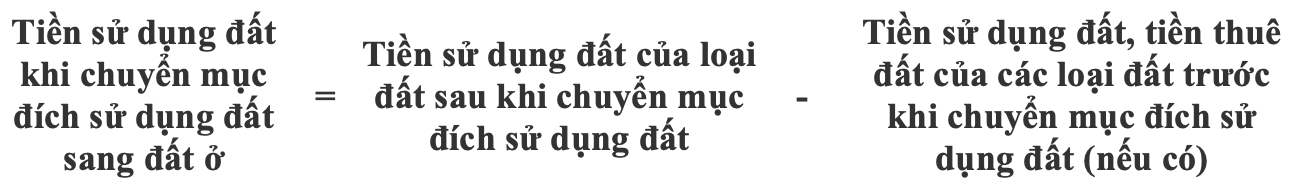

Land use fee

According to Clauses 1 and 2, Article 8 of Decree 103/2024/ND-CP, when households and individuals are issued a decision by a competent state agency allowing the conversion of land use purposes to residential land, land use fees are calculated as follows:

In which:

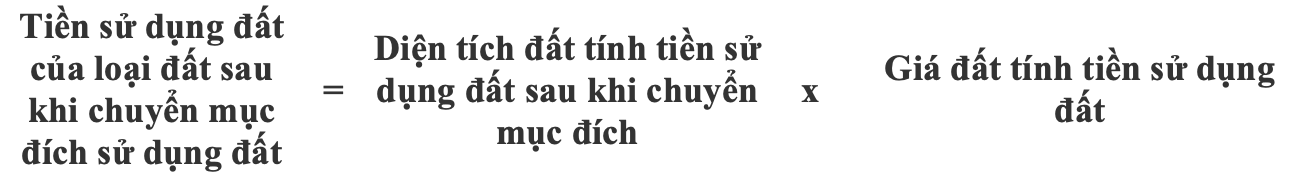

- Land use fee of the land type after conversion is calculated as follows:

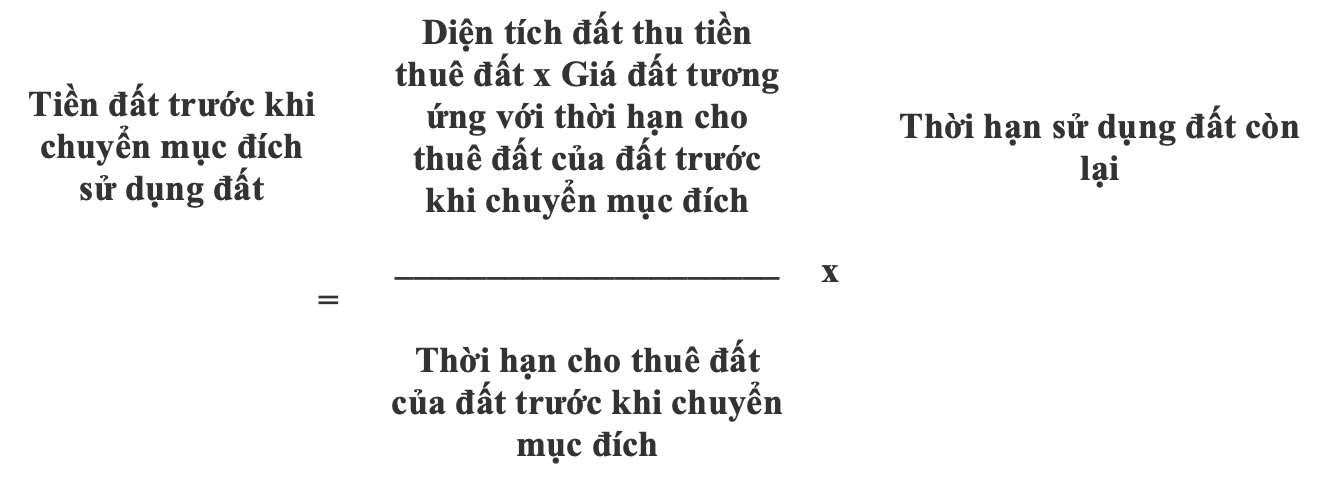

- Land use fee, land rent of land types before changing land use purpose (hereinafter referred to as land fee before changing land use purpose) is calculated as follows:

+ For land before changing the purpose, which is agricultural land of households and individuals allocated by the State without collecting land use fees or agricultural land of legal origin transferred by another household or individual that has been allocated land by the State without collecting land use fees:

+ For land before changing the purpose which is agricultural land leased by the State with one-time land rent payment for the entire lease term, the land fee before changing the land use purpose is calculated as follows:

In which:

- Land price corresponding to the land lease term of the land before changing purpose is the land price in the Land Price List to calculate the land rent with one-time payment for the entire lease term.

- The remaining land use term is determined by =) land allocation and land lease term before changing land use purpose tru (-) land use period before changing purpose.

In case the remaining land use period determined according to the formula specified in this point is not round, it will be calculated by month; if the period is not round, the period is not round, from 15 days or more, it will be rounded to 1 month, less than 15 days, the land use fee will not be calculated for this number of days.

- For land before changing the purpose which is agricultural land leased by the State in the form of annual land rent payment, the land price before changing the land use purpose is 0 = 0).

Note: In case the land use fee of the land type after changing the land use purpose is smaller or equal to the land fee before changing the land use purpose, the land use fee when changing the land use purpose is 0 =).

Certificate issuance fee

According to Circular 85/2019/TT-BTC, the fee for granting a Land Use Rights Certificate will be under the authority of the Provincial People's Council.

Fees for granting certificates of land use rights, house ownership rights, and assets attached to land include: Issuing certificates of land use rights, house ownership rights, and assets attached to land; land change registration certificates; cadastral map extracts; documents; cadastral records data.

Based on specific local conditions and local socio-economic development policies to stipulate appropriate fee collection levels, ensuring the following principles: The fee for households and individuals in districts under centrally-run cities, inner-city wards under cities or provincial towns is higher than the fee in other areas; the fee for organizations is higher than the fee for households and individuals.

Thus, the fee for granting a Certificate will be decided by the People's Councils of provinces and centrally run cities to apply to their localities, so there will be no uniformity across the country. However, the fee will usually be from 100,000 VND or less for each newly issued red book.

Registration fee

Pursuant to Article 3 of Decree 10/2020/ND-CP, organizations and individuals must pay registration fees when registering home ownership and land use rights. The current registration fee for houses and land is 0.5%.

Document appraisal fee

Circular 85/2019/TT-BTC stipulates the fee for appraisal of documents when transferring real estate under the authority of the People's Council at the provincial level (province, centrally run city), so the collection rate between provinces and cities will be different.

The appraisal fee for the issuance of a land use right certificate is the fee for the appraisal of the dossier, the necessary and sufficient conditions to ensure the issuance of a certificate of land use rights, house ownership rights and assets attached to the land (including initial issuance, new issuance, issuance of re-issuance, issuance of certificates and certification of changes to issued certificates) according to the provisions of law.

Based on the area of the land plot, the complexity of each type of dossier, the purpose of land use and the specific conditions of the locality to determine the fee for each case.