According to the real estate market report of the One Mount Group Market Research & Customer Understanding Center, the total transaction volume of the entire Hanoi market in 2025 reached about 109,000 units, a slight decrease of 8% compared to the previous year.

In which, transactions in the East area increased by 15 percentage points compared to the same period, while the West area decreased by 23 percentage points. The apartment segment continued to play a leading role in the market, accounting for 63% of total transaction volume thanks to the high increase in both the primary and transfer markets.

In the fourth quarter of 2025 alone, the high-rise housing segment recorded about 23,000 transactions, setting the highest level in the past two years. The residential segment also recorded signs of recovery with about 8,100 transactions, up 31% compared to the previous quarter but still down 19% compared to the same period last year.

Hanoi apartment market maintains continuous growth momentum from the first quarter of 2025. In the first three quarters of the year, the secondary market maintained a higher liquidity than the primary one. However, in the fourth quarter of 2025, this trend reversed clearly when transactions of high-rise secondary apartments decreased to about 9,500 units, down 22%, while primary transactions increased sharply to about 13,000 units, up 31%.

According to One Mount Group, secondary apartment transactions decreased partly because the price level has approached its peak. Secondary apartment unit prices increased continuously in 7 quarters and by the third quarter of 2025 were equal to primary prices. In the fourth quarter of 2025, the price of secondary apartments in Hanoi reached about 90 million VND/m2, an increase of 7.4%, exceeding the average primary price by about 86 million VND/m2.

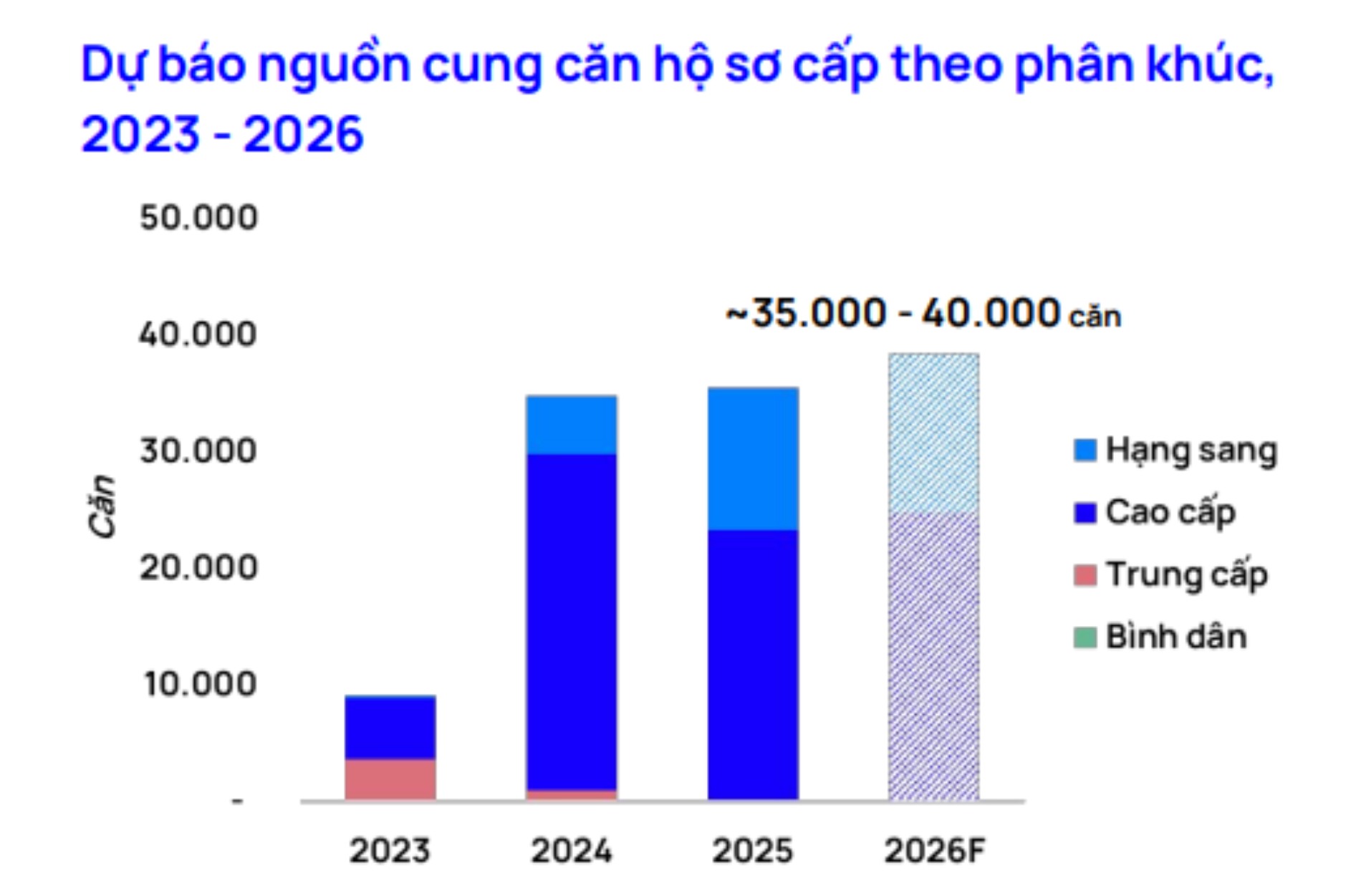

2025 is the second consecutive year that the Hanoi apartment market has entered a growth phase. New supply and transaction volume of primary apartments both increased by 2% compared to 2024, reaching about 35,500 units and 34,500 units respectively.

However, the supply structure recorded many notable changes. Specifically, the supply shifted strongly to the Van Giang area (Hung Yen), accounting for 40% of the total new supply, while in 2024 this area only accounted for 7%. The luxury apartment segment also expanded strongly, accounting for 35% of the total new supply - the highest level ever. The number of projects first opened for sale reached 32 projects, an increase of 78% compared to 2024.

One Mount Group forecasts that in 2026, the Hanoi market may record about 35,000 - 40,000 new apartments for sale. The supply of the high-end segment increased slightly, mainly concentrated in the Ring Road 3.5 area. Meanwhile, the area inside Ring Road 3.5 is still mainly luxury projects with prices above 100 million VND/m2, clearly reflecting the price difference between regions and the trend of expanding urban development space.

Primary supply will continue to grow positively as legal obstacles are gradually resolved, especially in satellite cities. With a more reasonable price level, new supply in these areas is expected to contribute to regulating and easing the real estate price increase in the inner city area.

Regarding demand, investment demand is forecast to decrease slightly, especially for short-term investors, due to pressure from increased interest rates in 2026. Conversely, housing demand is expected to continue to maintain at a high level, led by the rapid increase of the middle class. Along with the process of completing and expanding transportation - urban infrastructure, the trend of buying housing is forecast to gradually shift to large urban areas with full amenities, located outside the old inner city area.