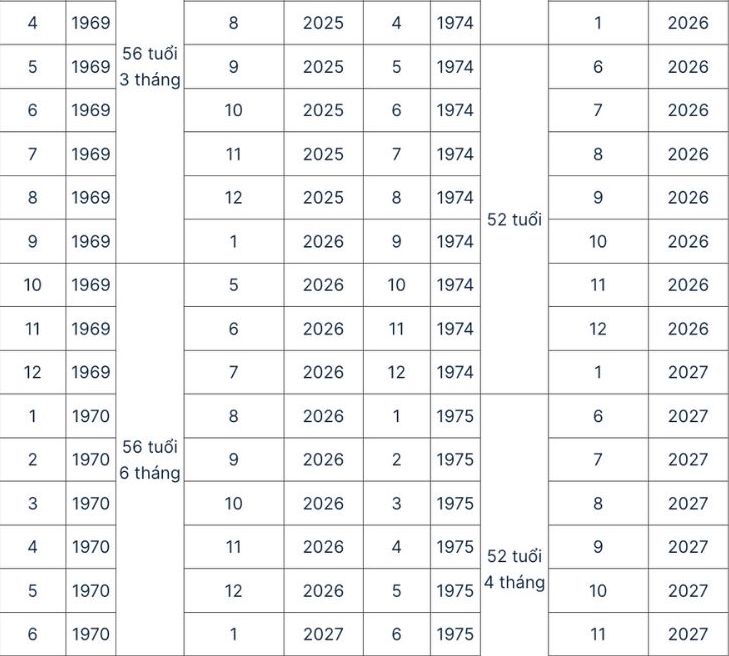

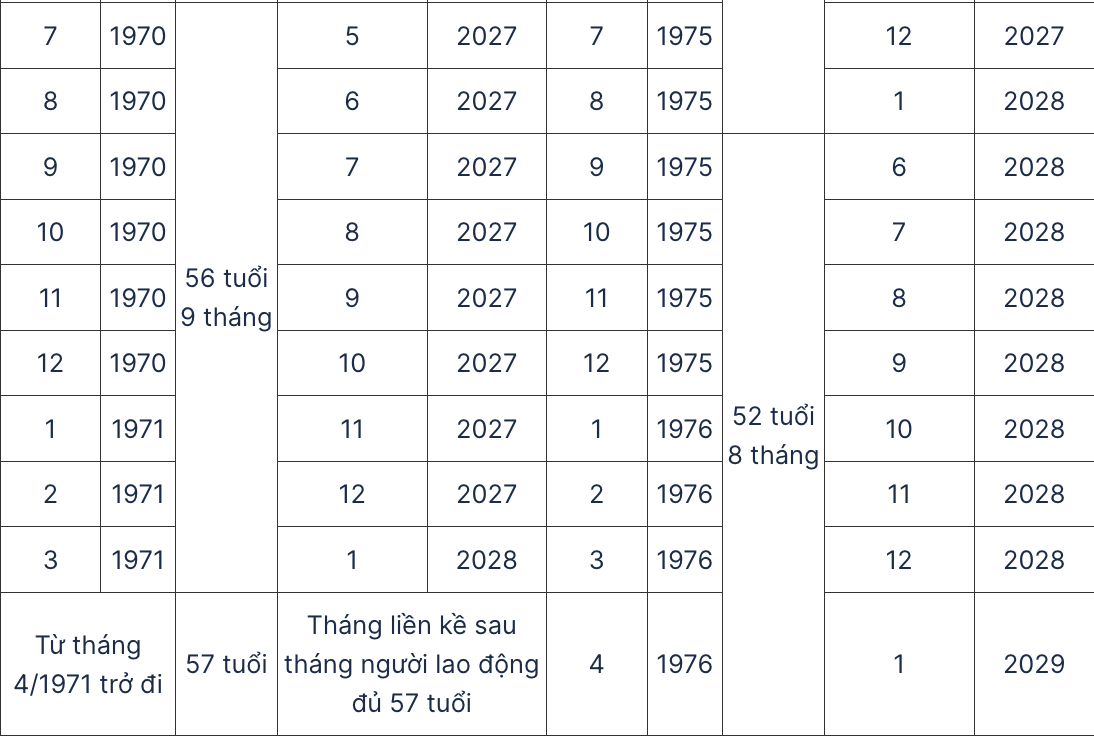

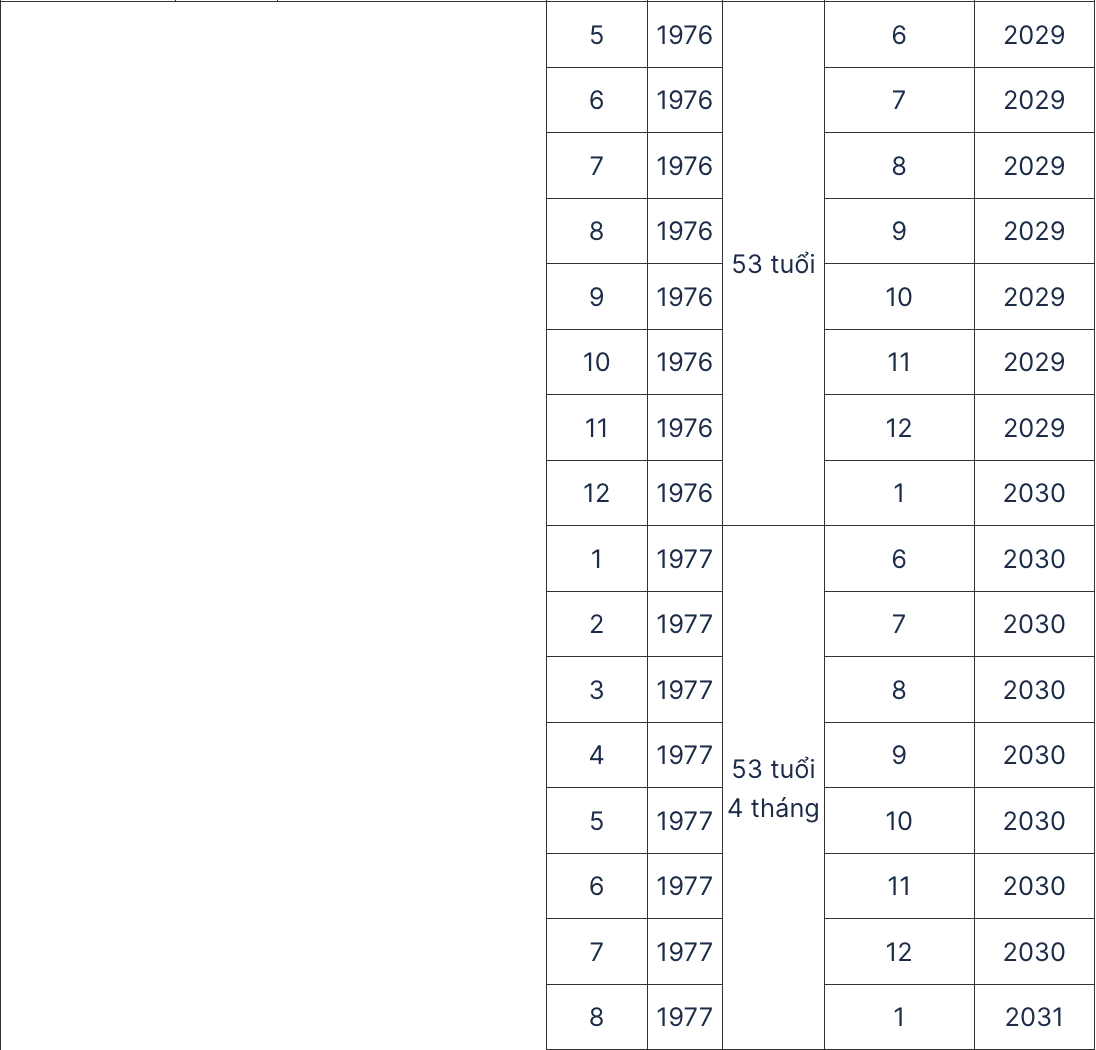

In particular, the policy for cadres, civil servants, public employees, workers and armed forces who are of retirement age is stipulated in Appendix II issued with Decree No. 135/2020/ND-CP as follows:

Regarding subjects of application:

Cadres, civil servants, public employees, and workers as prescribed in Article 2 of Decree No. 178/2024/ND-CP dated December 31, 2024 (amended and supplemented by Decree No. 67/2025/ND-CP dated March 15, 2025) of the Government on policies and regimes for cadres, civil servants, public employees, workers and armed forces in implementing the reorganization of the apparatus of the political system;

Cadres, civil servants, public employees, and workers with a total period of compulsory social insurance payment of 15 years or more when working in arduous, toxic, dangerous or especially arduous, toxic, dangerous jobs on the list issued by a Government agency performing the function of state management of labor or working in areas with particularly difficult socio-economic conditions;

At the same time, having worked in a place with an regional allowance coefficient of 0.7 or higher before January 1, 2021 and having reached the retirement age prescribed in Appendix II issued with Decree No. 135/2020/ND-CP, immediately quit immediately due to the direct impact of the reorganization of the apparatus, implementing the model of organizing local government at 02 levels;

Subjects belonging to the armed forces (except for subjects performing the retirement age as prescribed in the Law on Vietnam People's Army Officers, the Law on Professional Soldiers, Workers and National Defense Officials, the Law on the People's Public Security and guiding documents) stipulates Article 2 of Decree No. 178/2024/ND-CP (amended and supplemented in Decree No. 67/2025/ND-CP).

The group of armed forces also needs to have a total of 15 years or more of compulsory social insurance contributions when working in arduous, toxic, dangerous or especially arduous, toxic, dangerous jobs on the list issued by a Government agency performing the function of state management of labor or working in areas with particularly difficult socio-economic conditions, including working time in areas with regional allowance coefficient of 0.7 or higher before January 1, 2021 and having reached retirement age according to the provisions of Appendix II issued with Decree No. 135/2020/ND-CP, immediately leaving work due to the direct impact of the reorganization of the apparatus and implementing the model of organizing local government at 02 levels.

Regarding policies and regimes:

Receive pension immediately according to the provisions of the law on social insurance;

Receive a one-time allowance calculated based on the working period from the retirement age according to the provisions of Appendix II issued with Decree No. 135/2020/ND-CP to the time of retirement as follows:

In case of having worked for 15 months or less, they will receive a one-time allowance equal to 15 months of current salary.

In case of working for 15 months or more, they will receive a one-time allowance equal to 15 months of current salary for the first 15 months of work; from the 16th month onwards, for each month of receiving a allowance, the current salary is 0.5 months. The maximum one-time allowance is not more than 24 months of current salary.

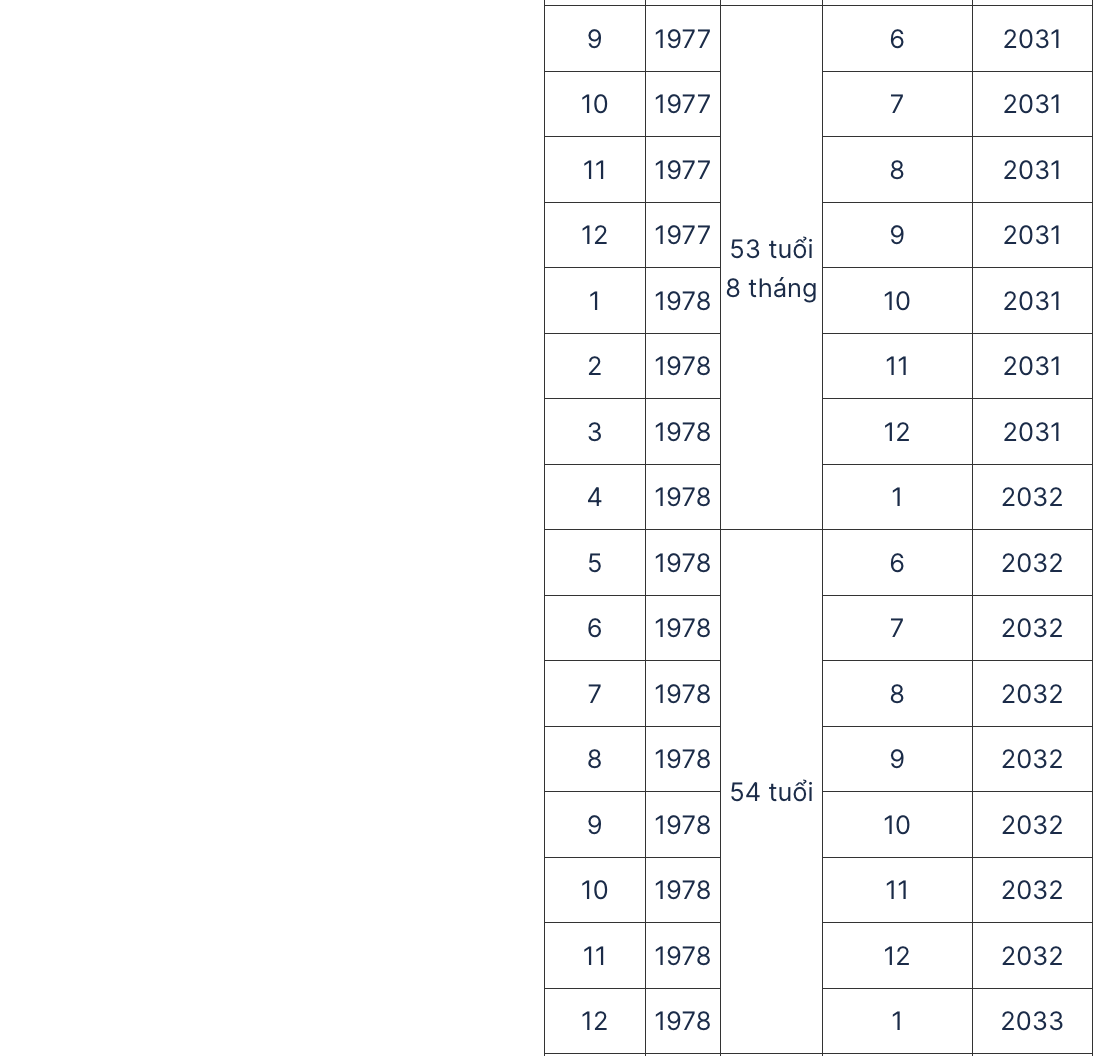

Below is Appendix II issued with Decree No. 135/2020/ND-CP on the lowest retirement age associated with the corresponding month and year of birth