The People's Committee of Thai Nguyen province issued Decision 17/2024/QD-UBND on standards and norms for the use of specialized cars equipped for agencies, organizations, and units under the management of Thai Nguyen province.

This decision stipulates the standards and norms for the use of specialized cars equipped for agencies, organizations, and units under the management of Thai Nguyen province as prescribed in clauses 2, 3, 4, and 5 of Article 16 of Government Decree No. 72/2023/ND-CP.

These regulations include cars with special structures (money transport vehicles, vehicles for gold, silver, and precious stones; vehicles equipped with laboratories, cranes, garbage collection and compression vehicles, garbage and waste transport vehicles...); Cars equipped with specialized devices (specialized devices fixed to the car) or cars with identification signs as prescribed by law (vehicles equipped with satellite receivers and transmitters; mobile broadcasting vehicles; traffic inspection vehicles; funeral service vehicles; customs supervision vehicles; training, practice driving, and driving test vehicles, money escort vehicles...); trucks; Cars with more than 16 seats.

Applicable subjects include: State agencies, agencies of the Communist Party of Vietnam, public non-business units (except for public non-business units that ensure regular and investment expenditures themselves), Project Management units using state capital (hereinafter referred to as agencies, organizations, units) under the management of Thai Nguyen province.

Other related agencies, organizations, units, and individuals.

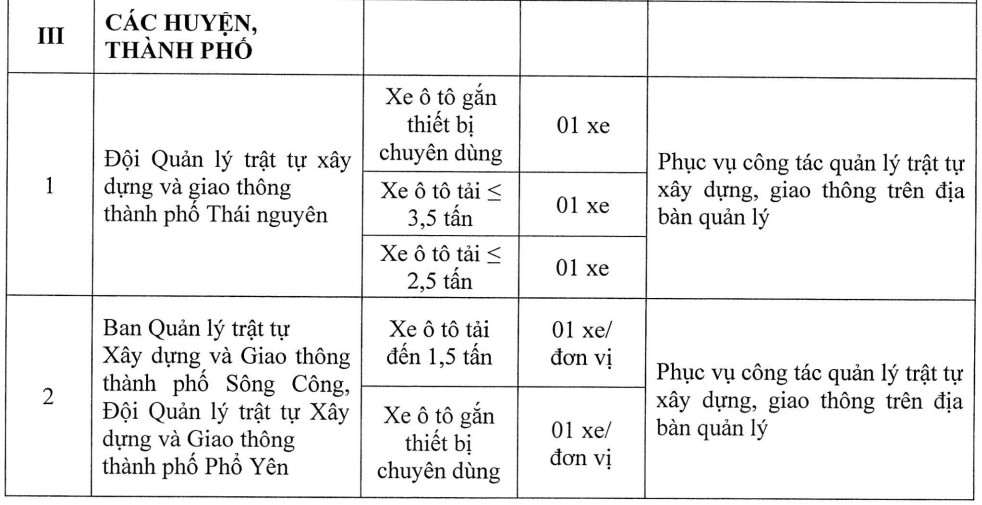

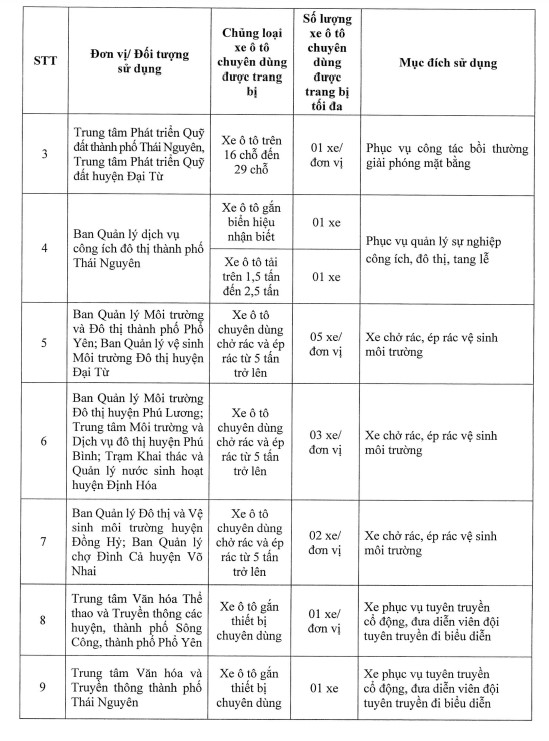

Standards and norms for the use of specialized cars equipped for agencies, organizations, and units under the management of Thai Nguyen province, including district-level units, are as follows:

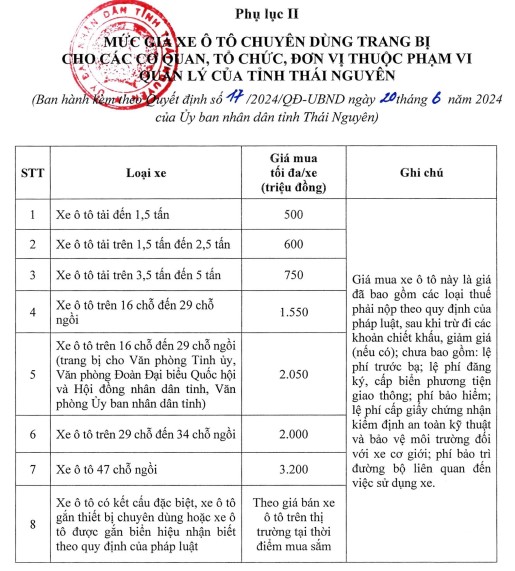

The purchase price of specialized cars is detailed as follows:

The purchase price of the car includes all taxes payable according to the law, after deducting discounts and reductions; excluding: registration fees; registration and vehicle license plate fees; insurance fees; fees for issuing technical safety and environmental protection inspection certificates for motor vehicles; road maintenance fees related to the use of the car. In cases where the car is exempt from taxes (import, special consumption, value-added), the exempted tax amount must be included in the purchase price to determine the standards and norms.