Hanoi - Growth focus of the apartment market

Mr. Tran Quang Trung - Business Development Director of OneHousing - said that 2025 recorded a strong explosion of the Hanoi apartment market, both in the primary and secondary markets. Not only increasing in supply scale, the apartment price level also set record highs (average primary unit price in the fourth quarter of 2025 reached 86 million VND/m2) - a price that the market had never recorded before.

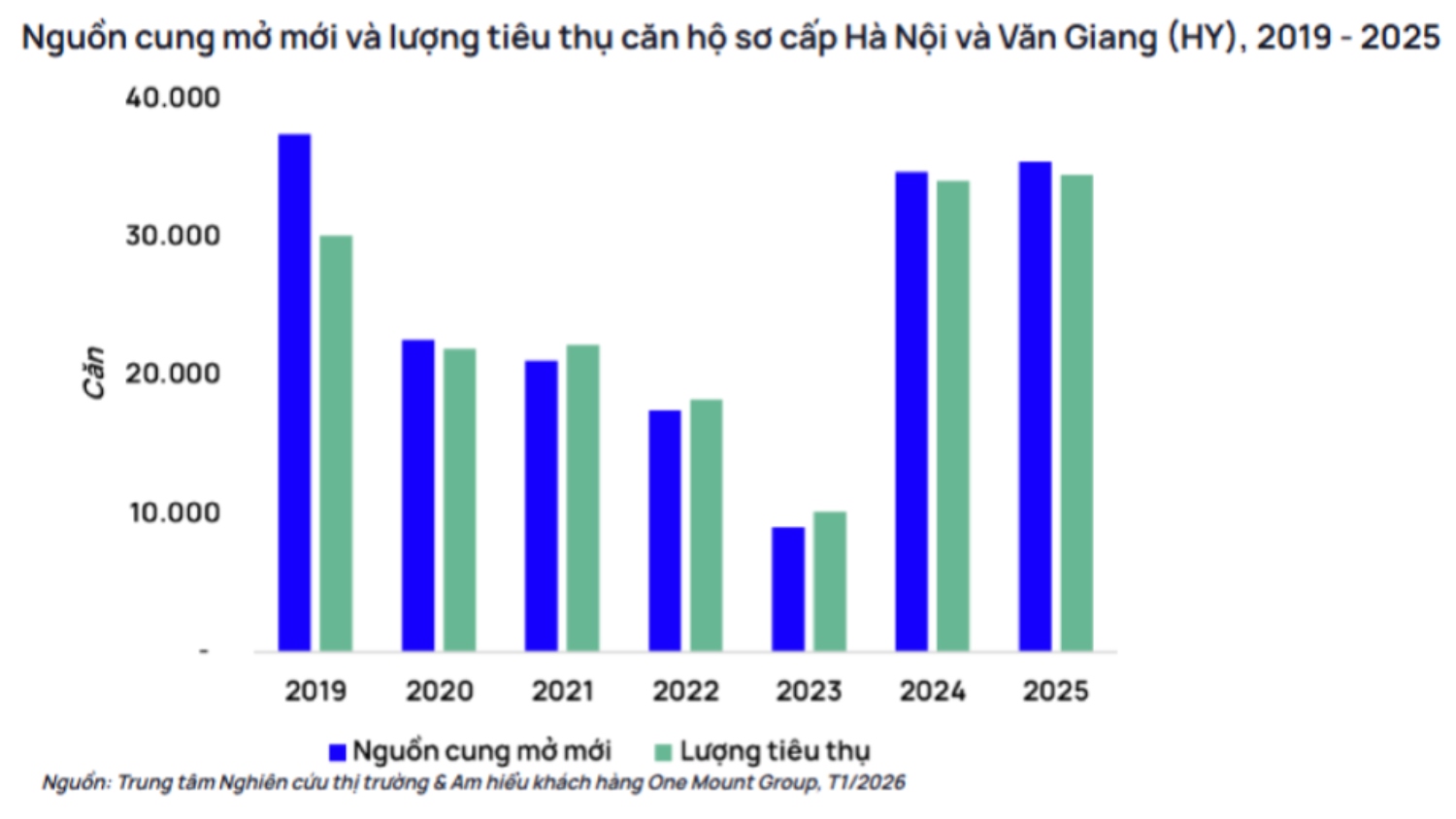

The total supply of apartments for sale in Hanoi in 2025 is estimated to reach about 34,500 apartments, with an absorption rate almost equivalent to the supply. This figure shows the great attractiveness of the market, and also reflects the real demand playing a leading role. Notably, this increase is not only concentrated in the apartment segment but also spreads to alley house products and some other segments in the inner city, especially in the first and second quarters of 2025.

The trend of price increases also spread to neighboring areas such as Van Giang (Hung Yen), Bac Ninh... showing that the process of expanding urban development space is taking place clearly, associated with infrastructure and regional connectivity.

A major difference of the market in 2025 compared to previous periods is the clear change in customer thinking. Cash flow is no longer distributed widely into speculative types, but is strongly shifted to products serving the actual needs of large cities. Transparent legality, exploitation and long-term accumulation value have become priority criteria, replacing short-term investment thinking," Mr. Tran Quang Trung said.

Macroeconomic momentum creates a foundation for the market

The growth of the real estate market in 2025 is not a random phenomenon, but a combination of many positive macroeconomic factors. During the year, the Government and the banking system have promoted public investment disbursement, thereby creating a strong spillover effect on the economy.

In addition, the macroeconomy recorded many positive signals, with GDP growth rate reaching about 8.02% in 2025. Along with that, timely adjustments related to land policies have contributed to stabilizing market sentiment. Although the new Land Law with the principle of approaching market prices once created pressure on input land prices in the early stages, subsequent adjustment measures have helped the market gradually balance back.

Notably, 2025 also marks a clear screening process in the real estate industry. Only investors with real deployment capacity, methodical product strategy thinking and understanding customer needs can stand firm. At the same time, the tightening of brokerage activities, regulations on taxes and practicing certificates has forced distributors to change their thinking, towards more professionalism and transparency.

Quarter IV/2025 is considered the most special quarter of the real estate market in recent years. In Hanoi alone, the Eastern region witnessed the active participation of a series of large investors, with large-scale projects launched to the market and achieving impressive absorption rates.

There are projects from 8 - 10 apartment buildings sold in just one month - something that the market may have taken 2-3 years to achieve before, showing that investors have "read the taste" of market demand and launched product lines suitable to the expectations of the majority" - Mr. Trung emphasized.

In addition, signals about the preparation for the launch of social housing projects also began to appear clearly in the fourth quarter. This is expected to be an important component, contributing to completing the supply structure in the coming period.

In terms of supply scale, the fourth quarter of 2025 can be placed next to the vibrant period of 2018; and in the context of the last three years, this is the quarter that creates the strongest mark of the market.

In 2026, the real estate market is expected to continue to maintain its growth momentum, but in a more selective and sustainable direction. Market confidence has been established, legality is gradually clear, while real housing demand is still the main pillar.