In 2024, Vietnam Construction and Import-Export Joint Stock Corporation (Vinaconex) achieved revenue of VND 12,873 billion (up 1.3%) but pre-tax profit increased by 155%, to VND 1,420 billion.

The positive point in Vinaconex's revenue structure is that the construction sector recorded a gross profit of 500 billion VND after a loss of 243 billion VND in 2023.

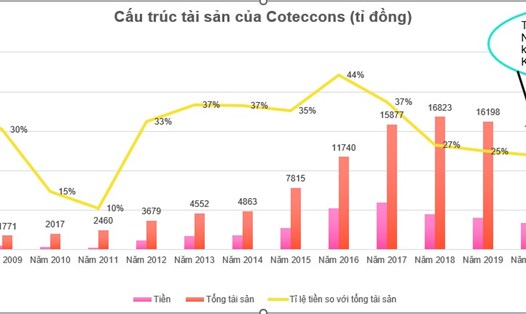

Another giant in the construction industry, Coteccons Construction Joint Stock Company, has just released its second quarter financial report (according to the year of October 1, 2024 - December 31, 2025), recording revenue of VND 6,886 billion, up 22% over the same period. Profit after tax reached 106 billion VND, up 54% over the second quarter of 2024.

Accumulated in the first 6 months of fiscal year 2025, Coteccons' revenue reached VND 11,645 billion, up 19% over the same period, completing 47% of the plan. Profit after tax reached 199 billion, up 47% and completed 46% of the annual plan.

CTD shares of Coteccons Construction Joint Stock Company are also experiencing a series of vibrant trading days since the beginning of this year. In just 1.5 months, CTD's market price has skyrocketed by 34% and advanced to the highest level in the past 6 years. Notably, this is also the highest price that CTD shares have recorded since Mr. Bolat Duisenov became Chairman of the Board of Directors.

After a period of difficulties, in the fourth quarter of 2024, Hoa Binh Construction Group Joint Stock Company recorded revenue of more than VND 1,587 billion, down 27.5% over the same period last year. Thanks to other income (mainly from asset liquidation) increasing nearly 3 times in the same period last year to VND45 billion, Hoa Binh achieved a profit after tax of VND9.45 billion.

In 2024, Hoa Binh's revenue will reach more than VND 6,374 billion - the lowest level in the past 8 years. However, after-tax profit still reached nearly 852 billion VND. This breakthrough mainly comes from the sale of assets in the second quarter of 2024.

Currently, the company is still facing accumulated losses of up to VND 2,412 billion, accounting for nearly 70% of charter capital.

The company's outstanding debt decreased by 9.5% compared to the beginning of the year, to VND 4,270 billion, of which short-term debt accounted for the majority. However, with a debt ratio of 3.5 times equity. In 2024, Hoa Binh had to pay interest of up to 405 billion VND, equivalent to more than 1 billion VND per day that the company had to spend just to pay interest.

It can be seen that the revival of the construction industry is also thanks to the gradual recovery of the real estate market, making construction and installation activities more vibrant, improving the business picture of enterprises in the industry.

Contractor enterprises are assessed to have bright business prospects this year, thanks to the promotion of 4 main factors.

First, FDI capital flows have grown steadily. Second, the real estate market warms up after three new laws are related, including the 2024 Land Law, the 2023 Real Estate Business Law, and the 2023 Housing Law, which were implemented from the beginning of August 2024.

Third, the capacity and position of the enterprise is increasingly affirmed. Fourth, the growth potential of enterprises and the ability to penetrate international markets.

According to experts from FPT Securities Joint Stock Company (FPTS), the group of housing developers and real estate developers will have their difficulties in project implementation resolved by widespread legal improvements and increased access to credit when real estate risks are reduced.

The Land Law, the Real Estate Business Law and the Housing Law are expected to resolve legal problems for backlogged projects and create favorable conditions for the development of new projects, thereby bringing a source of work for civil construction enterprises.

However, FPTS also believes that businesses in the industry will need time to reflect on actual business results, when the recovery of the civil real estate market in 2024 is still localized, causing the supply to not have a significant improvement.

This securities company expects that businesses will have more contracts in the first half of the year and achieve the revenue and profit drop point in the fourth quarter of 2024, because the last quarter of the year is usually the time to close the project acceptance.