According to Lawyer Tran Tuan Anh - Director of Bright Legal Company, when people convert garden land to residential land, they will lose the following costs:

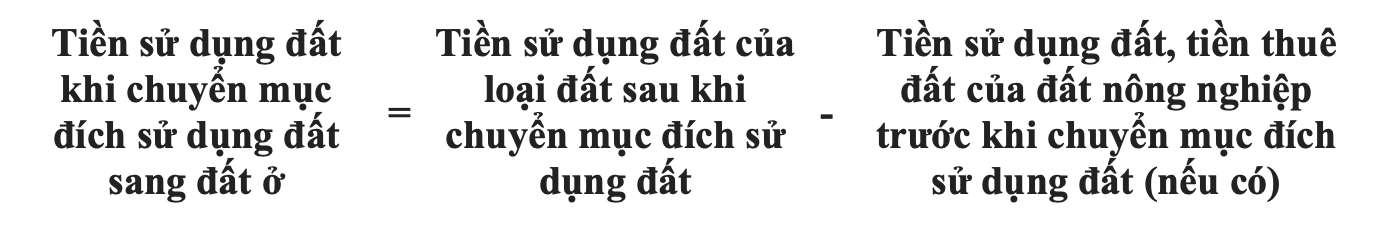

First, the land use fee. Article 8 of Decree 103/2024/ND-CP stipulates: Households and individuals, when competent state agencies issue a decision allowing the conversion of land use purposes to residential land, land use fees are calculated as follows:

Note, this calculation method only applies to households and individuals.

Second, registration fee. Subjects to pay: Organizations and individuals with assets subject to registration fees must pay registration fees when registering ownership.

Pursuant to Article 8 of Decree 10/2022/ND-CP, the registration fee is calculated according to the following formula:

Registration fee = (Land price in land price list x area) x 0.5%

Third, the Certificate issuance fee. Applicable subjects: Only pay this fee if a new Certificate is issued (a new book cover is issued).

- Payment rate: Although each province and city has different collection rates, most of them are under 100,000 VND/paper/issuance.

Fourth, the file appraisal fee. The fee for appraisal of documents is determined by the People's Councils of provinces and centrally run cities; this content is clearly stated in Point i, Clause 1, Article 5 of Circular 85/2019/TT-BTC as follows:

i) The fee for appraisal of documents for granting Land Use Rights Certificates is the fee for appraisal of documents, necessary and sufficient conditions to ensure the issuance of Certificates of land use rights, house ownership rights and assets attached to land (including issuance, exchange, re-issuance of Certificates and certification of changes to the issued Certificate) according to the provisions of law.

Because it is under the authority of the Provincial People's Council and the centrally-run city, people must know the following two things:

- Not all provinces and cities collect this fee.

- If collected, the collection rate between provinces and cities is not the same.