Youme Law Firm LLC replies: Pursuant to Clause 1, Article 7 of Decree 146/2018/ND-CP regulating the contribution level and responsibility for paying health insurance:

"The monthly health insurance premium for the subjects is regulated as follows:

a) Equal to 4.5% of the monthly salary of employees for subjects specified in Clause 1, Article 1 of this Decree.

- Employees who are on sick leave for 14 days or more in a month as prescribed by the law on social insurance are not required to pay health insurance but are still entitled to health insurance benefits;

- For employees who are detained, held in custody or temporarily suspended from work for investigation and consideration of whether or not they have violated the law, the monthly contribution is equal to 4.5% of 50% of the employee's monthly salary.

In case the competent authority concludes that there is no violation of the law, the employee must pay health insurance on the amount of salary received in arrears;

b) Equal to 4.5% of pension and disability allowance for subjects specified in Clause 1, Article 2 of this Decree;

c) Equal to 4.5% of the employee's monthly salary before maternity leave for the subjects specified in Clause 5, Article 2 of this Decree;

d) Equal to 4.5% of unemployment benefits for subjects specified in Clause 6, Article 2 of this Decree;

d) Equal to 4.5% of the basic salary for other subjects;

e) The health insurance contribution rate for the subjects specified in Article 5 of this Decree is as follows: The first person pays 4.5% of the basic salary; the second, third, and fourth persons pay 70%, 60%, and 50% of the first person's contribution rate, respectively; from the fifth person onwards, the contribution rate is 40% of the first person's contribution rate.

The reduction of health insurance premiums as prescribed in this point is implemented when members participating in family health insurance participate together in the same fiscal year".

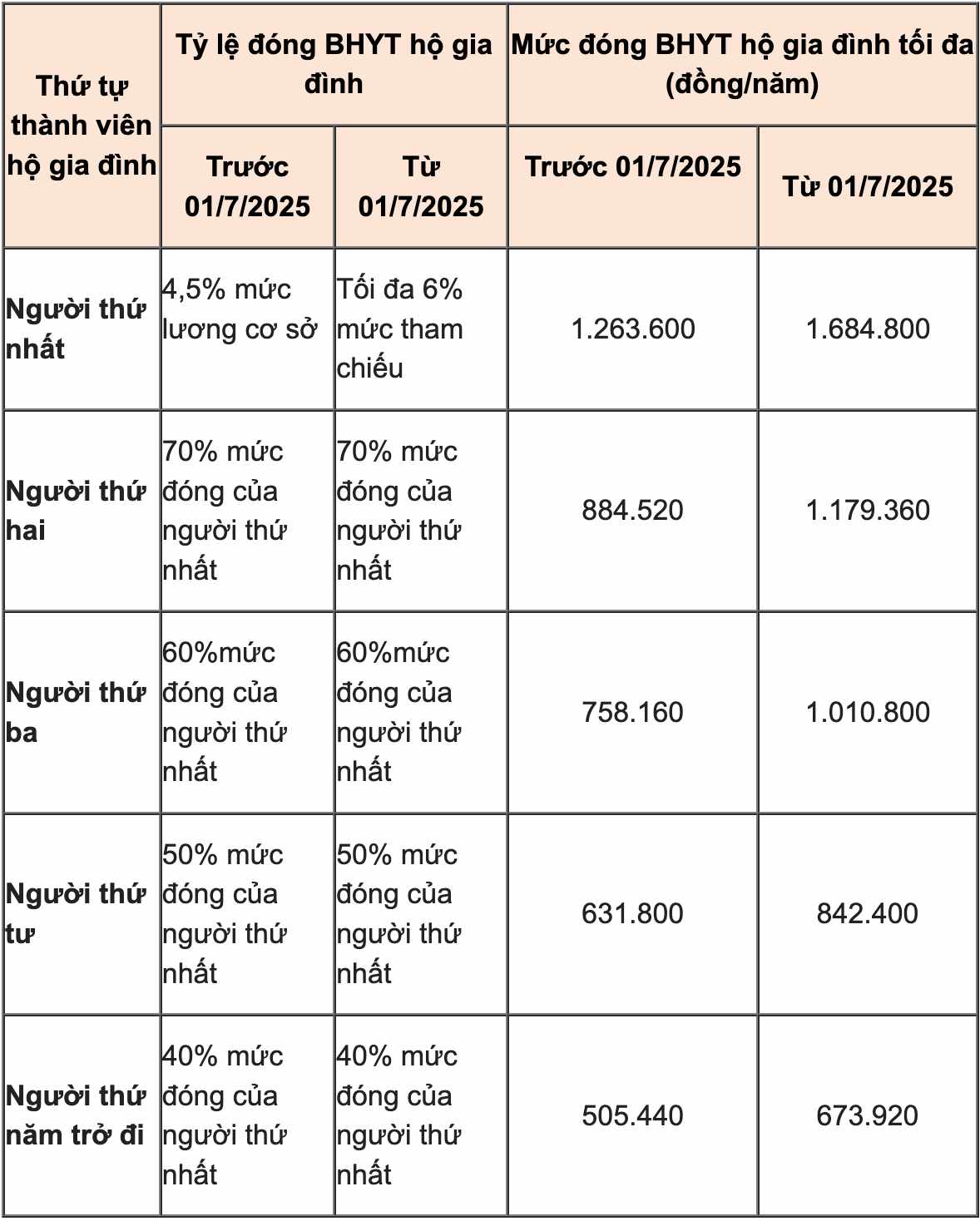

Thus, the latest family health insurance premium in 2025 will be regulated as follows:

- The first person pays 4.5% of the basic salary

- The second person pays 70% of the first person's contribution.

- The third person pays 60% of the first person's contribution.

- The 4th person pays 50% of the first person's contribution.

- From the 5th person onwards, the contribution is 40% of the first person's contribution.

Pursuant to Clause 2, Article 3 of Decree 73/2024/ND-CP, the basic salary is still 2.34 million VND/month. Thus, the maximum health insurance contribution per household from July 1, 2025 will change as follows: